The broad markets are making new all-time highs. Stocks are breaking out everywhere. You want to participate but you keep hearing from the television that the market is due for a correction. I could tell you to just turn off the television, but there ways to deal with this discomfort as well. Let me illustrate what I am doing with one stock right now.

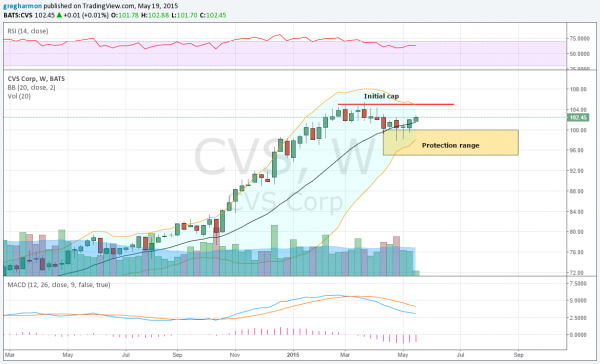

CVS Health (NYSE:CVS) had a great run higher over the back half of 2014. Since February though it pulled back in a shallow retrenchment. It bottomed a few weeks ago when the long lower shadows appeared on the weekly candles on the chart below. That chart shows the rising trend with the 20 week SMA, and that it reconnected with that moving average as it bottomed. Now moving back higher, the price is over the 20 week SMA and has support from the RSI to continue.

That momentum indicator remained bullish through out the pullback. The MACD though continues to look lower, but is flattening. The volatility indicator, the Bollinger Bands® are getting tighter. This is often a precursor to a move. All sets up for a big move higher. And looking at the move up into the pullback, you could establish a target over 125.

I added this stock to client accounts but with a twist. As a long term position, I protected the downside until the early august earnings report by adding a August 100/95 Put Spread. This cost about $1.20, and with the price of the stock at 102.60 gives about $3.80 in risk, assuming I stop the stock if it moves under 100. But to reduce that cost somewhat I also sold a June 26 Expiry Covered Call on the 105 Strike for about 80 cents. This drops my risk to only $3.

But the story is not over yet. By selling that Covered Call, I have capped the upside in the trade, but only for 1 month. My goal will be to continue to sell covered calls as these expire, or move out the maturity, to collect more premium and further lower my cost on the protective collar to zero or below. With weekly options in CVS this is very possible.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.