In his July statement, Chairman John Kearney stated that Anglesey (AYM.L) is well poised to weather the storm in the resources sector. It is focusing on cash retention and is undertaking a review of all information on Parys. Meanwhile, Labrador Iron Mines (LIM), of which Anglesey owns 15.3%, is now on track to produce up to 2Mt iron ore Fe 62% for the next five years. This gives LIM time to consolidate its agreement with Tata Steel (to develop the Howse project) and to arrange funding of the Houston project.

LIM has achieved its original target

With the successful commissioning of the Silver Yards upgrade, including the expansion for the wet plant and the connection to the grid, LIM has effectively achieved its initial plan. An annual production target of between 1.75Mt and 2Mt pa of saleable iron ore Fe 62% should be achievable for the next five years without any further major capital expenditure.

LIM looks forward to a strategic relationship with Tata

Tata Steel Minerals Canada (TSMC), a company operating on land adjacent to LIM, has signed an agreement to cooperate with LIM on rail and port infrastructure and in other areas. Subject to final agreement, TSMC proposes to take an initial 51% interest in the Howse deposit for a C$30m cash injection. This money would be available to provide around 50% of the C$58m required to fund the capital expenditure on the Houston project, which, when operational, is expected to produce 2Mtpa iron ore for 15 years.

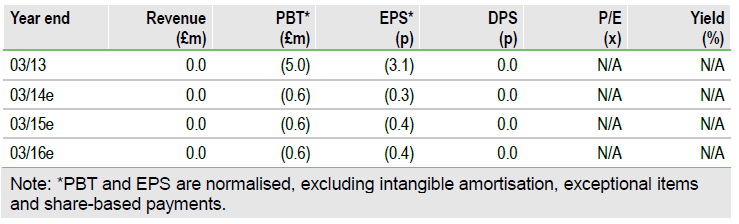

Valuation: Dependent on commodity prices

Anglesey’s 15.3% stake in LIM is now accounted for as an investment, rather than associate. At LIM’s current price (C$0.51), it is worth £6.2m (3.9p/share). In addition there is further value in its100% holding in Parys, which should be clearer when the update to the White Rock scoping study is published. However, Anglesey has postponed all discretionary spending, so publication is not imminent. Based on our forecast iron ore prices of US$131/t for FY14, US$125/t for FY15 and US$90/t long-term, LIM’s dividend discount flow (DDF) valuation is C$120m (at 10%) compared with LIM’s current market cap of C$64m, putting LIM on a discount of 47%. A 10% rise in the long-term iron ore price would give LIM a DDF of C$191m, putting LIM at its current price on a 66% discount. Significant to LIM’s strategy is financing of the plant at Houston, which should raise throughput to 4-5Mt by FY16.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Anglesey Mining Well Positioned In Current Uncertain Market

Published 08/04/2013, 04:45 AM

Updated 07/09/2023, 06:31 AM

Anglesey Mining Well Positioned In Current Uncertain Market

Well poised in the current uncertain market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.