Gold has been in a range all year long. Bouncing back and forth between between about 1310 and 1360. A fifty dollar range, now working into the 4th month. This hardly makes it exciting to an investor. Perhaps interesting to a trading that buys at the bottom of the range ans sells at the top. But not so exciting to the guy that was convinced to park his entire IRA or 401k in Gold by some aged TV celebrity.

Will this change? Forget what the TV actors say about it. Even the Goldbugs in the financial world cannot tell you anything more than that you should always own Gold as a (fill in the black). How do you know if it is a good investment? Well, how do you measure investment performance? You look at the change in the price. The chart below is your road map.

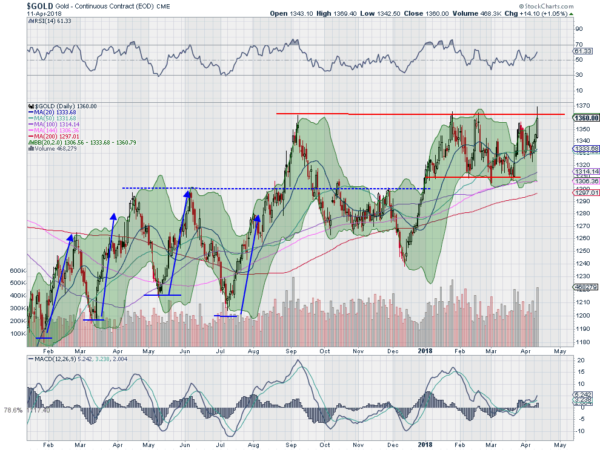

Looking at the price action over the last 15 months shows an even broader range giving way to a move higher in August that stalled right around 1360. The pullback from there was shallower, with two steps stopping at a higher low in December. Another push higher also stopped ant 1360 and pulled back to 1310, establishing the current range.

It has now bounced off of the top of the range 3 times, but this time might be different. First the intraday price action pushed to a new 20 month high. It is only about $15 above the close that would lead to a new 4 year high. That sounds interesting doesn’t it? Momentum continues to build yet indicators are well below the peak values from the last 2 touches at resistance, meaning it can continue to build for some time still. And volatility is shifting to wards a bias to prices going higher.

I will not go as far as TV promoters or Goldbugs and say just buy Gold now. But Gold is making a solid case for a break out of a 4 year range. A move over $1380 on a weekly close would give it significant confirmation of a nascent reversal to the upside.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.