The December Rate hike probability is set near 100%, and the UST 10’s are nearing 2 .38 %. The USD bulls have shown little fear by taking the greenback into the weekend trading at, or near, recent highs.

Given the sheer USD buying volumes of late and with the DXY surging, traders are positioning for another USD leg higher, despite concerns that we are nearing a near-term pinnacle from the USD positivity of Trump mania. As we enter a short US holiday week, liquidity should drop off significantly by Thursday, and I suspect we may see a lull in activity with some consolidation and profit taking place after a tumultuous ten days of monumental USD strength.

However ,as s we enter a short US/Japanese holiday week, liquidity should drop off significantly by Thursday, and I suspect we may see a lull in activity with some consolidation and profit taking after a tumultuous ten days of monumental USD strength.

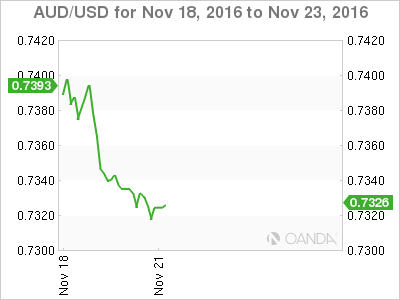

The Australian Dollar continues to struggle, as do all high yield currencies. With US yields surging, the AUD’s return has been significantly tarnished. US inflation expectations are mounting on speculative bombastic fiscal spend, so dealers are quickly repricing a steeper Fed rate hike tangent.

Since the turn in the metals complex last week, there has been no looking back after the break of the 200 days MA at .7410. The AUD is trading frailly within the Commonwealth basket, yet by no means is it isolated, as regional US dollar outflows are mainly concentrated in the Emerging Market Asia space. Given that the AUD is a liquidity proxy to express economic APAC sentiment, the currency is feeling the negative regional effects.

While the interest rate narrative is dominating currency movements , the threat of US trade barriers continues to bode poorly for global industrial supply chain champions like Australia.Of course ,there is no guarantee that Trump’s campaign rhetoric will turn into foreign policy, but the threat of trade sanctions will keep the RBA on a dovish lean, which could magnify if the Fed Fund Rate curve steepens.

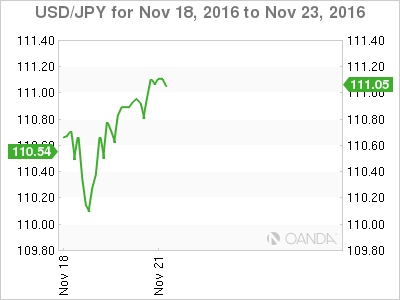

Playing to a similar song, US fixed incomes are ratcheting higher while the BOJ maintains its de facto 0% peg in JGB 10's. This underlying divergence will continue to support USD/JPY higher and given current momentum, any pull back to 110 levels will present excellent opportunities to add to long positions.

Despite the strong directional energy, retracement has been shallow and profit taking from leveraged names has been sparse. The key for this trade is yield divergence and provided the UST10’s move higher, and the BOJ holds the de facto peg, USDJPY remains the most obvious trade to express USD bullish sentiment.

While very much a yield trade it is not without risk. Currently, the BOJ is forced into QQE (Rinban buy Bonds) as UST10's exerted pressure on global bond yield. If global bond yields ebb lower, the opposite will hold and the BOJ will need to reduce bond purchases, which may be viewed by the market as tapering.

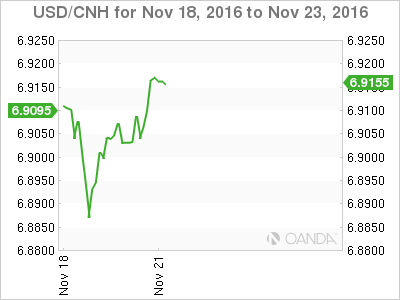

We are approaching the psychological 7 USD/CNY level, and predictable rumblings from Chinese policy makers are making the rounds, suggesting that the 7.00 level will be the “next “line in the sand”. No doubt capital outflows are of concern, but to what measure they will defend the currency is open to much interpretation.

Up until now, the PBOC has been unperturbed about the sliding yuan, but may be concerned about the rapid pace of the depreciation enough to “pump the brakes”. That said, a break of 7.0 may be tolerable but may force the PBOC into smoothing action to better control a yuan slide. Investors are carefully watching the PBOC’s reaction to the test of the psychological 7.00 level.

EM Asia

Massive USD outflows, chaos in the NDF markets due to BNM policy and another leg higher in US yields has traders exiting and by all accounts, they can’t leave quick enough. Look for continued pressure on MYR and locally correlated currencies, as investors find hedges against what is essentially an offshore non-tradable MYR.