Have you been eager to see how U.S. energy firm Apache Corp. (NYSE:APA) performed in Q3 in comparison with the market expectations? Let’s quickly scan through the key facts from this Houston, TX-based company’s earnings release this morning:

About Apache: Apache is one of the world's leading independent energy companies engaged in the exploration, development and production of natural gas, crude oil and natural gas liquids. Approximately 72% of proved reserves and 60% of its production comes from North America. Internationally, Apache has core operations in Egypt and offshore U.K.

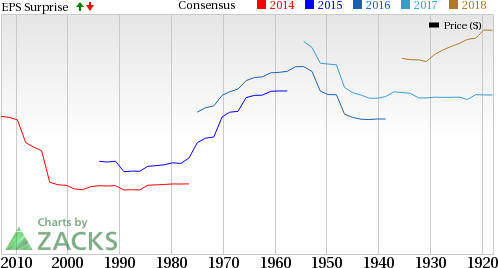

Zacks Rank & Surprise History: Currently, Apache has a Zacks Rank #3 (Hold) but that could change following its third quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Coming to earnings surprise history, the company is on a bit of a slippery surface, having gone past the Zacks Consensus Estimate just once in last four reports resulting in an average negative surprise of 59.09%.

We have highlighted some of the key details from the just-released announcement below:

Apache Reports Profit: Earnings per share – excluding one-time items – came in at 4 cents, versus the Zacks Consensus Estimate for a loss of 5 cents.

Revenue Came in Higher than Expected: Revenues of $1,575 million were above the Zacks Consensus Estimate of $1,416 million.

Key Stats: The production of oil and natural gas (excluding divested assets and non-controlling interests) averaged 353,645 oil-equivalent barrels per day (BOE/d) (68% liquids), down 6.5% from last year. Apache’s production for oil and natural gas liquids (NGLs) was 241,722 barrels per day (Bbl/d), while natural gas output came in at 671,533 thousand cubic feet per day (Mcf/d).

The average realized crude oil price during the third quarter was $49.34 per barrel, representing an increase of 11.3% from the year-ago realization of $44.35. Moreover, the average realized natural gas price during the September quarter of 2017 was $2.75 per thousand cubic feet (Mcf), up 6.2% from the year-ago period.

Apache’s third quarter lease operating expenses totaled $358 million, down 6.3% from the year-ago quarter.

Share Performance: Apache has lost 3.9% of its value year to date versus the 5.3% growth of its industry.

Check back later for our full write up on this Apache earnings report later!

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Apache Corporation (APA): Free Stock Analysis Report

Original post

Zacks Investment Research