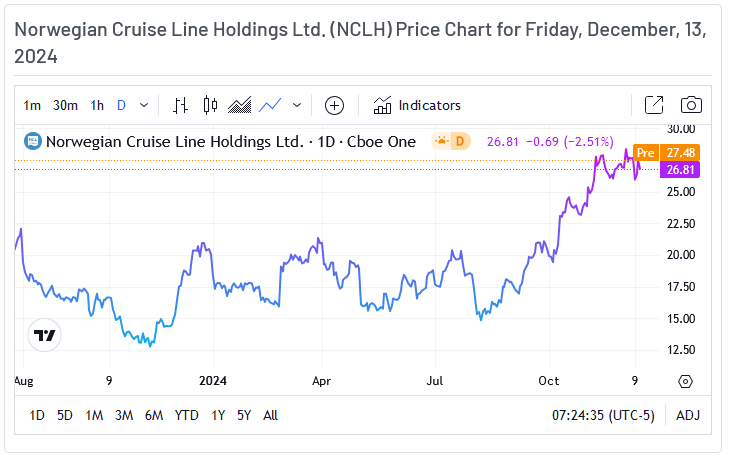

Shares of Norwegian Cruise Line Holdings (NYSE:NCLH) have been on an absolute heater since August. After a lackluster first half where shares traded in a tight range with no clear direction, they've surged nearly 90% in the past four months. As the travel industry gears up for a bumper 2025, it has all the makings of a strong end to the year for Norwegian Cruise Line investors.

The cruise line operator, headquartered in Miami, has been working hard to reclaim pre-pandemic performance levels, both operationally and financially. While it hasn't been smooth sailing, the company's recent performance and outlook are giving investors plenty of reasons to be excited. Let's jump in and see why.

Fundamental Performance

To start with, there's the company's fundamental performance, which has been trending in the right direction. While its earnings reports have been mixed this year, the most recent update at the end of October was impressive.

The company smashed expectations, delivering a beat on both revenue and earnings. Notably, it was a record revenue print, surpassing even the best pre-pandemic years, and marked Norwegian's most profitable quarter in recent memory.

For these reasons alone, it's a stock that's worth watching closely, as few other companies have managed such a dramatic rebound. With fundamental momentum like this, Norwegian is putting itself in a strong position heading into 2025.

Bullish Analyst Updates

It's also worth noting that analysts are bullish on Norwegian Cruise Line's outlook, with several upgrades landing in recent weeks. This week alone saw the team over at Goldman Sachs upgrade their rating on the stock to a Buy, as they highlighted some multi-year tailwinds that are set to benefit Norwegian Cruise Line significantly.

First, the expected increase in travel demand, particularly for cruises, is projected to outpace the growth in supply. This trend is already evident in the year-over-year increase in new-to-cruise customers, as reported by some of Norwegian's competitors.

Secondly, the introduction of new ships and a favorable shift in fleet composition are expected to enhance pricing power through a "halo effect," which drives premium bookings.

Third, Goldman Sachs pointed to structural improvements in Norwegian's revenue management strategies. These include fewer unsold cabins, reduced reliance on last-minute discounting, and initiatives to encourage earlier onboard spending by passengers.

Their bullish similar stance echoed that of Truist Financial earlier this month, which also rated the stock a Buy. Both teams have issued a $35 price target for Norwegian shares, which, from where the stock closed last night, points to a targeted upside of nearly 30%.

Potential Concerns

Despite the strong momentum and bullish analyst outlook, Norwegian Cruise Line still faces a few hurdles that investors will want to keep in mind. For one, the company needs to break through the $35 range, where it's previously struggled, particularly in the post-pandemic highs of 2021.

If Norwegian can't push on from this level despite delivering record revenue numbers and bullish tailwinds, concerns will grow about the stock's ability to maintain its upward trajectory.

There's also the lingering question of consistent profitability. While the company's top-line growth is undeniable, Norwegian hasn't yet proven its ability to hit reliably profitable quarters. The EPS miss earlier in the year stands out as a reminder of this challenge, and the company will need to start 2025 strong to convince investors that it can sustain its momentum.

Getting Involved

However, these are concerns that should be more than manageable. Even from a technical perspective alone, Norwegian's setup looks increasingly bullish.

The stock's Relative Strength Index (RSI) currently sits at 57, indicating that shares have strong momentum but still plenty of room to run.

Combine this with the broader market's strong performance and improving consumer spending trends, and you can't help but feel that the travel industry is definitely a space to be involved in.

Investors should look for Norwegian stock, in particular, to continue building on its recent gains, especially with its improving fundamentals and bullish analyst outlook coming together. There are several reasons investors should be getting excited, and as we head into the last couple of weeks of the year, Norwegian Cruise Line could be offering a perfect opportunity for those ready to jump aboard.