Memorial Day is just around the corner. This holiday, meant to honor those who have given their lives to ensure our freedom, brings to mind what should be a collective source of pride and gratitude for all Americans. Let's hope it does so for all who benefit this year including our elected leaders. In my town we have a parade that passes by the end of my street. Like your town all the fire trucks and police drive by. The local chapter of the Rotary Club marches as well. But the highlight is the high school marching band. Our marching band has over 350 members. And when they come down the street it is a treat.

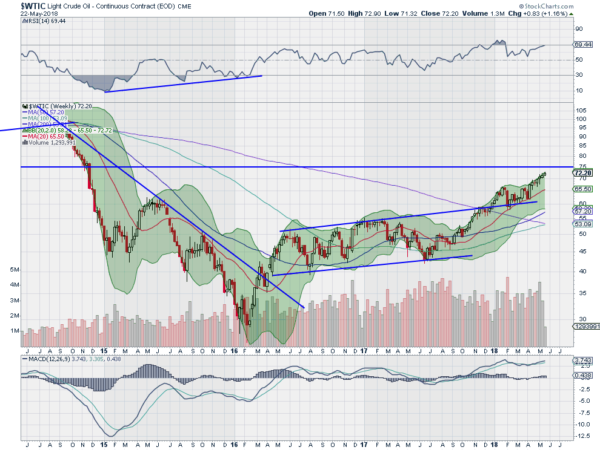

There is something else marching along as we head into this holiday though. Crude Oil has been driving higher since the beginning of April and is at 3 1/2 year highs. And there does not seem to be anything ready to stop the march in the near future. Looking at the weekly chart below there is minor resistance at $75 where it paused on the way down and then nothing until $83 per barrel.

There are many positive factors in the chart that support a continued march higher. The price is over the 200 week SMA. It printed a Golden Cross just a few weeks ago. Momentum is strong with the RSI near 70 and the MACD rising. The Bollinger Bands® have shifted to the upside. This move in Crude Oil looks solid and no where near done.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.