Anthem Inc.’s (NYSE:ANTM) second-quarter 2017 adjusted net income per share of $3.37 surpassed the Zacks Consensus Estimate of $3.25 by 3.7%. The bottom line also jumped 1.2% year over year.

Operating revenues of $22.2 billion missed the Zacks Consensus Estimate of $22.3 billion. The top line, however, grew 4.3% year over year due to premium rate increases as well as higher enrollment in the Medicaid, Medicare, and Local Group insured and self-funded businesses.

Medical enrollment increased 1.6% year over year to 40.4 million members. The rise was primarily recorded by commercial & specialty business as well as fully insured and self-funded Local Group businesses. This upside was partially offset by a decline in membership in the National Account and Individual businesses.

Total expenses increased nearly 6% to $21.2 billion in the reported quarter, mainly due to a 3% rise in total selling, general and administrative (SG&A) expenses and 2.3% higher interest expenses, on a year-over-year basis.

Anthem’s benefit expense ratio of 86.1% deteriorated 190 basis points (bps) from the prior-year quarter. This was largely due to the one-year waiver of the health insurance tax in 2017 and less favorable adjustments to the prior-year risk adjustment estimates. However, improved medical cost performance in the Local Group and Individual businesses was an offset.

The SG&A expense ratio of 13.8% improved 20 bps from the year-ago quarter. This was primarily driven by the one-year waiver of the health insurance tax in 2017, the impact of operating expense efficiency initiatives taken by the company and fixed cost leverage on operating revenue growth. However, the improvement was partially offset by higher performance-based incentive compensation accruals and the 2015 cyber attack litigation settlement recorded during the quarter.

Segment Results

Commercial & Specialty Business

Operating revenues were $10.3 billion in the second quarter, up 4.1% year over year.

Operating gain totaled $967.9 million, down 10% year over year due to less favorable adjustments to the prior-year risk adjustment estimates, the one year waiver of the health insurance tax in 2017 and higher performance-based incentive compensation accruals. The decrease was partially offset by improved medical cost performance in the Local Group and Individual businesses.

Operating margin was 9.4%, down 150 bps year over year.

Government Business

Operating revenues were $11.9 billion in the second quarter, up 4.5% from the prior-year quarter.

Operating gain was $293.3 million, down 35% year over year. The downside reflected higher performance-based incentive compensation accruals and the impact of the one year waiver of the health insurance tax in 2017.

Operating margin was 2.5%, declining 150 bps year over year.

Other

Anthem reported an operating loss of $34.2 million in the Other segment for the second quarter compared with an operating loss of $25.6 million in the prior-year quarter.

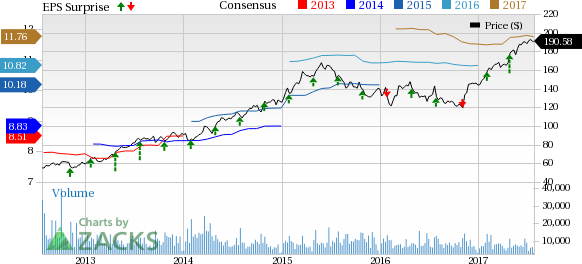

Anthem, Inc. Price, Consensus and EPS Surprise

Financial Update

As of Jun 30, 2017, Anthem had cash and cash equivalents of $4.6 billion, up 12% from year-end 2016.

As of Jun 30, 2017, its long-term debt increased 5% to $15.1 billion from year-end 2016.

As of Jun 30, 2017, shareholder equity was $26.4 billion, up 5.2% from year-end 2016.

Operating cash flow was $3 billion, reflecting year-over-year growth of 50%.

Share Repurchase and Dividend Update

During the quarter, Anthem repurchased 2.5 million shares of its common stock for $0.5 billion. During the first half of 2017, it repurchased 2.8 million shares of its common stock for $0.5 billion. As of Jun 30, 2017, it had approximately $3.7 billion of share repurchase authorization remaining.

During the second quarter, Anthem paid a quarterly dividend of 65 cents per share, representing a distribution of cash totaling $171.8 million.

On Jul 25, 2017, the Audit Committee declared third-quarter 2017 dividend to shareholders of 70 cents per share, an increase of 7.7% from the second quarter.

Guidance for 2017

Anthem expects adjusted net income to be greater than $10.35 per share.

Medical membership is expected in the range of 40.2–40.4 million. Fully insured membership and self-funded membership are likely to be in the band of 15.2–15.3 million and 25–25.1 million, respectively.

Operating revenues are projected in the range of $88.5–$89.5 billion.

Benefit expense ratio and SG&A ratio are expected to be around 87% and 13.6%, respectively, with adjustment of 30 bps.

Anthem expects operating cash flow to be greater than $3.5 billion.

Zacks Rank and Other Stocks to Consider

Anthem presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other firms in the medical sector that have reported earnings so far, the bottom line of Centene Corp. (NYSE:CNC) , Quest Diagnostics Incorporated (NYSE:DGX) and UnitedHealth Group Inc. (NYSE:UNH) beat their respective Zacks Consensus Estimate.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX): Free Stock Analysis Report

Original post

Zacks Investment Research