The prevailing view in the gold community is that banks are speculators who bet on a falling price. To begin, they commit the casino faux-pas of betting on Do Not Pass at the craps table. When everyone wants the price to go up, the banks seem to want it to go down. Uncool.

In contrast to this view, ours is that the banks are arbitrageurs. They aren’t betting on price, they are profiting from the small spreads in between bid and ask, spot and future, future and Exchange Traded Funds.

We thought we would revisit the crash of Nov 6. Recall that our last look was at spot and futures. The quote on spot did not respond to the drop for 79 long seconds. We believe that this was a simply a delay in updating the quote, as spot quotes displayed by the data providers are indicative only. They are not tradeable.

This time, let’s look at the futures market and the leading gold exchange traded fund, SPDR Gold Shares (N:GLD).

The Bid and Ask Prices of GLD and the Dec Future

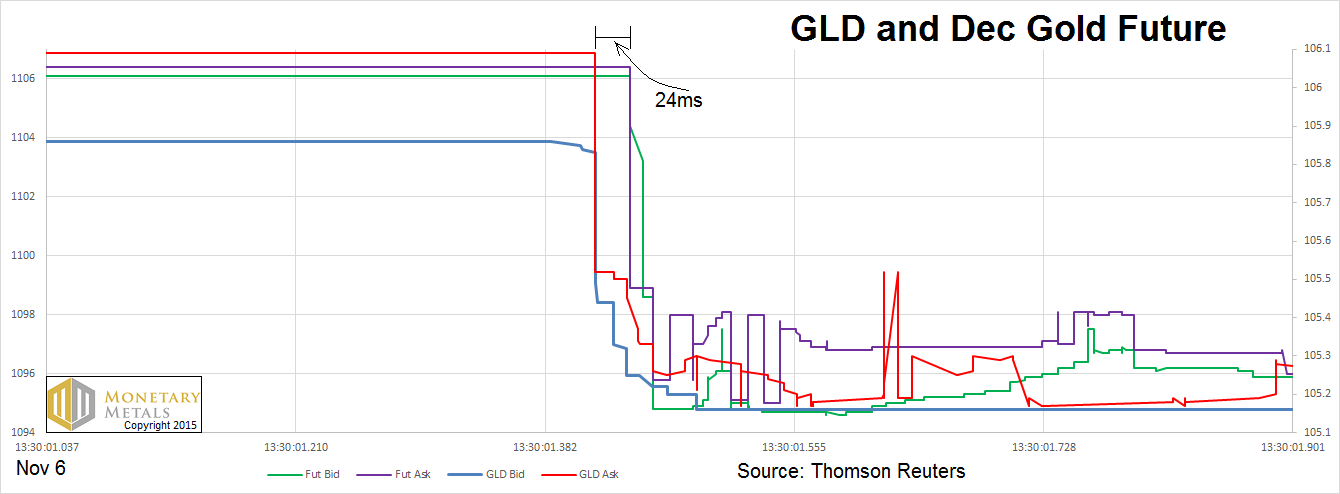

First, notice the time period of the graph. The whole thing occurs in just under a second, at 13:30:01 London time.

Second, note that this occurred an hour before the NYSE opens, so the bid-ask spread on GLD is much wider than normal.

Third, it’s fascinating to see the immediate aftermath of the crash. There’s even a brief period when the bid in the future appears to be above the ask. We are inclined to believe that’s an artifact of the quoting process. But perhaps, in the heat of the moment, the ask price fell below the bid. someone may have had nine nice long milliseconds to take the bank to the cleaners.

Fourth, after that period—around the :555ms mark—we see a relatively flat bid on GLD and ask on the future. So how do we explain the slowly but steadily rising bid on the futures? Our read is that once the selling pressure is over, the market returns to normal with the tight bid-ask spread being achieved by the bid rising near to the ask. We don’t have an opinion on the unstable ask on GLD. Perhaps the market makers were moving it around guessing where things would settle. There may have been some intermittent buying too, thus the upward pressure on the ask while the bid is table flat.

One last thing to note. It does appear as if GLD sold off first. In this data series, the bid and ask prices on GLD drop 24 milliseconds before the future reacts. However, we cannot rule out that this may be an artifact of the quoting process. GLD and futures trade on different exchanges, and it’s possible that the clock on one exchange server could be 25ms ahead of the other.