The Andersons, Inc. (NASDAQ:ANDE) reported adjusted earnings of 54 cents per share in second-quarter 2017, up 6% year over year. Earnings, however, missed the Zacks Consensus Estimates of 65 cents.

Including one-time items, the company posted a loss of 94 cents in the quarter compared to a profit of 51 cents recorded in the year-ago quarter.

Operational Update

Revenues in the reported quarter declined 6.6% year over year to $994 million.

Cost of sales fell 6.3% to $905.8 million from $967.2 million in the prior-year quarter. Gross profit dropped 9.5% year over year to $87.8 million. Consequently, gross margin contracted 30 basis points to 8.8% in the quarter.

Operating, administrative and general expenses were down 7.3% year over year to $70 million. Andersons posted operating profit of $17.9 million in the quarter compared with $21.6 million witnessed in the year-earlier quarter.

Segment Performance

The Grain Group: Revenues dipped 6.6% year over year to $488.4 million from $523 million generated in the year-earlier quarter. The segment reported an operating income of $6.9 million compared to a loss of $13 million incurred in the comparable quarter last year.

The Ethanol Group: Revenues jumped 31.8% year over year to $187.8 million. The segment reported an operating profit of $4.6 million that declined from $7.2 million in the year-ago quarter.

The Plant Nutrient Group: The segment reported revenues of $264.7 million, down 17.3% year over year. The segment reported an operating loss of $25.8 million as against an income of $23.5 million in the comparable period last year.

The Rail Group: Revenues declined 5.4% year over year to $38 million. Operating income descended 10.6% to $5.9 million from $6.6 million in the prior-year quarter.

Retail Group: Revenues plunged significantly to $14.5 million from $38.4 million generated in the year-ago quarter. The segment reported an operating loss of $6.7 million compared with a profit of $1 million in the year-earlier quarter.

Financial Performance

Andersons reported cash and cash equivalents of $18.9 million at the end of second-quarter 2017, down from $31.4 million in the prior-year quarter. Long-term debt was $416.5 million as of Jun 30, 2017, compared with $452.5 million as of Jun 30, 2016.

Andersons substantially completed the process of closing the Retail business during the second quarter. The four stores were closed in early June. Remaining tasks primarily include the sale of the store properties.

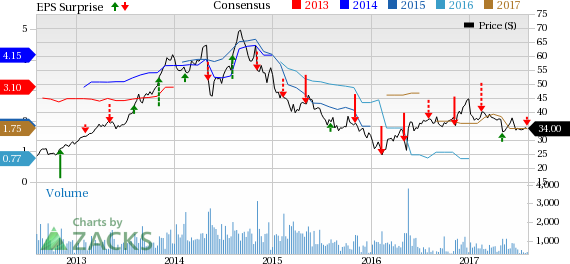

Share Price Performance

In the last one year, Andersons has underperformed its industry with respect to price performance. The stock lost around 9.3%, while the industry recorded growth of 12.7% over the same time frame.

Zacks Rank & Stocks to Consider

Andersons currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Kronos Worldwide, Inc. (NYSE:KRO) , POSCO (NYSE:PKX) and Versum Materials, Inc. (NYSE:VSM) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos has expected long-term growth rate of 5.00%.

POSCO has expected long-term growth rate of 5.00%.

Versum Materials has expected long-term growth rate of 11.00%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

The Andersons, Inc. (ANDE): Free Stock Analysis Report

Original post

Zacks Investment Research