It came as little surprise that the Federal Reserve announced this past week that QE and ZIRP would continue unchanged. They put the blame squarely on Congress stating bluntly “fiscal policy is restraining economic growth“. The Fed took an additional kick at the government shutdown insinuating that there was not enough data available to make any decision on changing Fed policy.

My theme for last few weeks – How can the Fed ever end quantitative easing and it zero interest rate policy? The economy is acting like it is running with a flat tire, and never seems to gain enough momentum for one to believe the economy is organically expanding. How much of the current meager economic growth is attributable to QE and ZIRP?

And the government shutdown assured that there would not be enough information for the Fed to make any changes to its policies. In any event, had the government not shut down – likely the data would have been very soft anyway.

Retail Sales This Week

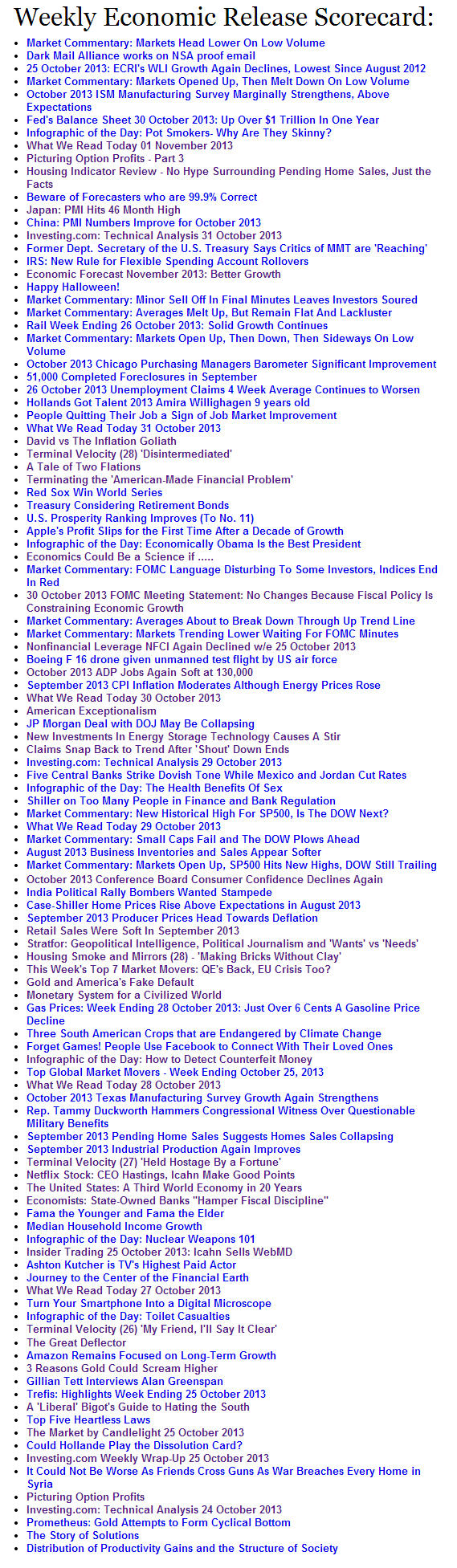

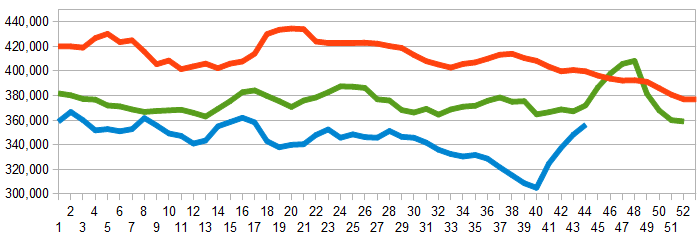

September’s retail data was soft. Everyone wants to look at the headline seasonally adjusted numbers but these numbers are not “chained” (removing the components associated with inflation). Inflation adjusted numbers show retail sales growth year-over-year at 2% (red line in chart below).

Year-over-Year Growth of unadjusted Retail Sales – Retail Sales (blue line), inflation adjusted Retail Sales (red line), and 3 month rolling average of Retail Sales (yellow line)

Wow – 2% inflation adjusted year-over-year growth in a consumer based economy. Should you believe that the Fed will discontinue its extraordinary monetary policy with the consumer component of the economy scrapping along at 2%?

We have been warning in our economic forecasts that consumer expenditures have been outpacing the growth of consumer income – and that this would remain a headwind in the 2H2013. We now have two months of decelerating growth for unadjusted retail sales.

