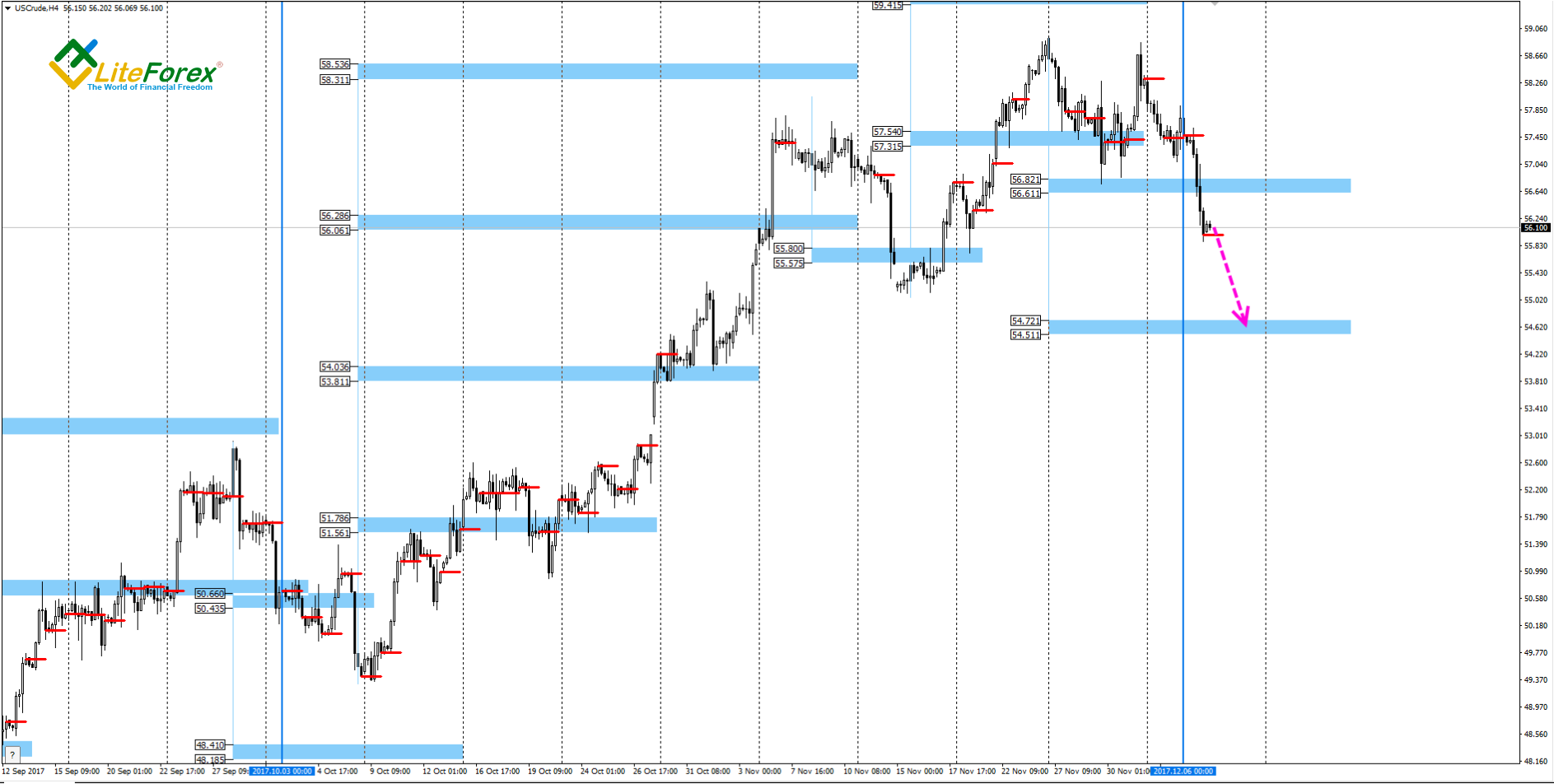

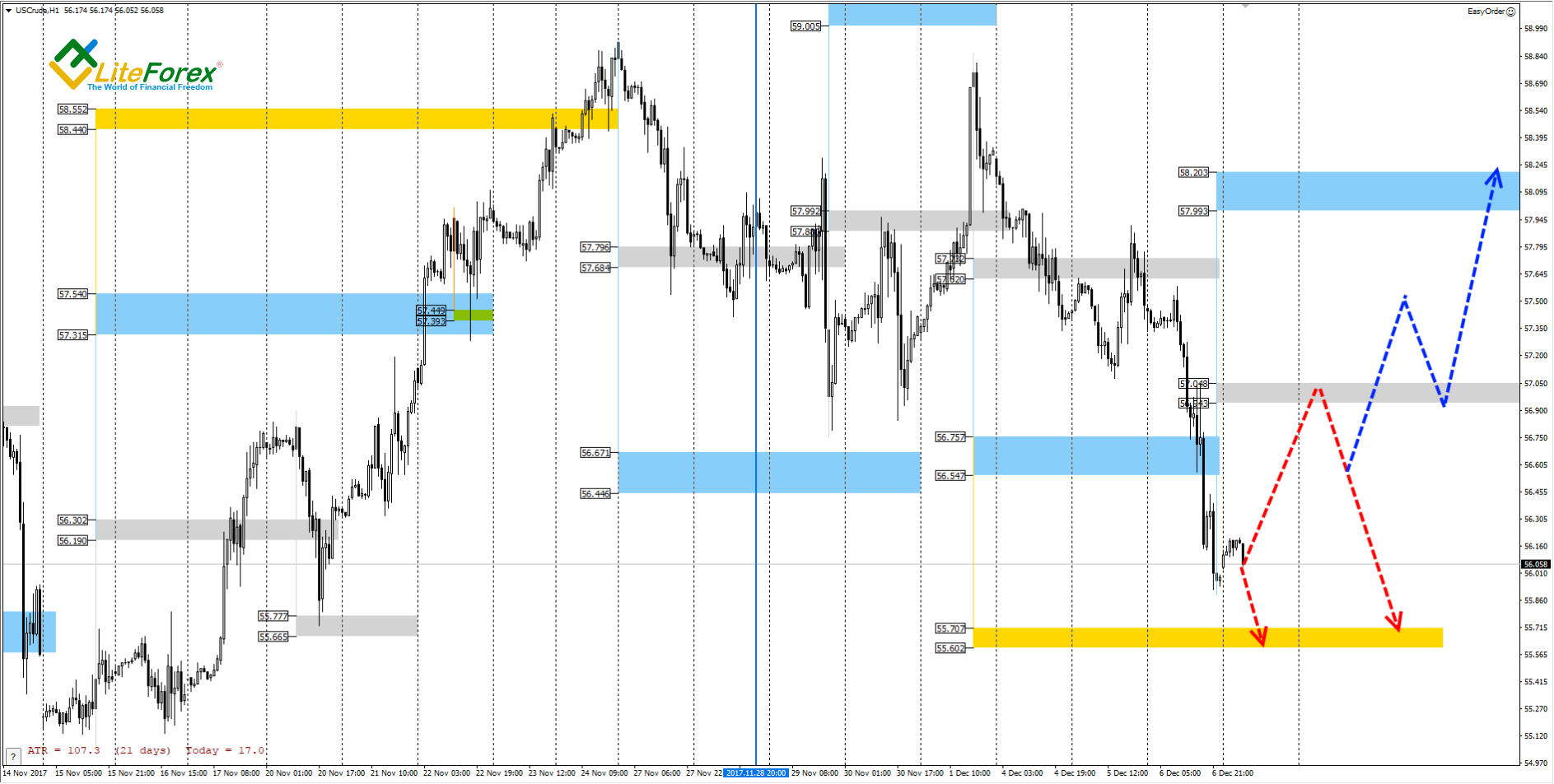

WTI

Oil middle-term trend reversed downwards, as yesterday the American session closed the price outside Target Zone [56.82 – 56.61]. Now sell target is the next middle-term support, Target Zone 2 [54.72 – 54.51].

In the shorter timeframe, oil is trading in the short-term downtrend. Yesterday we spoke about sells in the out-broken IZ [57.73 – 57.62] with the target of Target Zone [56.75 – 56.54]. The trading recommendation has worked out.

Moreover, Target Zone was out-broken and the American session closed below. That set bears the next downward target, Gold Zone [55.70 – 55.60].

I recommend selling on the corrections. The key resistance to the trend is Intermediary Zone, with the borders at [57.04 – 56.94].

