The Andersons Inc. (NASDAQ:ANDE) reported third-quarter 2016 earnings of 6 cents per share, marking a reversal from the prior-year quarter’s loss of 4 cents per share. Earnings, however, fell short of the Zacks Consensus Estimate of 22 cents by a wide margin of 73%.

While conditions are improving for Grain Group and margins are strong for the Ethanol Group, challenges remain with the Plant Nutrient Group facing weak margins and the Rail Group continuing to experience softening in utilization.

Operational Update

Revenues in the reported quarter declined 5.4% year over year to $859.6 million and fell short of the Zacks Consensus Estimate of $1052 million.

Cost of sales fell 5% to $783 million from $824 million in the year-ago quarter. Gross profit declined 10% year over year to $77 million. Consequently, gross margin contracted 40 basis points to 9% in the quarter.

Operating, administrative and general expenses went down 11% year over year to $78.8 million. Andersons posted a loss of $1.75 million in the quarter, as against loss of $3.5 million in the year-ago quarter.

Segment Performance

The Grain Group: Revenues inched up 1% year over year to $550.2 million from $545 million in the year-ago quarter. The segment reported an operating profit of $1.9 million as against earnings of $0.1 million in the year-ago quarter. In the quarter, the Grain Group benefited from the sale of its underperforming Iowa assets earlier this year. Grain production in the Eastern Corn Belt has rebounded from last year. Bean yields were strong and corn did well in most markets.

The Ethanol Group: Revenues increased 16% year over year to $139 million gaining from record production. The segment reported an operating profit of $9.5 million, a 62% surge from $5.9 million in the year-ago quarter. Ethanol margins improved as corn prices remained modest and gasoline prices began to return to prior-year levels after remaining at five year lows for most of the year.

The Plant Nutrient Group: The segment reported revenues of $102 million, down 32% year over year. Oversupply and falling prices continue to challenge Plant Nutrient volumes. The segment reported an operating loss of $7.2 million compared with a loss of $11.1 million in the prior-year quarter. Benefits from lower expenses resulting from integration of the Kay-Flo business and savings generated as part of the company's productivity initiative were largely offset by a continuing weak margin environment for nutrients due to oversupply and falling prices in the market.

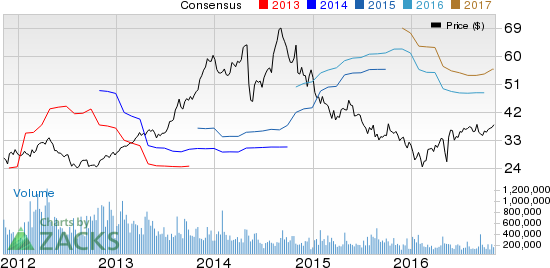

ANDERSONS INC Price, Consensus and EPS Surprise

KOPPERS HOLDNGS (KOP): Free Stock Analysis Report

HECLA MINING (HL): Free Stock Analysis Report

FIBRIA CELULOSE (FBR): Free Stock Analysis Report

ANDERSONS INC (ANDE): Free Stock Analysis Report

Original post

Zacks Investment Research