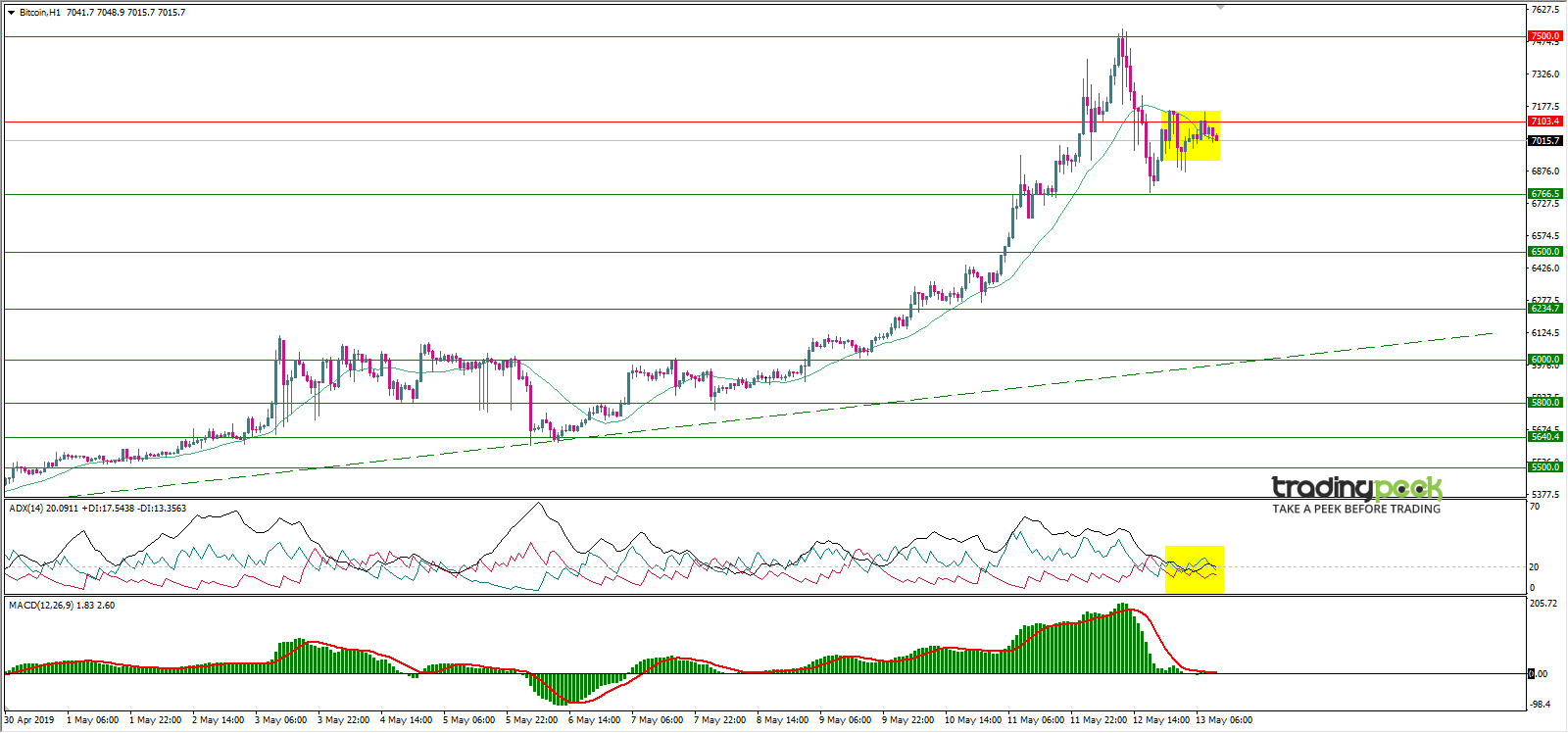

BTC\USD

Bitcoin (BTC) rose last Saturday from $6299 as demand increased to $7536.

The most heavily traded currency failed to break through $7500 resistance areas due to weaker buyers' momentum and therefore fell towards $6766 areas (first support areas).

Bitcoin is our current neutral view on the 60-minute interval due to trading in a specific direction, and the technical indicators confirm a neutral view of not taking a specific direction to trade through it. (ADX) index break areas of 20 points so my view is currently neutral.

The SMA 20 is currently neutral as a result of overlapping with the price movement. The index of the moment is currently neutral as a result of not trading in a specific direction at the moment.

Outlook

It is expected that, if Bitcoin breakout, the $7036 zones may target areas of $7414. On the other hand, in the case, if Bitcoin breaks zones $6766 the currency may target $6,500.

- Support: 6766- 6500-6234

- Resistance: 7103 - 7500 - 7850

- Direction: neutral

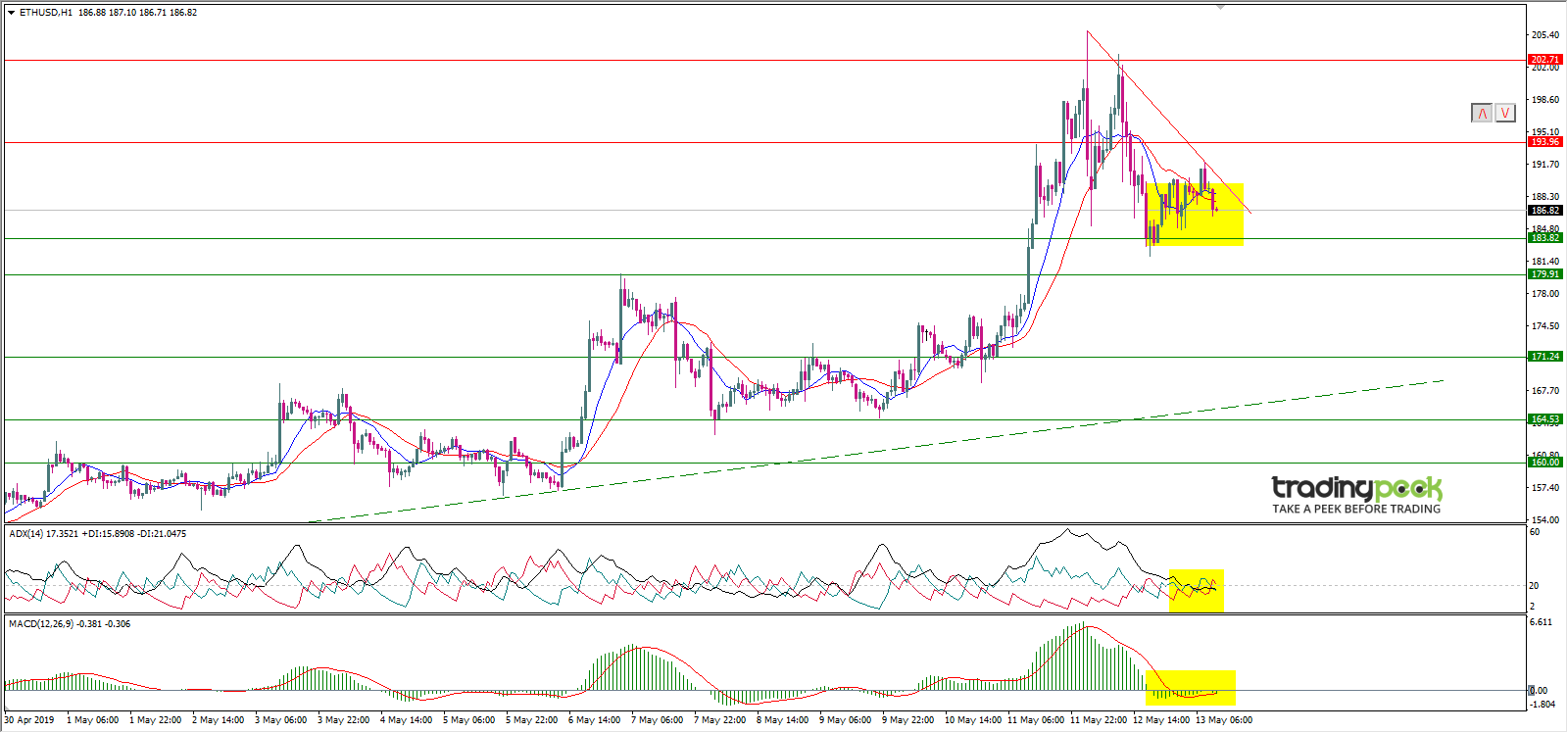

Analysis Of The ETH\USD

The Ethereum (ETH) rebounded during Saturday's trading from $171.244 and continued to rise as high as $202.71 due to bull pressure. And during yesterday's trading failed to break through the areas of $202.71 as a result of the entry of buyers, therefore fell to levels of $183.82.

Ethereum is a neutral view at the moment due to non-trading in a specific direction and trading between $183.01 zones and even $189.61 zones on the hourly interval. And the index (ADX) neutral signal at the moment the result of trading down 20 points areas.

The 10 SMA and the 20 SMA are neutral because of the price action. And the index of the torque MACD with the normal settings is currently neutral signal due to non-trading in a specific direction.

Outlook

It is expected that in the case of Ethereum breaks regions $183.82 may target the digital currency $172.73. While in the case of Ethereum Breaks area $191.90 may target the area of $200.91.

- Support: 183.82 - 179.91 - 171.24

- Resistance: 193.96 - 202.71 - 211.22

- Direction: neutral

Analysis Of XRP/USD

Yesterday, the Ripple (XRP) failed to break through the $0.3377 area as a result of weaker buyers' resolve, thus falling to break the areas of $0.3288 and $0.3202.

XRP currency ended my neutral outlook during yesterday's trading by breaching the $0.3163 area on the hourly interval.

And is currently trading in a bullish trend that is going through a weakness due to the negative price behavior on the areas of $ 0.3288.

The (ADX) indicator indicates that the bullish uptrend is in weakness. The 20 SMA is currently bullish and is a very important support area.

Momentum RSI 14 is trading in a bearish direction and forming a weakness in the current bullish trend.

Outlook

It is expected that in the case of XRP breaks for the region of $0.3050 the digital currency may target the area $0.2942.

