We think any Federal Reserve policy loosening will be more modest than the market's current pricing. Confidence is strong, the US labour market remains incredibly tight; workers have the comfort of job security and the prospect of higher pay

170k July non-farm payrolls growth

A lack of workers caps jobs' gains

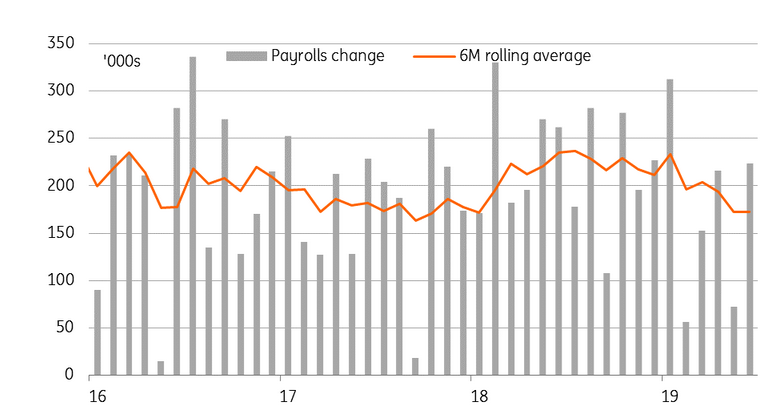

After June’s incredibly strong jobs growth of 224,000, which was above every one of the 75 forecasts in Bloomberg's survey of analysts, there is obviously the risk of a softer outcome for July. We are looking for 170,000, which would be broadly in line with the six-month moving average. This also tallies with evidence from the latest Federal Reserve Beige Book, which based on data up to July 8 reported that “employment grew at a modest pace, slightly slower than the previous reporting period.”

Despite last month’s positive surprise, there has been a gradual slowing in the rate of job creation through 2019, and you can see that in the chart below. However, we continue to highlight that this is more due to the lack of suitable workers rather than any meaningful downturn in labour demand. The Beige Book commented that “labour markets remained tight, with contacts across the country experiencing difficulties filling open positions.” Interestingly, the Beige Book also made reference to some concern that it was becoming increasingly difficult to secure and renew work visas for foreign nationals, which will further constrain worker supply and make it even more challenging to fill vacancies

Payrolls growth is moderating

Demand remains strong with job openings remaining close to all-time highs while business surveys such as the ISM and NFIB employment components pointing to a robust appetite for hiring workers. Given the early (2nd August) release date we unfortunately haven’t got much up to date information specifically for July, but certainly the recently released regional manufacturing surveys offer encouragement that firms are still expanding and need workers.

The consensus range of expectations for July payrolls growth is pretty broad from a low of 74,000 up to 224,000

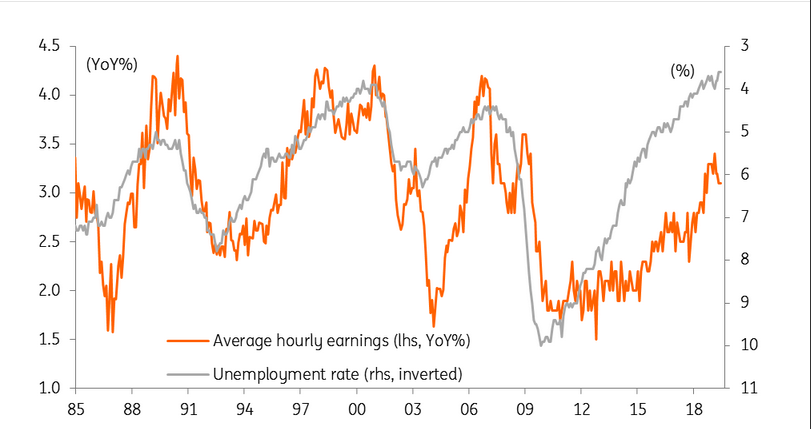

Wages to grind higher

Given this demand-supply imbalance in the jobs market, there is stiff competition to retain and recruit staff. This should, in theory, be boosting worker pay, but wage growth has been a little underwhelming, slipping back to 3.1%YoY in recent months. The July Beige Book commented that “compensation grew at a modest-to-moderate pace, similar to the last reporting period, although some contacts emphasized significant increases in entry-level wages.”

