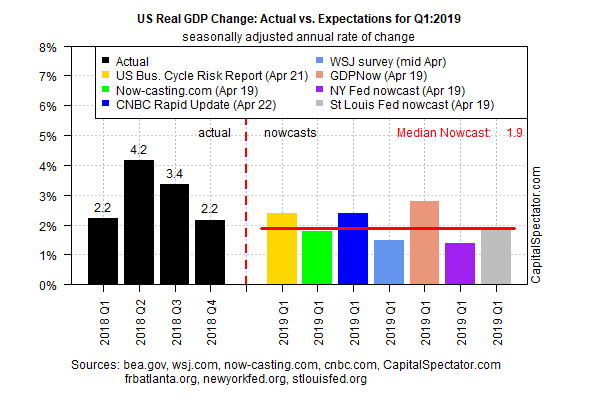

This week’s initial report on US gross domestic product for the first quarter is expected to post a mild slowdown, according to the median nowcast for a set of estimates compiled by The Capital Spectator. Several of the nowcasts foresee a slight pickup in growth and so it’s premature to rule out a degree of firming for Q1. But with some of the estimates calling for the slowdown to continue, it’s safe to say that there’s enough variability in the numbers to keep the crowd guessing until the end of the week, when the Bureau of Economic Analysis publishes its “advance” GDP report on Friday, April 26.

The strongest nowcast in the chart below comes from the Atlanta Fed’s GDPNow estimate. The bank’s model estimates Q1 growth at a relatively firm 2.8%, as of April 19. If accurate, US output for the first three months of the year is set to accelerate from the previous quarter’s 2.2% advance, delivering the first acceleration in quarterly growth since 2018’s Q2.

But several sources call for a weaker pace in Q1, including the New York Fed’s nowcast – the weakest of the bunch in the chart above. Using this estimate as a guide, the output is on track to slip to roughly a 1.4% gain. If correct, US growth will ease to the slowest rate since 2015’s Q4.

The median for all of the nowcasts in the chart above is 1.9%, which reflects a mild deceleration in growth vs. Q4.

It’s easy to find economists with more optimistic expectations. Macroeconomic Advisers, for example, recently lifted its Q1 projection to 2.8%, a solid improvement over the firm’s 1.0% estimate from a month earlier.

But looking for an acceleration appears to be an outlier relative to recent estimates from economists generally. Econoday.com’s consensus forecast reflects a 2.2% pace for Friday’s report, unchanged from the previous quarter. Meantime, The Wall Street Journal’s mid-April survey of economists calls for a slowdown to 1.5%, based on the average estimate.

To be fair, a smaller sample of Wall Street economists are looking for firmer results Q1. CNBC’s survey data for yesterday (April 22) reports a median forecast of 2.4% — a fractionally stronger gain over Q4.

Count Bloomberg’s economists as among the analysts looking for a weaker report on Friday, followed by firmer numbers later on in the year. GDP is set to rise 1.5% in Q1, the firm reports. The good news is that there’s a decent case for expecting re-acceleration in 2019’s second half, predict Bloomberg Economics’ Yelena Shulyatyeva and Carl Riccadonna

“A substantial inventory glut — the byproduct of 2018 trade tensions — is contributing to weak readings on economic activity at the start of the year and may be the most overlooked near-term economic risk,” they explain. “This is partly responsible for the overly bearish assessment of economic prospects. However, as this mini-inventory cycle runs its course, growth will be poised to significantly outperform in the second half.”