Investing.com’s stocks of the week

The headline says so.

Hedge-fund veteran Paul Tudor Jones has joined the growing chorus of big hitters in the fixed-income world warning that bonds are well and truly in a bear market.

Well, they truly are not in a bear market sir. They are in a bull market. At significant issue is whether or not they will enter a secular bear market after the decades-long bull funded and nurtured all manner of bullish asset market excesses since the early 1980s.

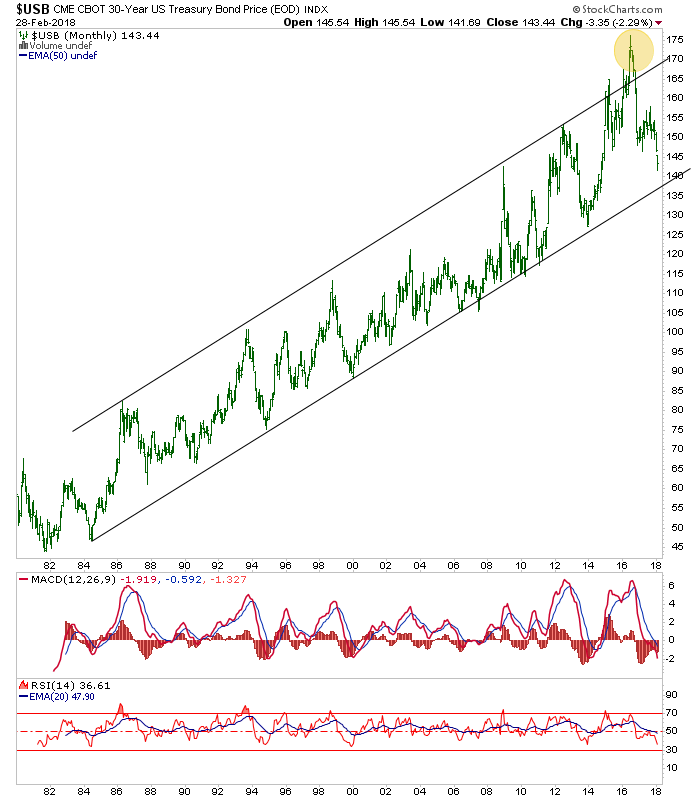

The 30-yr. ‘long bond’ is not in a bear market because it is in an unbroken uptrend. Ugly 2014-2018 pattern? Sure. Concerning upside overshoot (attn: stock market, you did the same recently) that could trigger an equal and at least opposite response? Sure. Bear market? Easy boyz, stop making headlines for people to get hysterical over and watch the market.

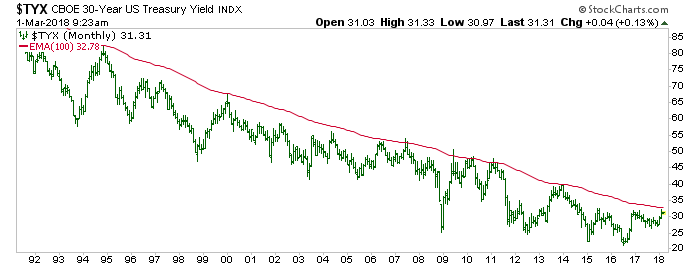

The 30-yr. yield is only now approaching our anticipated target.

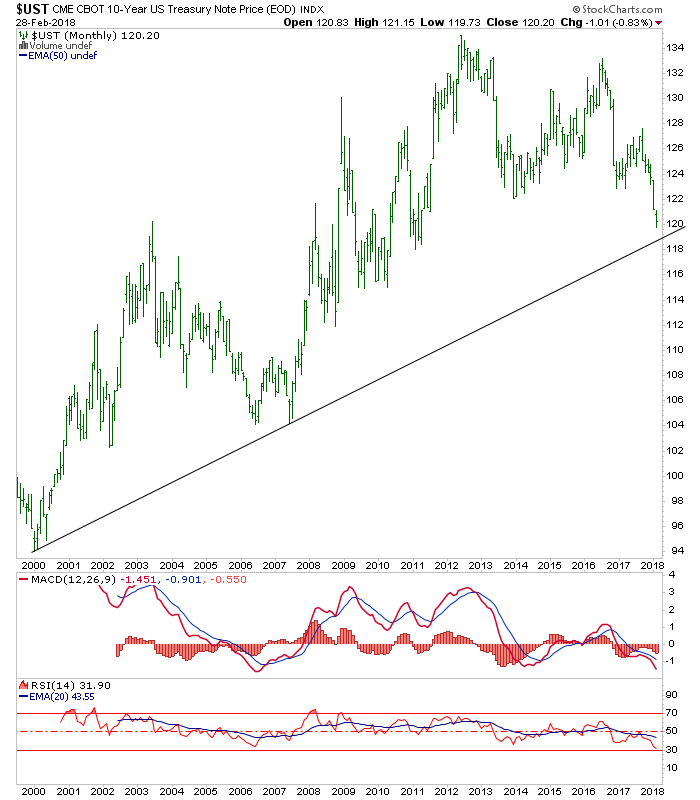

The 10-yr., albeit with less history, is approaching a trend line as well.

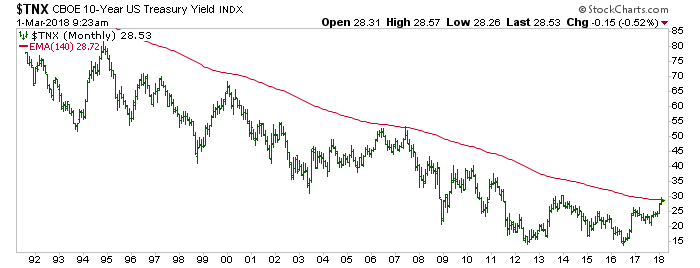

Just as its yield is.

I realize that there are very valid reasons why a bond bear could begin. Unmanageable debt, the Fed with no way out… why, just the overshoot on the 30-yr. bond above on that ridiculous NIRP hysteria are all valid inputs to a secular bear market.

Fact: Technically speaking, a bond bear has not yet begun.

No amount of media trumpeting of expert opinions changes that until it changes.