I have tended to avoid writing about the bad news in the market for a couple of reasons. First, up until August there really was not a compelling bad news story. There was slowing growth in the indexes but after a long run higher that is a pause not a compelling downside case. Also, there have been an unending number of overly bearish commentators over the past year that have that covered. Its almost as if there are more bearish commentators to balance out the natural tendency of the market to rise over the long term.

That has probably branded me a market bull or even a perma-bull by many. I do not look at myself that way but in a raging bull market like we have had since 2009 there are worse things to be called. But I am a follower of price and a realist. So lets give one to the bears today.

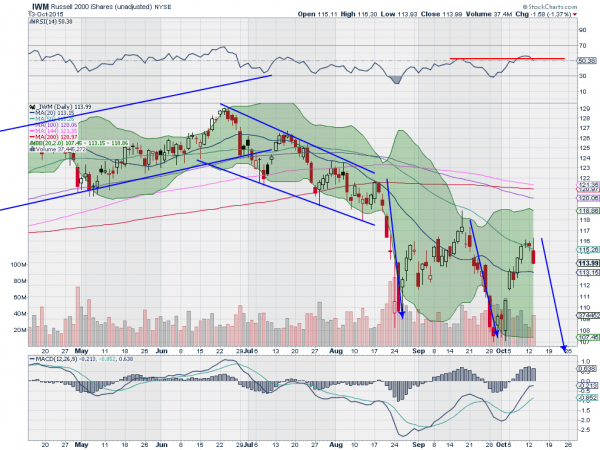

The chart of the iShares Russell 2000 (N:IWM)above shows the bearish truth. The channel that persisted following the peak in June was broken to the downside with the August plunge. The bounce resulted in a lower higher before turning back to a lower low. Now another lower high has been made and the price is heading lower again.

This series of lower highs and lower lows is bearish on its own and one of the simplest versions of technical analysis. But it gets worse, at least in the short term. The turn back this week makes for a Negative RSI Reversal. This happens when the RSI makes a higher high while the price makes a lower high in and then reverses back down. The pattern targets a move lower to 104.

Also note that the first two drops out of the channel were about equal in length, suggesting a possible 3 Drives pattern lower. This would look for completion at about 104 as well. A 3 Drives is a reversal pattern, but that does not mean a guarantee of a reversal higher. For now it looks like more downside in the small caps.

You don’t have to like it just follow the price lower if you trade on a short timeframe. If your timeframe is long make sure you have protection in place and a plan for when the protection is not enough. Now back to being an optimist.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.