It has been about a month since the last earnings report for CyberArk (CYBR). Shares have added about 1.2% in the past month, underperforming broad markets in that time frame.

Will this trend continue, or are there some catalysts on the horizon for this company? Recent analyst estimates could give us some clues, while a look to fundamentals may offer some guidance too. But before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

CyberArk Tops Q3 Earnings, Ups '16 View

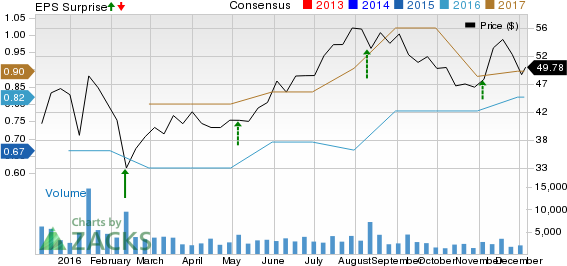

CyberArk Software reported third-quarter fiscal 2016 adjusted earnings per share (excluding amortization of intangible assets and other one-time items buts including stock-based compensation) on a proportionate tax basis of $0.22 per share, which came ahead of the Zacks Consensus Estimate of $0.18 per share. Adjusted earnings however were flat year over year.

Quarter Details

CyberArk’s revenues grew 37.2% year over year to $54.9 million and surpassed the Zacks Consensus Estimate of $52 million. The company’s revenues increased on a year-over-year basis, primarily due to better-than-expected demand for its privileged account security platform.

Revenues were also boosted by a 34% increase in License revenues, which came in at $33.3 million and accounted for 60% of total revenue. Also, a 42% year-over-year increase in Maintenance and Professional Services revenues (40% of total revenues) positively impacted the quarterly results.

CyberArk’s adjusted gross margin (excluding amortization of intangible assets and other one-time items buts including stock-based compensation) contracted 20 basis points (bps) on a year-over-year basis to 86%, primarily due to higher cost of sales.

The company’s adjusted operating margin (excluding amortization of intangible assets and other one-time items but including stock-based compensation) decreased 570 bps from the year-ago quarter to 16.8%, primarily due to higher adjusted operating expenses as a percentage of revenues. Adjusted operating expenses, as a percentage of revenues, increased 550 bps on a year-over-year basis.

Guidance

For the fourth quarter of fiscal 2016, CyberArk expects revenues in the range of $62 million to $63 million, representing 20% to 22% year-over-year growth. Non-GAAP operating income is expected to be in the range of $14.7 million to $15.5 million. The company expects non-GAAP earnings for the fourth quarter of fiscal 2016 in the range of 31 cents to 33 cents.

CyberArk raised its full-year 2016 guidance. The company now expects revenues in the range of $214.3 million to $215.3 million (previous guidance $210.5 million to $212.5 million), representing 33% to 34% year-over-year growth. Non-GAAP operating income is expected to be in the range of $53.3 million to $54.1 million (previously $48.4 million to $50 million). The company now expects non-GAAP earnings for fiscal 2016 in the range of $1.16 per share to $1.18 per share (previous guidance $1.03 per share to $1.07 per share).

How have estimates been moving since then?

Following the release and in the last month, investors have witnessed an upward trend for fresh estimates. There have been two revisions higher for the current quarter compared to zero lower. Additionally, the consensus estimate has shifted by a robust 6.52% higher due to these changes.

VGM Scores

At this time, Cyber Ark's stock has a subpar Growth score of 'D', however, its momentum is doing a lot better with an 'A'. Still, the stock was allocated a grade of 'F' on the value side, putting it in the bottom 20% quintile for this investment strategy.

Overall, the stock has an aggregte VGM score of 'F'. If you aren't focused on one strategy in particular, this overall score is the one you should be interested in and obviously it isn't great news for CYBR investors.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. Surprisingly, shares of CYBR have just a Zacks Rank #3 (hold), so we are expected a performance that is just in-line with the market in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 days. Click to get this free report >>

CYBER-ARK SFTWR (CYBR): Free Stock Analysis Report

Original post

Zacks Investment Research