The US dollar posted modest upticks against the G10 currencies in the New York session. USD bulls found solace in yesterday’s US initial jobless claims, which fell to a lower-than-expected 264k last week, lowering the four-week average by 7k to 270k. The weekly employment barometer certainly paints a more robust picture of the US labour market compared to last Friday’s gut-wrenching Non-Farm Payroll numbers. Those in support of a near-term Fed hike breathed a collective sigh of relief.

Global markets remain on edge as the UK’s EU referendum uncertainty casts a shadow. WTI continues to slide lower, and equity futures are struggling, and hard commodities are coming off the boil keeping USD supported with the Australian dollar looking a bit worse for wear this morning.

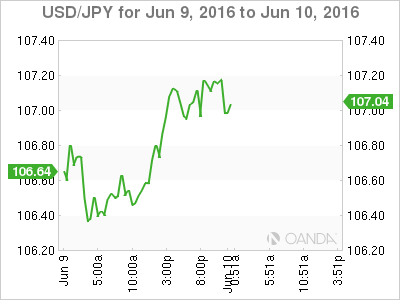

YEN – stimulus package may be back on radar

We’ve had a solid rebound after testing the 106.35 depths and are now testing above 107.0USDJPY. This is being driven by the surprising US initial jobless claims. as the market was very much short USD at time of release. But given the fragile and erratic nature of this report, I would not hang my hat on that report. However, the USD/JPY continues moving higher in early trade on the back of broader USD moves in early trade. But given how sparse the economic diary is, I am not expecting any drama today but definitely worth keeping an eye on risk sentiment.

The one data point from this week that should attract Japan’s policymakers’ attention was the decline in Japan’s machine order, which plummeted 11% in April. Given this staggering decline, we may start to hear more rhetoric about the fiscal stimulus, which could lend a hand to the higher USD/JPY argument.

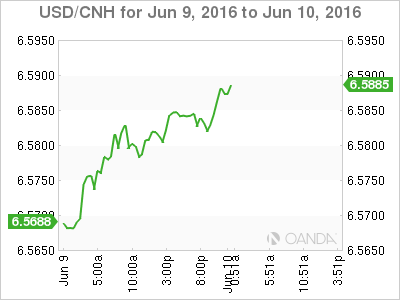

YUAN – trading light in holiday season

With Mainland China and HK markets on holiday yesterday, the turnover in CNH has been very light. The well-documented macro themes remain in place, but the market continues to show two-way interests with activity primarily centred on the Fix. Curve wise, the front-end continues to trade loose and, despite some weaker data earlier in the week, there was very little concern expressed in this quiet holiday period.

I expect a continuation of broader USD sentiment to dictate the pace of trade leading into weeks end.

Risk off sentiment saw reversals across much of EM and commodity basket. Oil was trading back toward the $ 50.00 mark, which in itself should provide a floor on USD/MYR today. Also the fall in US bond yield is suggesting investors are opting for the relative safety of less risky assets and this should weigh on near term sentiment.

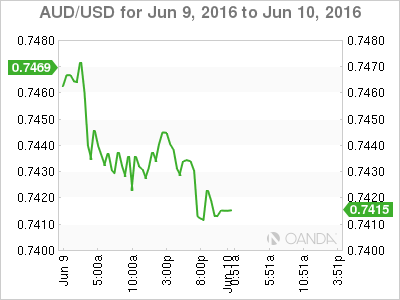

Aussie – rollercoaster ride continues

After a very impressive run to 0.7500, the Aussie has come under steady pressure during the NY session on the back of the risk aversion concerns. Australian dollar traders are well versed in rollercoasters and given that Q2 CPI data remains the key, the 0.7500 level was always going to be a huge hurdle for subsequent Australian dollar appreciation, risk aversion or not.

US equities should remain supported in the near term by recent dovishness from the Fed. However, the elephant in the room for risk sentiment is Brexit, which is just too much of a wild card to call. With nerves frazzling as we near the UK’s historical referendum, Aussie dollar bulls will likely find themselves running up the down escalator over the next week or two. Keep any eye on this current reversal, as risk sentiment is likely to remain fragile until the June 23rd crunch date.

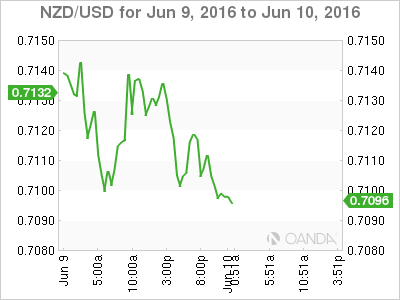

NZD – Kiwi rockets against major currencies

The RBNZ appears in little rush to cut rates and Governor Wheeler may want to keep his powder dry like other central bankers have done. Or he believes that in this global low-interest rate environment, monetary policy has a very limited influence to guide exchange rates lower in a constructive way. Whatever his thinking, the New Zealand dollar rocketed higher against the USD and all the major crosses. In fact, the AUDNZD broke south of the fundamentally key 1.050 levels. Given how fragile the hard commodity recovery remains, coupled with soft commodities like milk products surging, a move lower in the AUDNZD cross is in cards.