Employment from ADP

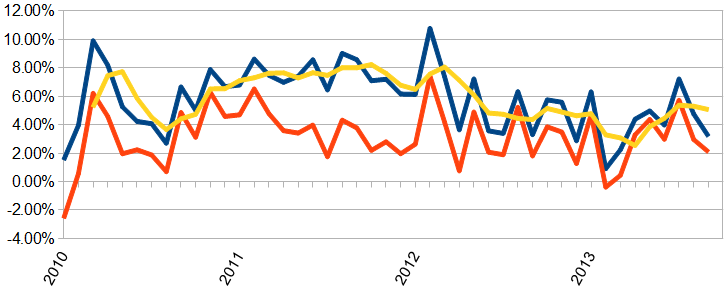

A nasty report. Because of the government shutdown we do not have the BLS data which was originally scheduled to be released this past week.

Jobs growth of 150,000 or more is calculated by Econintersect to the minimum jobs growth to support population growth. The graph below shows ADP employment gains by month. Look at the August, September and October numbers.

Even though the government shutdown has deprived us of the BLS October jobs report this past week, there has not been much difference between BLS and ADP data.

ADP versus BLS – Monthly Jobs Growth Comparison

Putting it all together

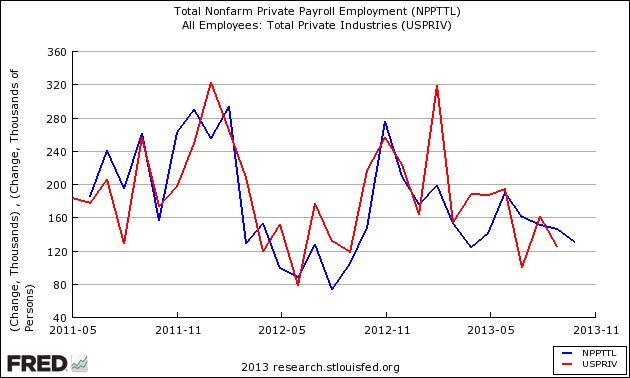

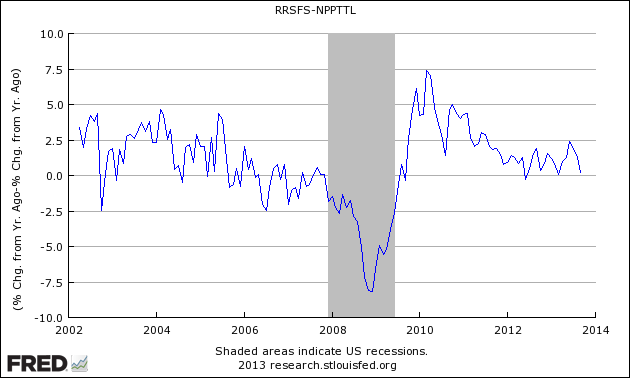

Econintersect reviews the relationship between the year-over-year growth rate of non-farm private employment and the year-over-year real growth rate of retail sales. The short term trend is declining. As long as retail sales grow faster than the rate of employment gains (above zero on the below graph) – a recession is not imminent. But we are not far above zero.

Growth Relationship Between Retail Sales and Non-Farm Private Employment – Above zero represents economic expansion

The real question on the table is how effective is QE and ZIRP in this current “economic expansion” in helping private consumption. There is no real evidence that it is helping or hurting. Everything I read is unsubstantiated opinion.

The weakness in the economy is consumer income. Lowering interest rates to zero helped the consumer initially – but four plus years later, it is no longer able to push higher economic growth. At this point, it is depriving the seniors living on CDs of income. QE seems to have no effect on the consumer.

How many think the Fed policies at this point commit the USA to be the next Japan?

Other Economic News this Week:

The Econintersect economic forecast for November 2013 again improved . There is no indication the cycle is particularly strong, as our concern remains that consumers are spending a historically high amount of their income, and the rate of gain on the economic elements we watch are not very strong.

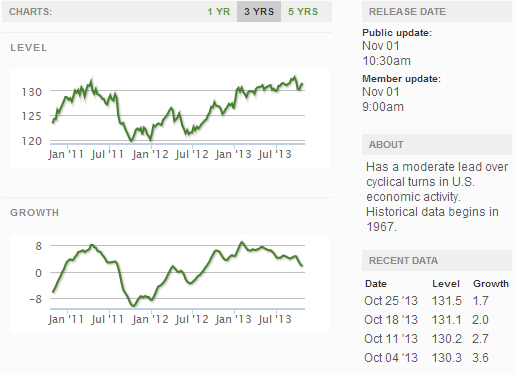

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

Initial unemployment claims went from 350,000 (reported last week) to 340,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate.

The real gauge – the 4 week moving average – degraded from 348,250 (reported last week) to 356,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: Green Field Energy Services, Allens

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements growth trend is continuing to accelerate.

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks