While no policy changes from the Fed or the BoJ, there has been no shortage of price action. So the end result – action through inaction.

Japanese Yen – Kuroda Corrodes

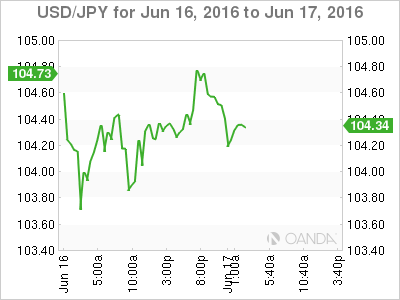

USD/JPY has fallen to the lowest level since August 2014 after the Bank of Japan (BoJ ) decided to keep monetary policy unchanged. While this move was widely expected, some traders expressed their disappointment sending the yen soaring. Governor Kuroda stated the central bank is watching currency movements carefully and that excessive FX moves were inappropriate.

In reality, there was no chance for the BoJ easing yesterday, given the proximity of Brexit. In the meantime, traders will continue to look for opportunistic spots to leg into long JPY, but as we near the Brexit tally, we should see a sizable portion of long JPY positions likely unwind. The main focus will continue to be on the BoJ as it has the most to lose on the currency front.

On a ‘Leave EU vote’, it’s widely expected the yen will appreciate on safe haven flows. However, I suspect global central banks, led by the Bank of England, would be quick off the mark providing liquidity to calm markets. Likewise for the BoJ, where liquidity contingency plans are in place. But a single-handed intervention will likely be ineffective in halting the tide, and only a concerted intervention would work. Since the BoJ has had little support from G8 peers on the intervention front, it’s unlikely to happen.

Look for increased volatility, as the market may be underpricing in a response from both the BoJ and the Ministry of Finance, notwithstanding a consorted intervention effort given the mounting Brexit Risks.

Brexit – Make or break time

The Brexit headlines took a horrible turn overnight with the ‘Leave’ and ‘Remain’ campaigning suspended after a pro-EU British MP was murdered. The tragic event has caused the IMF to delay highly anticipated reports that it had prepared on the implications of the UK leaving the EU.

Earlier in Europe, there was a slight shift in risk sentiment and an abrupt U-turn in GBP due to profit-taking and fears that Brexit might be overblown. On the flip side, commodity prices remain weak.

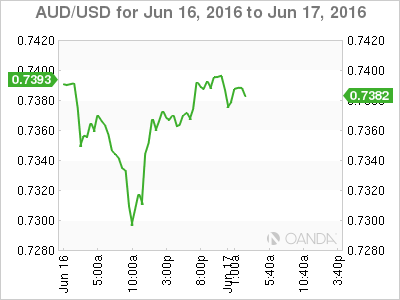

Australian Dollar – Reversal in the air

The Aussie dollar is apparently caught up in the Brexit vortex as the pair recovered boldly after plummeting below 0.7300 on the sudden shift in risk sentiment. However, momentum will continue to be capped by Brexit uncertainty and moderate commodity prices over the short term. Even with a dovish Fed in these uncertain times, the AUD failed to hold on to gains above 0.7400.

On the employment front, May jobs report from Australia came roughly in line (+17.9k vs. 15k expected) with gains attributed to the part-time sector and the minor uptick on the Australian dollar faded rather quickly.

However, if risk sentiment continues to swing positive, while factoring in the longer-term FOMC’s interest rate projections that have decreased substantially, the Aussie may well be primed for a significant move higher.

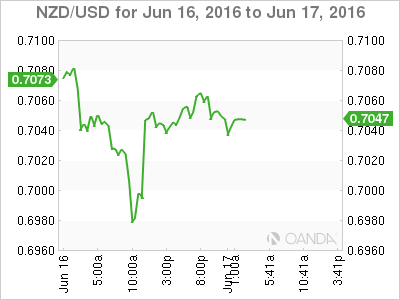

New Zealand Dollar – Kiwi taking flight?

The New Zealand dollar is attracting far more attention and was the clear winner after yesterday’s Q1 GDP, exceeding the RBNZ’s expectations. On the inflation front, a note published by the RBNZ stated: “the Reserve Bank’s inflation forecast have outperformed other macroeconomic forecasters”. The central bank continues to paint a rosy picture with the NZD only being handcuffed by risk off sentiment heading into Brexit. The question is how to play the NZD while avoiding the Brexit Fallout risk. The logical move could be to express this view through the Aussie dollar, which continues to trade off its back foot.

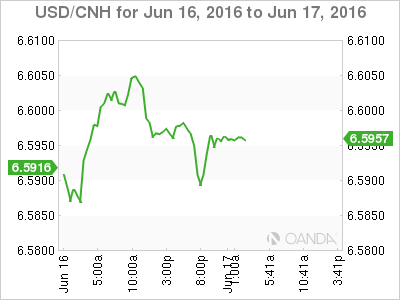

Yuan – a sideshow

The CNH has been a bit of a sideshow to the machinations on JPY over the past 24 hours. The spot USD/CNH has been relatively stable with Brexit still the primary market focus. I expect the Yuan to trade off broader risk and USD sentiment to end the week. However, given the whipsaw markets, continue to expect traders to clear out or at minimum shave their exposures ahead of the Brexit Vote as risk reward is far to skewed towards risk

The PBOC fixed the Yuan midpoint at 6.5795 vs 6.5739 this morning.

Ringgit

Lower oil prices should weigh on MYR sentiment, but generally, the markets have been on hold ahead of Brexit while traders mull over likely fallout scenarios. Regionally, the Ringgit has historically has been extremely susceptible to waves of risk-off. If the pound falls sharply on a Leave vote, there is a strong possibility the MYR will sell off aggressively over the short term.