Q3 financials largely a non-event

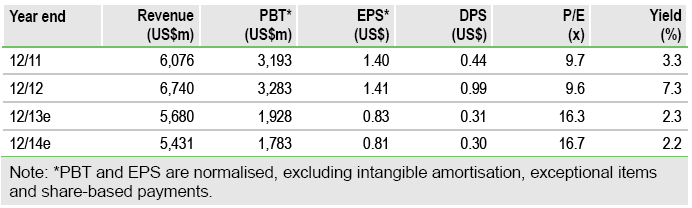

There are no surprises in Antofagasta's Q313 financial report, with revenues and EBITDA for the nine months to 30 September and attributable net cash at 30 September all in line with our forecasts. Sales volumes, cash costs, realised prices and provisional pricing adjustments were already reported, making the Q313 financial report largely a non-event. Based on the nine-month production and cost figures, we expect Antofagasta, (ANTO) to achieve FY13 guidance of 700kt copper production and US$1.40/lb cash costs. Our valuation of Antofagasta is 661p/share at a 10% discount rate and 721p/share at a 9% discount rate.

9M13 EBITDA down 27.9% y-o-y

Antofagasta reported group revenues down 9.2% to US$4,404m in 9M13 due to lower realised prices partly offset by increased copper and gold sales. Sales volumes of 532kt copper were 7.4% higher y-o-y, but slightly lower than production mainly due to shipping and loading schedules. The US$3.26/lb average realised copper price was 12.8% lower than the comparative period. Reported group EBITDA fell 27.9% y-o-y to US$2,053m reflecting the lower revenue, as well as higher operating costs. 9M13 average gross cash costs rose 11.9% y-o-y to US%1.79/lb and average net cash costs increased 34.3% y-o-y to US$1.33/lb, affected by weaker gold and molybdenum prices and lower molybdenum production volumes.

Balance sheet remains strong

Antofagasta reported US$1,641m group attributable net cash at 30 September 2013, down 22.5% from US$2,565m at 31 December 2012, mainly as a result of the US$887m dividend payments made during H113 following the 77.5c special dividend declared for FY12, bringing the payout ratio for the year to an exceptional 70%. We consider that Antofagasta’s US$1.5bn consolidated net cash position reflects management’s conservative approach and provides reassurance over Antofagasta’s ability to fund its development projects, while maintaining a 35% dividend payout ratio.

Valuation: 721p per share at a 9% discount rate

We are not making any revisions to our forecasts and our commodity price assumptions are unchanged, so there is no change to our valuation of 661p per share at a 10% discount rate and 721p per share at a 9% discount rate. A lower discount rate than 10% could be justified by Antofagasta’s lower risk profile compared to peers.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Antofagasta: Balance Sheet Remains Strong

Published 11/17/2013, 06:44 AM

Updated 07/09/2023, 06:31 AM

Antofagasta: Balance Sheet Remains Strong

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.