Tesla Motors Inc (NASDAQ:TSLA) has been garnering a lot of attention from Wall Street analysts and investors over the past several years as it rolls out new models of its luxury electric vehicles. Most recently, Tesla is slated to release the Model X, an all-wheel-drive crossover SUV that will be cheaper than the Model S.

Additionally, Tesla will release the Model 3 next March and be available for regular purchase in 2017. At $35,000 the Model 3 will be the most affordable Tesla to hit the market. Investors hope that the Model 3 will fill the void of an affordable, small, electric vehicle and boost sales.

Tesla also recently announced that it will go beyond cars and enter the energy storage sector with its home battery product; Powerwall. Powerwall will be charged through solar panels and will be equipped to power homes at night as well as provide backup electricity in the event of a power outage. The Powerwall will be retailed at $3,000 and become available for delivery in late summer.

Baird analyst Ben Kallo weighed in on Tesla on June 8 ahead of what he thinks is a string of positive upcoming catalysts. The analyst reiterated an Outperform rating on Tesla and raised his price target from $275 to $335. Though Kallo acknowledged “skepticism surrounding Tesla Energy, the Model X launch, and demand,” he assured “upcoming events will help improve sentiment and drive shares higher.” Specifically, the analyst notes there is uncertainty on Wall Street about the launch of the Model X in the third quarter, but he is “betting they will convert despite previous delays.” If the launch of the Model X is successful, it will “(1) expand TSLA’s addressable market (2) reinforce confidence in its product development competencies (3) increase scale and (4) continue to build the brand.”

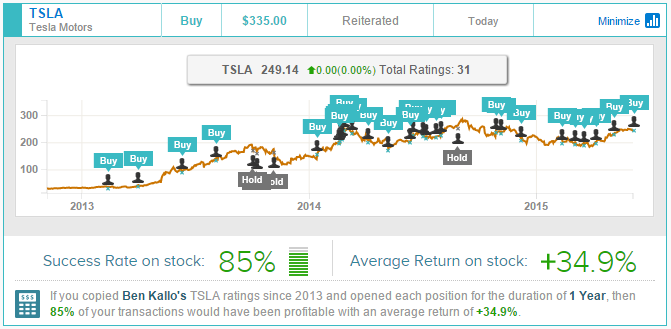

Ben Kallo has rated Tesla 31 times since February 2013, earning an 85% success rate recommending the stock and a +34.9% average return per recommendation. Overall, the analyst has a 61% success rate recommending stocks and a +11.6% average return per recommendation.

Similarly on June 5, Dougherty analyst Andrea James reiterated a Buy rating on Tesla and raised her price target from $320 to $355, according to Smarter Analyst. James’s bullish rating stems from her optimism in Tesla’s energy storage products. The analyst noted that Tesla is disrupting the grid storage market and that “Tesla’s primary advantage is in offering a turn-key solution, at scale and at favorable costs.”

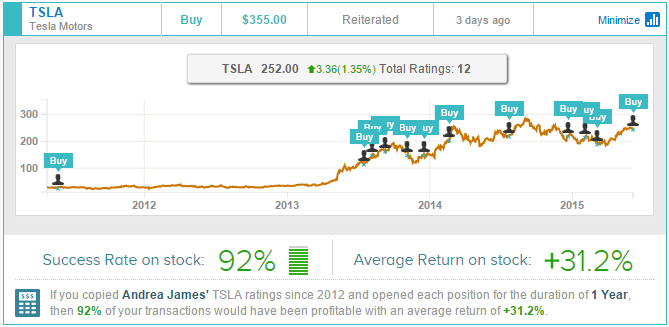

Andrea James has rated Tesla 12 times since May 2011, earning a 92% success rate recommending the stock and a +31.2% average return per recommendation. Overall, she has a 63% success rate recommending stocks and a +9.4% average return per recommendation.

On average, the top analyst consensus for Tesla on TipRanks is Moderate Buy.