Pay rates have been slowing despite labour market tightness

Instead, it seems that businesses are using other methods to incentivise staff, such as improving health care and pension packages. Here, the Beige Book commented that “most District reports also noted that employers expanded benefit packages in response to the tight labour market conditions.”

Nonetheless, we think there may be a little upside risk to the consensus estimate for wages given the demand-supply imbalance in the jobs market. We expect wage growth of 0.3%MoM, 3.2%YoY versus the market forecast of 0.2%/3.1%

3.2% Annual US wage growth (YoY%)

Unemployment at 50 year lows

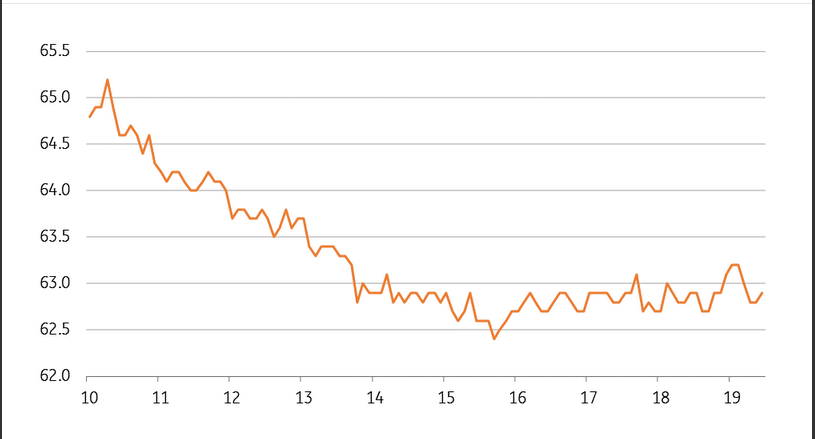

After 3.6% readings in both April and May, the unemployment rate ticked higher to 3.7% in June. We expect to see a return to 3.6% for July, which would also be the lowest reading since December 1969. The participation rate plays an important role here with a slight uptick last month, contributing to the increase in the unemployment rate.

Participation remains weak

The participation rate tends to be quite a choppy series, so if we do see that move higher once again it would make a 3.7% unemployment rate look more likely. A higher unemployment rate, for this reason, would certainly not be a signal we should be concerned. If anything, it would be a perfectly understandable development - competition for workers driving up pay, which attracts people who had left the labour market (early retirement for example), back into the jobs market. With unemployment at such low levels this gives workers a sense of job security, which is good news for spending, particularly on 'big ticket' items such as housing or autos.

3.6% Unemployment rate

What it means for the Federal Reserve

There is a concern that a weaker global economic backdrop and ongoing uncertainty surrounding trade will act as a brake on US growth. The Federal Reserve clearly recognises that threat and has signalled that it is prepared to offer support to the economy by cutting interest rates. Financial markets continue to look for around four 25bp interest rate cuts between now and the end of 2020.

We are more cautious, expecting just two rates cuts – one tomorrow (July 31st) and another in September. This is down to our more upbeat assessment on US growth prospects with the strength of the jobs market a key factor in our thinking. With employment at record levels and workers seeing larger pay packets and improving benefits, consumers have the confidence and the cash to go and spend. Moreover, the US-China trade truce has recently seen some positive shifts in activity in the manufacturing sector while the latest rebound in durable goods orders offers encouragement for investment spending.

Currently, Fed officials are signalling precautionary moves to head off the risk of a steeper downturn in the future. This is consistent with our view that we will merely be seeing some insurance policy easing, similar to the Fed’s response to the 1995-96 and 1998 slowdown fears. After all, according to Jerome Powell, the Fed’s “baseline outlook is for economic growth to remain solid, labour markets to stay strong and inflation to move back up overtime” to 2%.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more