Last week, Angie’s List Inc. (NASDAQ:ANGI) revealed that it has finally removed its paywall. The company had initially announced in Mar 2016 that it was planning to drop the paywall customer reviews this summer.

With the removal of the paywall, visitors of the online home services marketplace provider’s website will enjoy free access to all reviews and ratings. Earlier, reviews and ratings were available exclusively to members, for which the Indianapolis-based company charged an annual fee of $40.

Founded in 1995, Angie's List provides information, reports and reviews on service companies. The company offers product and company reviews, actively collects data on listed companies, and provides complaint resolution services between clients and businesses.

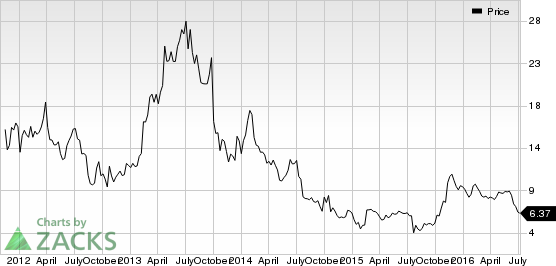

Angie's List had gone public in 2011 at $13 a share. However, the stock has fallen since then and has also been losing market share. Moreover, in the recent years, the company’s revenue growth has slowed down and profits have not materialized.

Notably, while Angie's List was charging membership fees from customers to give access to reviews and ratings, its competitors like Yelp Inc. (NYSE:YELP) and TripAdvisor Inc. (NASDAQ:TRIP) among others were already offering the same services for free. Hence, Angie’s List started losing out on subscribers.

In the March announcement, Angie’s List’s president and chief executive officer (CEO), Scott Durchslag said that “We get over 100 million visitors to the site every year, but about 90 percent of them are bouncing off the paywall”.

Interestingly, in spite of being founded a decade earlier than its arch rival Yelp, Angie’s failed to deliver consistently impressive performance. Meanwhile, having started with online restaurant reviews, Yelp brought many other businesses under its umbrella in a bid to boost members as well as to expand the revenue stream.

So, although the removal of Angie’s List’s paywall will result in a decline in membership revenues, it would be offset by increased web traffic and conversion ratio. In fact, the company may even see increased income from advertising.

Furthermore, we believe that the removal of paywall was just one of the steps taken by management in its turnaround efforts. Going forward, we could expect more of such strategic initiatives, including covering businesses other than home services.

We expect the latest move to contribute significantly to the company’s overall growth.

Currently, Angie’s List carries a Zacks Rank #3 (Hold). A better-ranked stock in the broader technology sector is Shutterfly Inc. (NASDAQ:SFLY) , sporting Zacks Rank #1 (Strong Buy).

SHUTTERFLY INC (SFLY): Free Stock Analysis Report

ANGIES LIST INC (ANGI): Free Stock Analysis Report

YELP INC (YELP): Free Stock Analysis Report

TRIPADVISOR INC (TRIP): Free Stock Analysis Report

Original post

Zacks Investment Research