There’s a common misconception that bitcoin is an anonymous, untraceable asset. In reality, bitcoin is pseudo-anonymous. Every wallet address and its transaction history are viewable on the network’s public ledger, known as the blockchain. These addresses do not have names attached to them, but with time, advanced software, and a subpoena, it’s often quite easy for a government agency to unmask bitcoin users when they attempt to trade their coins for fiat currency at an AML/KYC compliant exchange.

The IRS Tracks Bitcoin Tax Evaders

According to a recent report, the IRS has been contracting with Chainalysis, a firm that develops bitcoin transaction-tracing software, since 2015 to unmask bitcoin users accused of skipping out on taxes related to their cryptocurrency investments.

As government agencies acquire increasingly-sophisticated tools to track bitcoin users, it is likely that tax evaders and other criminals will turn to cryptocurrencies like Dash and Monero, coins designed to provide their users with maximum anonymity. Indeed, the now-defunct darknet market AlphaBay enabled Monero as a payment method last year.

But the rise of blockchain tracing software concerns many ordinary bitcoin users, too; it’s somewhat uncomfortable to realize your entire transaction history is publicly-available, even if you don’t have anything to hide.

Anonymous Cryptocurrency Prices Soar

Both Dash and Monero have experienced soaring prices this week. The Monero price has risen nearly 200%, from $55 on August 19 to a peak of $148 on August 26. This has launched Monero’s market cap above $2 billion.

Much of Monero’s current price rise should be attributed to the announcement that Bithumb--the world’s highest-volume cryptocurrency exchange--will enable Monero trading pairs, giving Monero its first access to the South Korean markets.

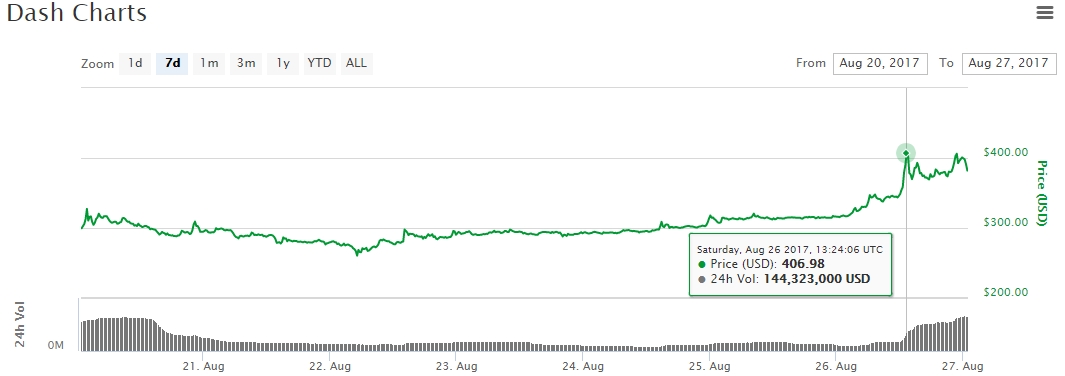

The Dash price, meanwhile, surged as high as $407 on August 26, hoisting its market cap above $3 billion for the first time. Dash trading is already enabled on Bithumb, and its KRW trading pair accounts for more than half of its single-day volume.

This privacy-centric coin, which was originally branded as Darkcoin when it launched in 2014, recently announced a research partnership with Arizona State University to study ways to improve blockchain security.

Untraceable Coins Will Have Staying Power

Cryptocurrency markets are notoriously volatile, and large-scale traders are known to seize on any and all news as an opportunity to shift the markets in their favor. Rapid movement like this is often followed by a corresponding sell-off as traders look to cash out their short-term positions. However, privacy is a rare and valuable asset in the digital age, so don’t be surprised if coins like Dash and Monero have long-term staying power.