Annaly Capital Management, Inc. (NYSE:NLY) , the New York-based mortgage real estate investment trust (“mREIT”) has made the announcement of extending its previously announced exchange offer for the purchase of Winston Salem, NC–based mREIT, Hatteras Financial Corp.’s (NYSE:HTS) outstanding shares. The extension of the offer has been made so as to obtain the remaining regulatory approvals which are essential for its completion. The exchange offer will now expire on Jul 11, 2016, unless extended further per the merger deal. The parties involved expect to get the regulatory nod by the extended time.

Notably, in Apr 2016, Annaly and Hatteras had inked a merger deal under which the former will acquire the latter for $1.5 billion. This strategic deal is likely to be beneficial for shareholders of both the companies and is expected to close by the end of third-quarter 2016 (Read more: Annaly Inks Deal to Acquire Hatteras Financial for $1.5B).

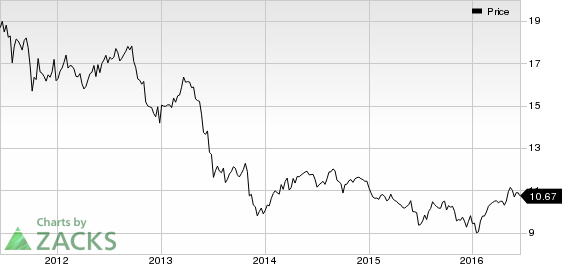

Annaly primarily owns, manages and finances a portfolio of real estate related investment securities. Its investment portfolio includes agency MBS, agency pass-through certificates, collateralized mortgage obligations (CMOs), interest-only securities and inverse floaters. Annaly reported first-quarter 2016 normalized core earnings of 30 cents per share, down from 34 cents earned in the year-ago quarter. The Zacks Consensus Estimate for the first-quarter earnings was pegged at 32 cents.

Currently, while Annaly carries a Zacks Rank #3 (Hold), Hatteras Financial holds a Zacks Rank #4 (Sell). Investors interested in the mREIT industry may consider stocks like Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) and Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI) . Each of these stocks sports a Zacks Rank #1 (Strong Buy).

ALTISOURCE PORT (ASPS): Free Stock Analysis Report

ANNALY CAP MGMT (NLY): Free Stock Analysis Report

HANNON ARMSTRNG (HASI): Free Stock Analysis Report

HATTERAS FIN CP (HTS): Free Stock Analysis Report

Original post

Zacks Investment Research