Asia has had an orderly session today. U.S. Dollar strength continues from Friday and Asia stock are flat to small down.

U.S markets ignored a low-ball Non-Farm Payrolls on Friday, preferring to concentrate on yet another dip in the employment rate instead. An excellent round-up of the session and the week ahead from my colleague Alfonso can be found here. week-ahead

FX has traded sideways mostly with just the AUD suffering as we await Europe.

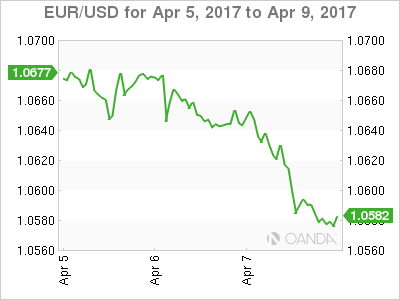

Languishing at the bottom of its New York range after breaking support at 1.0627, the 100-day moving average, on Friday. This will become meaningful resistance now.

The price action had bought the 1.0495/1.0500 area back into view. The Euro will become increasingly sensitive to the politcial headlines from France now vis-a-vis the election. A break of 1.0500 will open up a further drop below 1.0400 from a charting perspective.

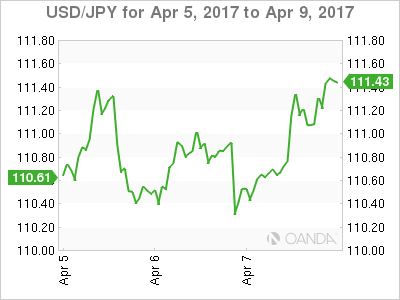

The comeback king, perhaps as U.S. yields have firmed belatedly after the Fed discussed a balance sheet run-off last week. The moving of Carl Vinson carrier battle group to the vicinity of South Korea won’t be helping either as geopolitical jitters from Friday continue to make themselves felt in that part of Asia.The range is still very well defined on the charts. Namely resistance at the 112.20 area with support at the 110.00 area. A daily close above or below respectively will tell us USD/JPY’s next direction. I note bullish divergence between the daily stochastic and RSI with the price action of USD/JPY itself.

The range, however, is still very well defined on the charts. Namely resistance at the 112.20 area with support at the 110.00 area. A daily close above or below respectively will tell us USD/JPY’s next direction. I note bullish divergence between the daily stochastic and RSI with the price action of USD/JPY itself.

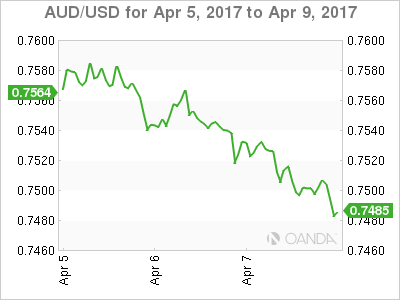

With Dahlian coal futures continuing to drop precipitously, copper flirting with support at its 100-day moving average and more negative reports on the Australian housing market, the AUD has found few friends today. The US/Australia 10-Year rate spreads won’t be helping either.

AUD cracked held support at 9490 on Friday, just, but trades under it at 7485 this afternoon. AUD has resistance at 7517 and 7556, it 100 and 200-day moving averages.

Below, the bottom of the daily Ichi moko cloud provides support at 7450. A break underneath here implies substantially lower levels lie ahead.

President Xi’s meeting with President Trump has passed without incident unsurprisingly. Perhaps except for Mr Trump telling Mr Xi he was bombing Syria over dinner. China has offered a few crumbs at the trade table, but as per Yen and Korean Won, its future is a USD story and a geopolitical one.

While we are mentioning Korea, Friday’s Syria raids were clearly more than a passing message to both North Korea and China. When pondering whether an action is imminent in North Korea however, two things should come to readers minds, as I am sure they did to President Xi.

- Seoul lies less than 60 kilometres from the North Korea border. Well within artillery and rocket range. North Korea has a lot of both.

- Any strike against N.Korea would have to be completely overwhelming immediately due to point 1 above. This would require a lot more forces to be placed locally then one carrier battle group.

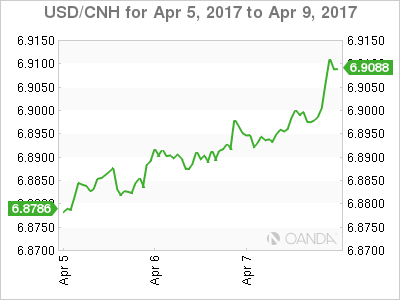

Back to USD/CNH, the price action is constructive on the charts. We have broken and held above the 100-day moving average at 6.8835 which becomes support. Behind this 6.8450 and 6.7900 are clearly denoted.

Resistance lies at 6.9300 and 6.9900 and as long as the USD continues to strengthen in general and yields rise, a slow grind higher seems to be the path of least resistance.

U.S. Bonds

The U.S. 2-Year, 5-Year and 10-year all had bearish outside reversal days on Friday, the 30-year narrowly dodging that bullet. That is, they made new highs, only to close lower than the previous day’s lows. This implies higher yields i.e. lower prices from a charting perspective. A look at the 5 and 10-year charts tells the story.

US 5 Year.

5-years broke support at 118.13 on Friday having initially rallied through resistance at 118.50 to trade as high as 118.81. These all remain resistance.

The 5-year is flirting with its 100-day moving average at 117.98 with support at 117.83 behind this. A daily close under the latter implies a move to the 117.00 area.

US 10 Year

The outside reversal is clear to see. Breaking through resistance at 125.90 and onto 126.28, before falling to 125.20.

Support, like both the two and five years, lies just below at it’s 100-day moving average at 124.84 and then the 124.75 level. A daily close below implies a move to and test of key support at 123.25.

Summary

Overall the USD is stronger although not markedly so against its g-10 compatriots. Nevertheless, some of the levels broken are significant, particularly in AUD and EUR. We realistically need to see still whether this is the start of a new move or a false dawn. The next couple of days should enlighten. More significant is the multiple bearish outside reversals on US Bonds as the market overcomes Friday’s safe-haven run and finally starting absorbing the implications of a Federal Reserve balance sheet run-down. The 4th tightening in any other words.