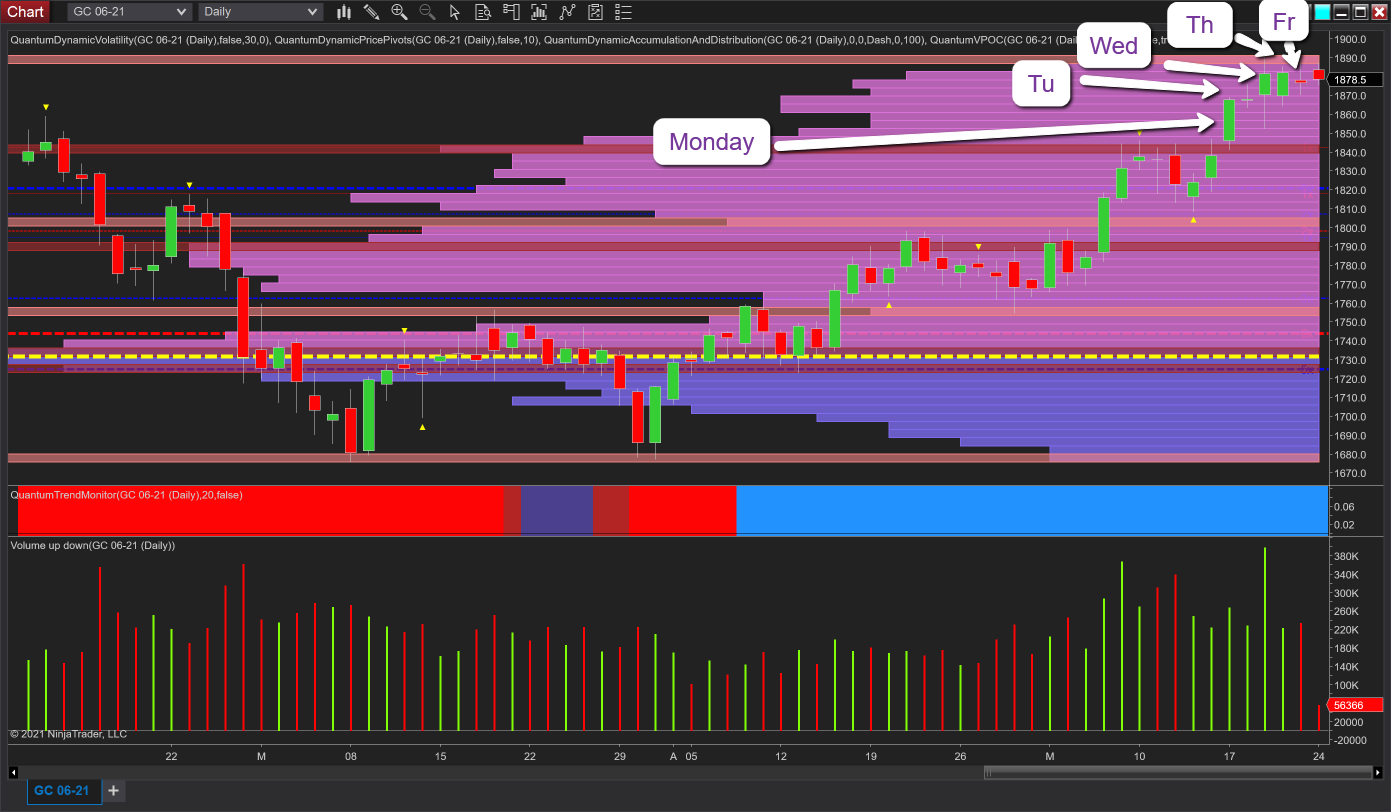

It was another solid week for gold, which as expected continues to bank gains as the longer-term bullish trend gathers pace on towards the $2,000 per ounce level. But what of the price action on a day by day last week from a vpa perspective?

Monday started with an excellent wide spread up candle with no wicks to either top or bottom on good volume thereby confirming price and volume in agreement. There was some weakness on Tuesday with profit taking but similar volume with the precious metal making a marginal gain on the day. Wednesday followed with volatile price action following the FOMC on Wednesday reflecting the uncertainty of the message, but again the precious metal closed the day higher on extreme volume despite the top and bottom, wick to the candle confirming once again the bulls remain firmly in control.

This sentiment continued on Thursday despite the gapped down open with gold recovering to test the $1880 per ounce region. Friday ended the week with some short-term weakness and probing higher into the $1890 per ounce area which is starting to build into a potential level of resistance at the top of the VPOC histogram.

This may develop into a significant level and one that needs to be breached with volume as we push on to $1900 per ounce and then on to the psychological level of $2,000 per ounce and beyond, where inflation may then become a key driver for the precious metal.