Aon plc (NYSE:AON) is set to report fourth-quarter 2018 results on Feb 1, before the opening bell. In the last reported quarter, the insurance broker's earnings surpassed the Zacks Consensus Estimate by 6.5% and also rose 1.6% year over year. This was primarily supported by positive performances across key financial metrics, driven by a core operational improvement.

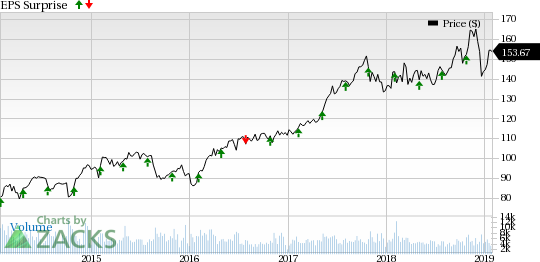

The company flaunts an impressive surprise history. Its earnings surpassed estimates in all the last four quarters, with average positive surprise of 4.57%. However, for the to-be-reported quarter, the Zacks Consensus Estimate for the bottom line is pegged at $2.13, down 9.4% year over year.

Factors to be Considered Ahead of the Upcoming Quarterly Release

The company is likely to have suffered from escalating expenses, owing to organic and inorganic investments, during the quarter. Moreover, Aon is likely to endure a high financial leverage, which has been rising since 2014 due to a high commercial paper outstanding.

Nevertheless, Aon’s constant efforts for strategic investments to expand the portfolio along with productivity improvement measures are likely to contribute to its revenues. The Zacks Consensus Estimate for fourth-quarter total revenues is pegged at $2830 million, down 2.7% year over year.

We expect higher contribution from its Commercial Risk Solutions, and Data & Analytics segments. Moreover, due to Aon’s consistent investments in data and analytics, we expect revenues from Data & Analytics services to be around $311 million, up 4.4% from the year-ago quarter.

The Zacks Consensus Estimate for Commercial Risk Solutions segment revenues for the fourth quarter also indicates a rise of 7.2% from the prior-year level. This is likely to be supported by growth across major geographies, management of renewal book portfolio, along with double-digit growth in the United States and Latin America.

Per the consensus mark, revenues from the Reinsurance segment are likely to decline 57% year over year.

The company might have witnessed increased operating leverage and free cash flow during the quarter due to its healthy capital position. Aon continued with its share repurchases and dividend payouts in the fourth quarter of 2018.

What the Quantitative Model States

Per our proven model, Aon is not likely to beat on earnings in the quarter to be reported. This is because a stock needs the right combination of a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen, which is not the case here.

Earnings ESP: Aon has an Earnings ESP of -0.39%. This is because the Most Accurate Estimate is pegged at $2.13, in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Aon currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, when combined with an Earnings ESP of -0.39%, surprise prediction is left inconclusive.

We caution against the Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Performance of Other Insurers

Of the insurance industry players that have reported fourth-quarter earnings so far, The Travelers Companies, Inc. (NYSE:TRV) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate for earnings while The Progressive Corporation (NYSE:PGR) missed the same. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Aon plc (AON): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

RLI Corp. (RLI): Get Free Report

Original post

Zacks Investment Research