Euro area manufacturing PMI has declined in eight consecutive months and on every release day of the flash estimate over this period EUR/USD has dropped.

On Thursday, we look for another drop in the manufacturing PMI to 47.0 from 47.5, while consensus is looking for a rise to 48.

If we are right, we could see EUR/USD drop 0.5-0.7% on the day.

We forecast EUR/USD at 1.13 in 3M (NYSE:MMM) before drifting higher to 1.15 and 1.17 in 6M and 12M on a China-led recovery.

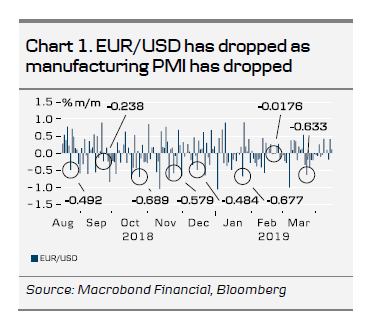

Euro area manufacturing PMI has declined in eight consecutive months from 55.1 in July to 47.5 in March. Moreover, on every release day of the flash estimate over this period EUR/USD has dropped. Some of the day-to-day declines in EUR/USD have been among the most significant over this period, i.e. in the area of 0.5-0.7% on six out of the eight observations - see chart 1 to the right.

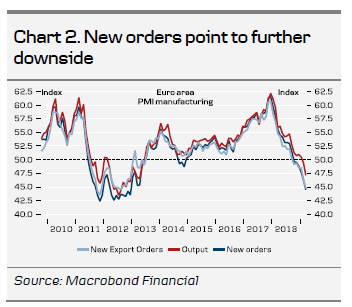

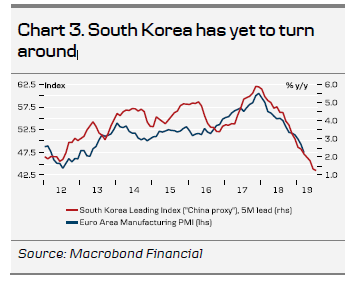

On Thursday, we look for another drop in the euro area manufacturing PMI to 47.0 from 47.5 in March. Although we have seen some rays of light in Chinese and even European data (Ifo, ZEW, industrial production) as of late, it might be too early to call for the trough in euro area manufacturing PMI in April. Forward-looking sub-indices such as new orders still showed marked declines in March and the leading order-inventory balance signals further downside in April (see chart 2). Eventually, we expect the improvement in the Chinese export sector also to spill-over to the euro area, but the impact will not be felt instantaneously. Looking at the South Korean leading indicator (which can be seen as a good 'China proxy'), we could still see further declines in the euro area manufacturing PMI in the coming 1-2M (see chart 3).

If we are right in our call for Thursday's PMIs to disappoint then we could see EUR/USD drop around 0.5-0.7% on the day, which is around 50-70 pips from the current level just above 1.13. Hence, the move above 1.13 following the positive data releases on Friday could prove temporary and we could see EUR/USD trading towards the 1.12 level after Thursday.

In the bigger picture, it is too early to be calling for EUR/USD to move higher in our view. There are some positive factors from improvement in Chinese economic data and progress towards a US-China trade deal, which are supporting the pair. However, we have yet to see a definitive bottom in euro area data, which would further cancel the need for further speculation in additional ECB monetary easing (beyond the recent extension of forward guidance and another TLTRO). We still expect the euro area macro data to bottom out in Q2, with some acceleration in the growth momentum ahead. In March, the ZEW expectations-current conditions spread turned positive for the first time since 2012, which historically has preceded turning points in the manufacturing PMI by some 2-5M. We forecast EUR/USD to stay close to 1.13 on 3M and only drift towards 1.15 in 6M and 1.17 in 12M once a turn in the Chinese cycle and the impact of a US-China trade deal start to show in the euro area.