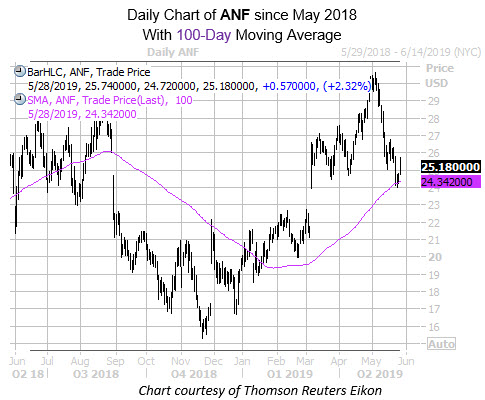

Retail giant Abercrombie & Fitch Company (NYSE:ANF) has pulled back from its May 3 three-year-peak of $30.63. However, while just last Thursday the equity fell to its 100-day moving average, this mark is home to the stock's March post-bull-gap levels. The shares also still carry a 22.4% year-to-date lead, and this afternoon were last seen up 2.3%, at $25.18. ANF options traders may be gearing up for the Hollister parent's quarterly report, slated for before the bell tomorrow, May 29.

Looking at ANF's earnings history, the retailer has closed higher the day after reporting in its last six earnings, including a more than 20% surge for the past two in a row. Over the past two years, the shares have swung an average of 16.1% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 20.4% swing for Wednesday's trading.

Moving onto analyst sentiment, those covering Abercrombie stock have been far from optimistic. Specifically, all 11 brokerages sport a tepid "hold" or worse rating on the stock, with not a single "buy" in sight. Further, ANF's average 12-month price target of $24.50 comes in 2.7% below current trading levels.