The dollar lost its value during yesterday’s intraday trading session as crude oil blasted through $110 to touch a high of $111.37 per barrel. In addition the dollar lost its ground on expectations that company earnings will show that the U.S economy is currently in a direr situation than what most people think. To date analysts are expecting an additional rate cut of at least 0.5% at the Feds next meeting. Current market expectations are that the additional rate cut will help the U.S economy crawl out of its bad situation.

In addition, volatility in the markets along with two upcoming major market events, gave traders the incentive to prepare their portfolios for today’s results. Today the ECB and the BOE will be releasing their decisions regarding their interest rates. Recent economic data, including a 2.5 percent decline in house prices, are currently pointing to a rate cut in England, while more stable data from European countries are pointing to a “No Change” status from the ECB.

The U.S stock market continued to pull back loosing an average of 1%, while Gold closed the session up at $933.71 per ounce.

As mentioned above, eyes will focus on two major interest decisions today from the Bank of England and the European Central Bank. In addition, economic data from the U.S will be released later on during the trading session.

Euro | Japanese Yen | British Pound

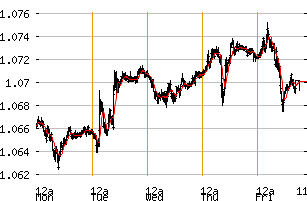

Euro

After opening the session in Asia at $1.5709, the Euro traded mixed throughout the first few hours of the session. Breaking intraday resistance of 1.5737 the EUR rallied up to an intraday high of $1.5856. The EUR/USD managed to hold on to most of its intraday gains to close the session at $1.5830.

Support: 1.5800, 1.5750, 1.5700

Resistance: 1.5880, 1.5900, 1.5913

Euro | Japanese Yen | British Pound

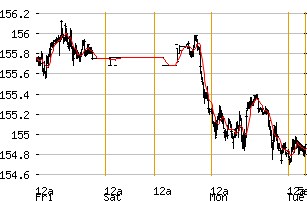

Japanese Yen

Testing an intraday high of 102.80 twice throughout the session, the Dollar couldn’t hold onto its strength. Towards the second half of the day, the Dollar gave up its strength dropping to an intraday low of 101.54. This carry trade pair closed the session at 101.79

Support: 100.80, 100.50, 100.00

Resistance: 101.50, 102.00, 102.50

Euro | Japanese Yen | British Pound

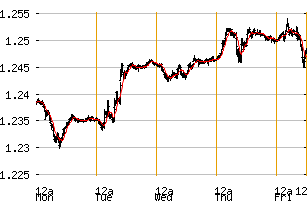

British Pound

After opening at $1.9688 this pair range traded up until the middle of the session. The Pound managed to find some strength rallying up to touch an intraday high of $1.9790. The weak Industrial result had no negative affect on this pair, climbing higher after every slight correction. The pound ended the session up high at $1.9762.

Support: 1.9650, 1.9600, 1.9550

Resistance: 1.9770, 1.9880, 1.9950

Euro | Japanese Yen | British Pound