The June 23rd UK referendum on EU membership is expected to dominate the headlines this week as markets and trading desks prepare for the day of reckoning. Expect polls to continue driving markets as volatility increases ahead of the judgement day. Volatility may remain, but the more likely scenario is that traders will start to pare back positions on both short GBP and long JPY. Despite the uncertainty over Brexit, one thing is for certain; regardless of the outcome, there will be a massive market reaction.

I see two possible things traders should be on the lookout for early in the week. One is a mad dash to cover speculative Brexit positioning as we near the event. And two, is shots across the bow from central banks expressing their readiness to stand in front of unwanted and excessive post-Brexit currency moves.

Brexit – know when to fold them

The final weekend before the referendum and the GBP/USD is trading some 200 pips higher through 1.4575, while USD/JPY is greater by 40 pips at 104.60, with the key GBP/JPY hitting the accelerator moving above 152.00. In early trade, investors continue to view the likelihood of a UK exit a tad lower than priced in last week. Sterling was gaining momentum at the beginning of APAC trading session with GBP/JPY zeroing in on the key 152 level. While liquidity has been decent this morning, it’s not expected to hold.

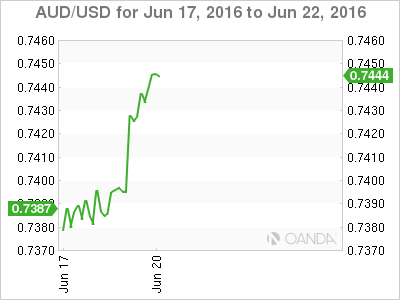

The Aussie – overshadowed by Brexit fears

With oil prices recovering and risk sentiment bouncing after the temporary suspension of the referendum campaign, the Aussie was supported into the weekend. In addition to the gyrations in risk sentiment around Brexit, local traders will be keeping an eye on the RBA meeting minutes to be released on Tuesday.

The market will be looking for any guidance that supports an August rate cut after the less-dovish tone of their post-meeting statement. However, the Brexit vote is the biggest driver for overall risk appetite.

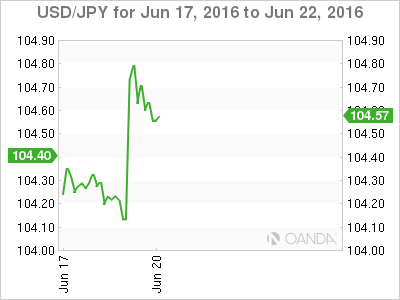

Yen – finger on the trigger for BoJ

The Bank of Japan has been keeping its powder dry for the Brexit fallout. It’s likely the BoJ will intervene if JPY breaches 100 JPY as the rapid appreciation would be perceived to be unrelated to actual Japanese fundamentals. Other central banks are unlikely to take a passive view of the events as well. In fact, we should expect the BOE along with ECB to thwart unwanted currency speculation. It’s not out of the question that the US monetary authorities would also join in a consorted effort.

In early trade, the JPY has weakened against the USD trading above 104.70 on shifting investor sentiment. This move higher is driven by position squaring and fast money looking to speculate on changing referendum opinion polls. However, traders will be incredibly nimble and trade very defensively this week given the uncertain market conditions.

After the initial move higher on improving risk sentiment, USD/JPY upside momentum has stalled despite the huge gains in Sterling. Indicating that even with a Remain Camp vote winning, USD/JPY upside may be limited. Given risk sentiment will remain fragile, there’s a strong likelihood that opportunistic offers on USD/JPY will emerge as we reach the 105.00 level. It certainly appears the Japans domestic economic issues are trumping Brexit to a degree as far the USDJPY recovery goes.

The Fed – a load of Bullard

A hawk seeks asylum in the doves’ nest. Uber-hawk James Bullard described the US economy as now mired in “secular stagnation,” and suggested that only one more rate hike is needed through 2018. Within a month, he has swung from dominate hawk to the ultra-dove while raising more questions than answers about Fed credibility. The Fed’s Open “Mouth” Committee has been too early in the economic cycle to make public statements and far too eager to grab the microphone.

In real Fed news, Chairman Janet Yellen will be in the spotlight giving testimony on monetary policy to the Senate Banking Committee on Tuesday. While the Humphrey-Hawkins testimony is typically a critical event for traders, with Brexit dominating news flows her testimony may only attract a fleeting glance.

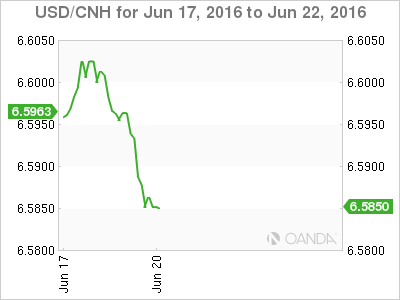

CNH – position trimming to dominate pre-Brexit flow

China has released its May property price data. Based on a Reuters’ calculation, the average house price in 70 major cities increased by 0.9% month on month, down from 1.2% month-on-month in April. However, the annual increase lifted to 6.9% year-on-year from 6.2%. The hot property markets continue to be a bright spot for the Chinese economy.

On the currency front, smart money will likely continue to trim speculative bets ahead of Brexit.

The Ringgit continues to trade in a very tight range as investors, for the most part, remain sidelined until the UK referendum dust settles. Domestic factors and oil price moves continue to be upstaged by Brexit risk.

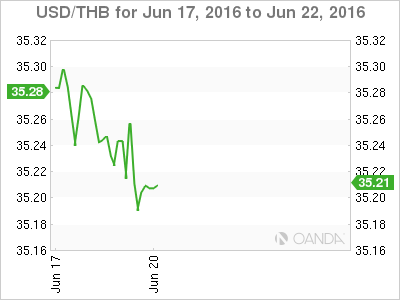

Thai Bhat

The THB should come into focus this week with a policy rate decision on June 22. The Bank of Thailand will likely watch the reaction from other regional central banks. With the Bank of Korea and the Bank of Indonesia reducing interest rates, there is a chance that the Bank of Thailand could thwart the consensus view and reduce the bench market by 0.25 bps.