On the other hand, if the $0.3288 is breached, the pair will target $0.3373.

- Support: 0.3008- .2942- .2814

- Resistance: 0.3202 -0.3288- 0.3373

- Direction: Up

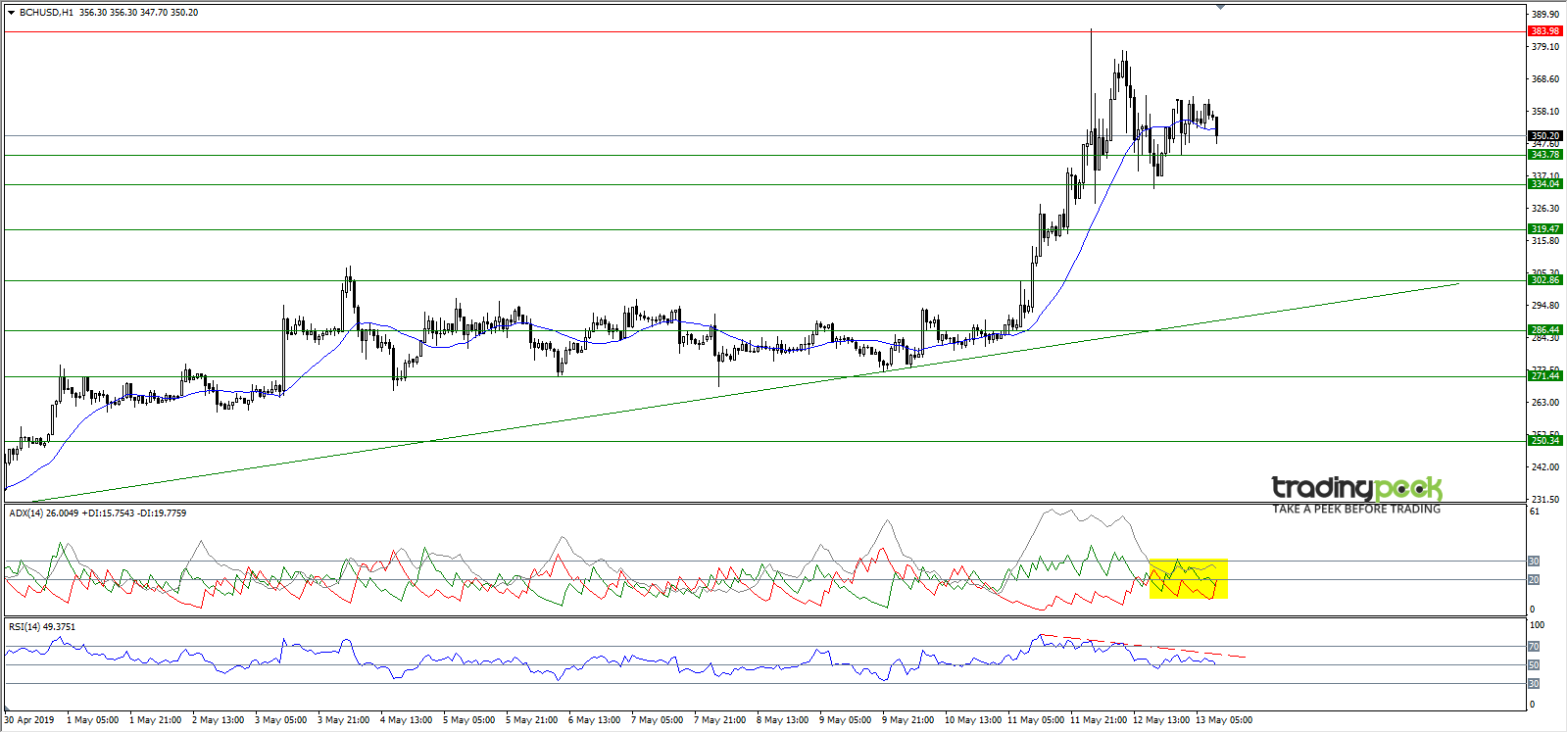

Analysis Of The BCH/USD

The currency Bitcoin Cash (BCH) (Bitcoin Cash) rebounded during trading yesterday from the areas of $286.44 and continued to rise up to areas of $383.98. The coded currency failed to break through $383.984 areas of resistance due to the weakness of the buyers' direction and therefore fell towards the second support levels.

The Bitcoin Cash is trading in a bullish direction. This trend is weak due to its inability to breach $ 383.8 on the hourly interval.

Also, the technical indicators in the position confirm the weakness of the current bullish trend.

The ADX indicator points to a weak current bullish trend by trading below 30 pips. The 20 SMA is currently neutral as it is interfering with price action. Momentum Relative Strength 14 is trading in a bearish trend currently forming a current weakness factor.

Outlook

It is expected that in the event of BCH breakout $362.90 USD may target the currency area of $383.97.

On the other hand, in the case of BCH break Level $343.78 may target the currency $319.47.

- Support: 343.78 - 319.47 - 302.86

- Resistance: 383.97 404.58 - 425.00

- Direction: Up