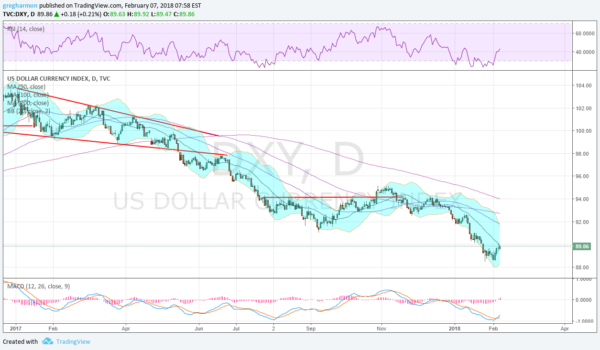

The US Dollar Index has been in a downtrend since the beginning of 2017. It has not been a straight line lower by any means, but it has been a big move. Nearly a 14% drop from the peak to last week’s low under 89. Currently it is trying to make a move higher, climbing up off of the mat. We have seen this before. In September the Dollar embarked on a 2 month rally, gaining 4% and moving back over all of its moving averages except for the 200 day SMA. That did not last though. A bull trap some would call it. Or a Dead Cat Bounce as they say. Why Dead Cat Bounce? Because a dead cat does not bounce, it just thuds and then falls back to the ground.

Now the US Dollar is trying to move higher again. There is a short term double bottom that formed and the greenback is moving up to its 20 day SMA. Momentum is turning up as this is happening. The RSI is making a higher high and rising toward the bullish zone. The MACD is crossed up and rising toward the positive range. Both support more upside. This is good news for the Dollar.

But will it turn into another Dead Cat Bounce? There are signs to watch for. The first is how it deals with the SMA’s. Will it fly through that 20 day SMA and continue on above the 50 and 100 day SMA’s to the 200 day SMA? Any failure to to continue through these indicators is a sign of a possible end of the move. Will the Bollinger Bands® turn higher? Now they are squeezing to the downside. Will it make a higher high, moving over the November high? This is the most important indication. A higher high would take it over the 200 day SMA as well. It has not closed over that since May 2017. Until that happens be prepared that this may just be another Dead Cat Bounce.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.