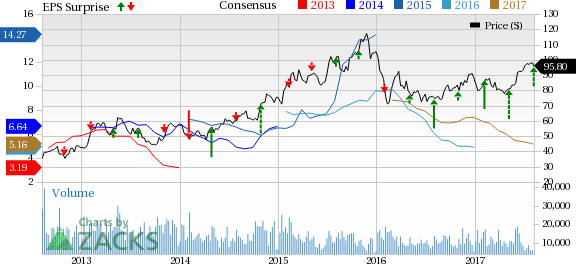

Independent refiner and marketer Andeavor (NYSE:ANDV) – formed following the merger of Tesoro Corporation and El Paso-based Western Refining Inc. – posted mixed second-quarter results in its first earnings release under the new name. While earnings came ahead of the Zacks Consensus Estimate, revenues lagged the same. Shares of the company declined 1.41% to eventually close at $95.80 on Aug 8 after this Zacks Rank #3 (Hold) stock increased its guidance related to capital and turnaround expenses for the full year. However, the company also increased its throughput levels guidance.

Andeavor reported second-quarter 2017 adjusted earnings from continuing operations of $1.96 per share, which surpassed the Zacks Consensus Estimate of $1.61. Improved performance from the marketing and logistics segment drove results. The bottom line, however, deteriorated from the year-ago quarter figure of $3.47 per share on significantly weaker performance by the refining segment.

Andeavor reported quarterly revenues of $7,849 million as against $6,285 million in the year-ago quarter, reflecting growth of 24.9%. However, the top line missed the Zacks Consensus Estimate of $8,091 million.

Andeavor Price, Consensus and EPS Surprise

Segmental Analysis

Refining: The segment posted operating income of $45 million compared with $527million in the year-ago quarter. Decrease in refining margins weakened the quarterly result.

Logistics: During the second quarter, this segment generated operating profit of $167 million compared with $118 million in the year-ago quarter. The performance was driven by contributions from the acquisitions of the North Dakota Gathering and Processing Assets, the Northern California Terminalling and Storage Assets, Alaska Storage and Terminalling Assets.

Marketing: The segment recorded $236 million compared with $161 million in second-quarter 2016. Performance in the quarter was negatively impacted by increased demand and higher margins. Retail and Branded fuel margins were up by 17% and Merchandise gross margin increased to $20 million from $2 million in second-quarter 2016 driven by the Western Refining acquisition.

Throughput

Total refining throughput averaged 893 thousand barrels per day (MBbl/d) as against 802 MBbl/d in the prior-year quarter.

Overall, throughput volumes in California (consisting of Martinez and Los Angeles refineries) rose from 513 MBbl/d to 531 MBbl/d, on a year-over-year basis. Throughput in Andeavor's Pacific Northwest (Alaska and Washington) operations was 170 MBbl/d, compared with 158 MBbl/d in second-quarter 2016. Throughput volumes in the Mid-Continent (North Dakota and Utah) were up by 44.6% to 192 MBbl/d in the repotted quarter.

Refining Margins

Gross refining margin decreased 39.8% year over year to $9.44 per barrel.

Region-wise, refining margin was down almost 32% to $10.78 per barrel in California, 65.5% to $4.72 in the Pacific Northwest and about 43% to $9.96 in Mid-Continent, on a year-over-year basis.

Realized Costs & Prices

Manufacturing costs before depreciation and amortization increased 13.2% from the year-earlier level to $5.67 per barrel. The improvement came on the back of higher energy costs.

Total refined product sales averaged 1092 Mbbl/d in the reported quarter as against 974 Mbbl/d in second-quarter 2016.

Operating Cost

Andeavor's operating costs in the reported quarter were $739 million compared with $602 million in second-quarter 2016.

Capital Expenditure & Balance Sheet

Andeavor’s total capital spending in the reported quarter including Andeavor Logistics LP (NYSE:ANDX) totaled $263 million. Turnaround expenditures for the second quarter were $196 million.

As of Jun 31, 2017, the company had $1,061 million of cash and cash equivalents. This was down from $2,298 million in the prior quarter primarily due to due to the closure of the Western Refining acquisition and Andeavor Logistics’ acquisition of the North Dakota Gathering and Processing Assets. Excluding Andeavor Logistics’ debt and equity, total debt was $3.1 billion.

Dividend

The board of directors declared a quarterly cash dividend of 59 cents per share reflecting an increase of 7.3%, payable on Sep 15, to all holders of record as of Aug 31.

Guidance

Andeavor expects throughput level for the third quarter between 1,090 MBbl/d and 1,145 MBbl/d. Region wise, California expects throughput volumes between 505 and 530 MBbl/d. Pacific Northwest and Mid Continent expects throughput levels within 185–195 MBbl/d and 400 –420 MBbl/d respectively.

The company now expects total capital expenditures for 2017 of approximately $1.35 billion, up from the prior guidance of $1.1 billion. Turnaround expenditures for the full year 2017 are expected to be $485 million.

Stocks to Consider

Some better-ranked players in the energy space are TransCanada Corporation (TO:TRP) and Braskem S.A. (NYSE:BAK) . Both companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TransCanada reported an average positive earnings surprise of 4.06% in the trailing four quarters.

Braskem posted an average positive earnings surprise of 107.79% in the trailing four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Braskem S.A. (BAK): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Tesoro Logistics LP (ANDX): Free Stock Analysis Report

Tesoro Corporation (ANDV): Free Stock Analysis Report

Original post

Zacks Investment Research