ANSYS Inc. (NASDAQ:ANSS) recently collaborated with Taiwan Semiconductor Manufacturing Company (TSMC) for an Automotive Reliability Solution Guide, which will help in accelerated development of new-age automotive features.

Coverage of the Guide

Notably, with advanced driver assistance system (ADAS) and autonomous driving systems steadily gaining pace, this collaboration is anticipated to be a positive for both companies as well as relevant technologies.

This is a first-of-its-kind guide that will support the aspects of automotive applications for TSMC’s 16-nanometer FinFET Compact Technology (16FFC) process and Automotive Design Enablement Platform (ADEP).

The guide will help optimize chips’ efficiency. It will outline the different processes to simulate and identify the problems in a chip and thereby perform electromigration, thermal and electrostatic discharge analysis to find a solution to the problems.

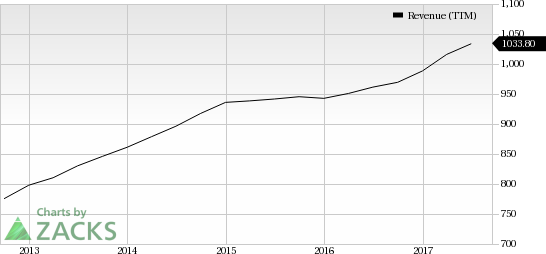

We believe that with ANSYS’ simulation solutions that enable access to instant feedback on chip designing related experiments, the guide will be more user-friendly. This is expected to increase the adoption rate of ANSYS’ offering as well improving its top line going forward.

Shares of ANSYS have gained 39.6% year to date, significantly outperforming the industry’s 28.5% rally.

ADAS: The New Trend

Per MarketsandMarkets, the ADAS market will reach $42.4 billion by 2021. We have seen influential chip makers in the industry including the likes of Intel (NASDAQ:INTC) , QUALCOMM (NASDAQ:QCOM) and NVIDIA (NASDAQ:NVDA) competing hard to gain an edge.

Intel recently formed a consortium for building an autonomous car ecosystem. We believe that in such a scenario where the big names are fighting for establishing a presence in the ADAS sector, forming a guideline for the basic infrastructure of the system will definitely be beneficial.

Other Growth Prospects of ANSYS

ANSYS, which has a significant presence in the high-end architecture simulation market, is also gaining traction from the combination of its Discovery Live simulation with NVIDIA’s graphic processing units (GPUs).

The company’s recent acquisitions of Computational Engineering International (CEI), SpaceClaim, Reaction Design and Evolutionary Engineering also bode well as these will expand its expertise in 3D modeling as well as analyzing simulation data. These have also increased the company’s total addressable market (TAM), which has a diversified coverage ranging from IoT, next-gen 5G product designs, autonomous vehicle, mobile products as well as high-performance chips for ADAS.

Moreover, collaborations with leading vendors like Autodesk (NASDAQ:ADSK) and Synopsys will also drive demand for the company’s products in the long run.

Zacks Rank

ANSYS has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

ANSYS, Inc. (ANSS): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research