Yesterday, we saw silver prices also recoding a similar performance as seen in gold and closed the day with little participation and movement. At the closing time, Silver March expiry at MCX was moderate higher by 0.1% to Rs 43830 per Kg. For the fresh session today, as also updated above Bullion segment is recording huge gains and silver being the high beta one, is adding to its positive move in early trading.

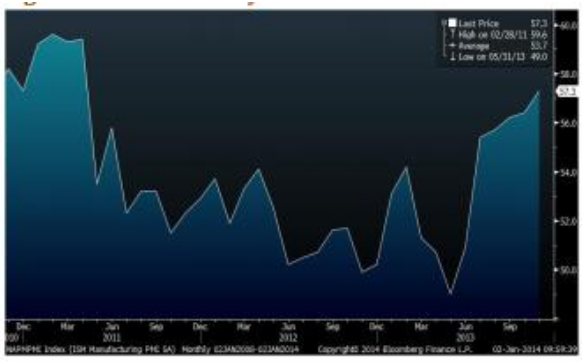

During the day today, we have a number of major manufacturing gauges to be watched as per the global economy is concerned. Early morning today the Chinese manufacturing number disappointed modestly, it still managed to stay above the critical 50 mark suggesting continuing expansion in the economy. Later we have the similar number from EU and the US wherein extended positive reading could provide additional support to the base metals complex and we feel some part of that optimism is already being seen in silver which is having near double gain today as equated to gold. We have a cautiously positive view into the commodity in Intra-day.