Shares of Apache Corporation (NYSE:APA) fell around 3% to eventually close the day at $44.55 on Jan 9 after the company issued drab production outlook for the fourth quarter of 2017. Houston-based upstream player estimates fourth-quarter production from international operations to miss the prior guidance — provided in October 2017 — owing to weaker-than-expected performance of some of its projects in the North Sea.

The company currently expects the fourth quarter production values from international operations to be in the range of 138,000-140,000 barrels of oil equivalent per day (BOE/d) compared with its prior forecast levels of 150,000-160,000 BOE/d. Unexpected shutdown of Forties Pipeline System and underperformance of wells in the Beryl area have been the primary factors for the lower forecast. Nevertheless, Apache expects improved realized prices to offer respite amid the declining volumes.

As it is, the company has been bearing the brunt of contracting production volumes in all the last three reported quarters. From January to September 2017, Apache’s production averaged 345,495 BOE/d, down 13% from the first nine months of 2016.

Meanwhile, despite the international shortfall, the oil producer is expected to meet its fourth-quarter production target on the back of its U.S. operations. The company expects its output in the United States to be at the high end of its guidance range of 218,000- 224,000 BOE/d for the fourth quarter driven by strong performance in the Permian shale play. The company expects to have achieved its production target of 25,000 BOE/d at Alpine High.

In fact, Apache has been banking on its Alpine High discovery in West Texas to remain afloat in the market, which could be its major growth driver in 2018. Estimated to hold massive oil and natural gas reserves, the wells are expected to drive strong economics and top-tier returns. The company expects to more than double its product portfolio by virtue of its Alpine High shale play in 2018 compared with the last year’s tally as it has initiated drilling operations in more than 5,000 locations. Notably, Apache intends to invest $1 billion in the region in 2018 toward this end.

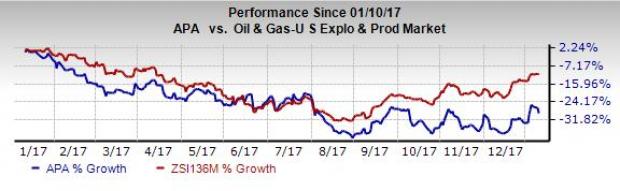

Apache currently carries a Zacks Rank #3 (Hold). Shares of Apache have tumbled 33.8% over a year compared with the industry’s decline of 15.6%.

Investors interested in the same space can consider some better-ranked players like Cabot Oil & Gas Corporation (NYSE:COG) , Denbury Resources, Inc. (NYSE:DNR) and Pioneer Natural Resources Company (NYSE:PXD) . All the three companies sport Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot is expected to record 92.9% year-over-year earnings growth in 2018.

Denbury Resources is likely to witness 189.81% year-over-year earnings growth in 2018.

Pioneer Natural Resources is expected to record 127.12% year-over-year earnings growth in 2018.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Apache Corporation (APA): Free Stock Analysis Report

Denbury Resources Inc. (DNR): Free Stock Analysis Report

Original post

Zacks Investment Research