Buys will be available in case of IZ outbreak and closing above. If so, the target to fix long positions will be upper TZ [58.20 – 57.99].

Today’s trading tips for oil:

Sell in Intermediary Zone [57.04 – 56.94]. Take Profit: Gold Zone [55.70 – 55.60]. Stop Loss: 57.37.

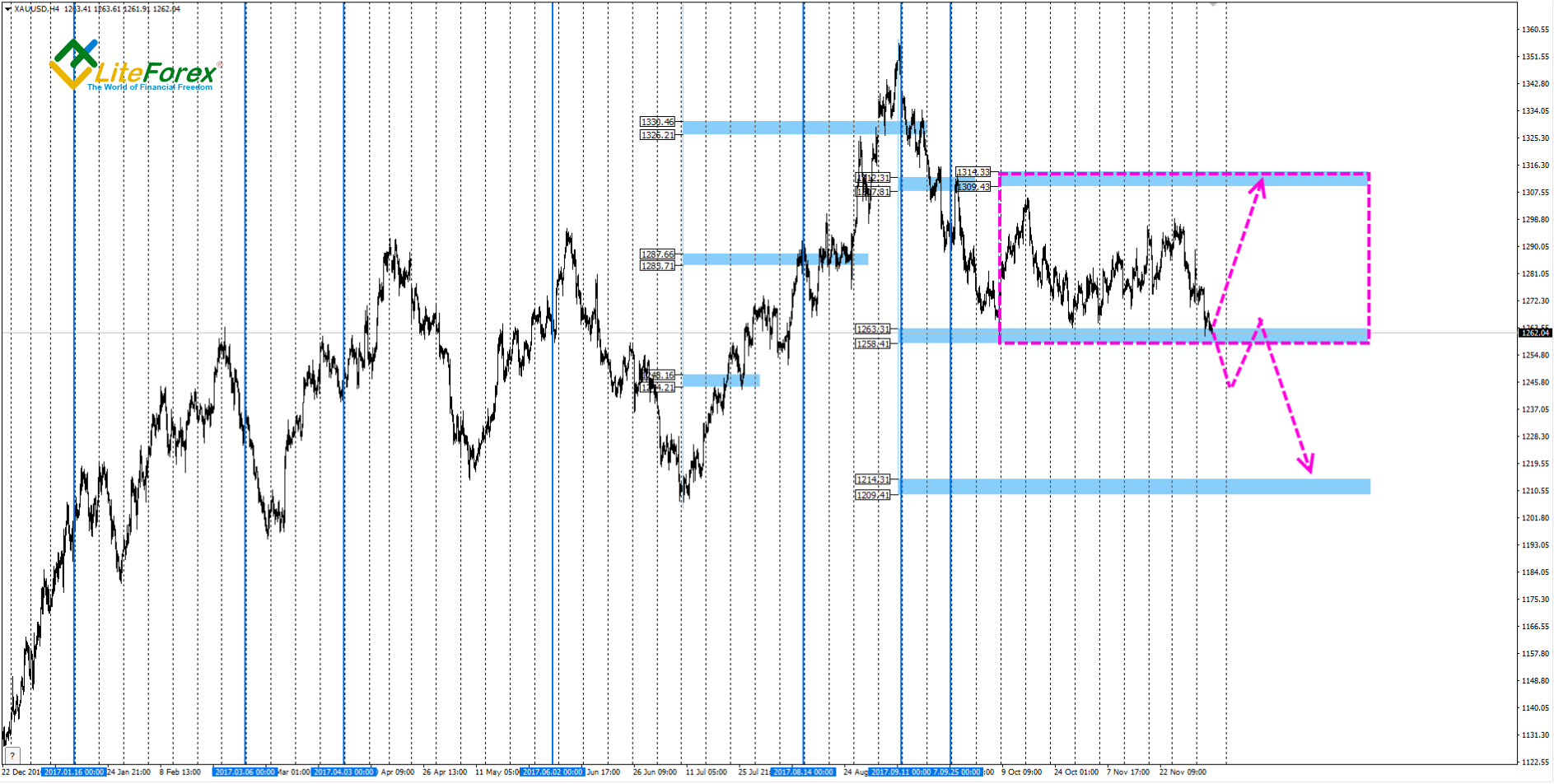

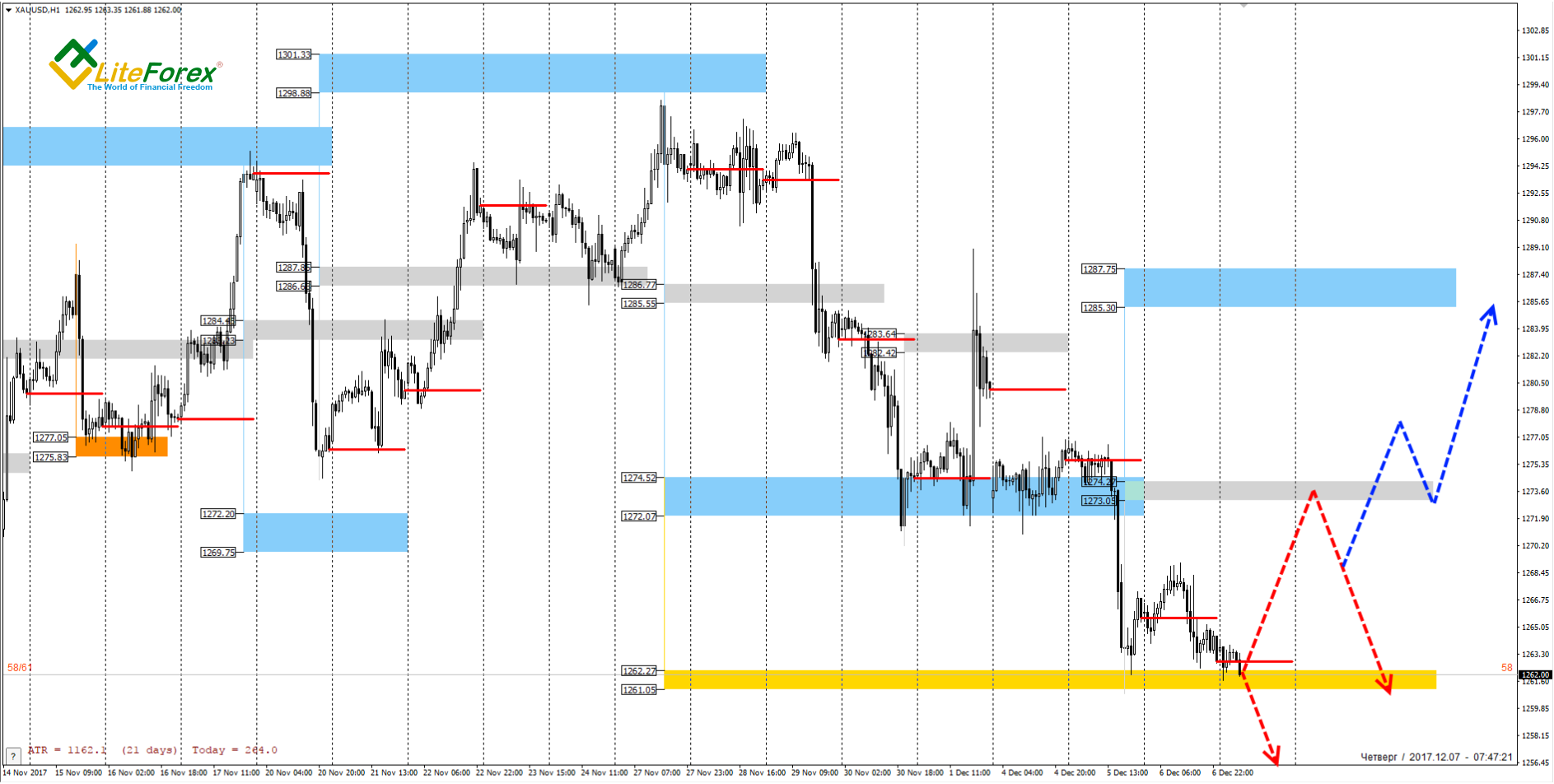

Gold price is testing the middle-term support within the middle-term downtrend, it is Target Zone 2 [1263.3 – 1258.4]. If it is out-broken and the price is consolidated below the zone, bears will have the next target in Target Zone 3 [1214.3 – 1209.4].

In the shorter time frame, the trend is downward. Now XAU/USD quotes are in the strong support zone, Gold Zone [1262.2 – 1261.0]. While the zone is held, we can’t expect further decrease, but we can count on the local correction with the target to sell the instrument at good prices.

The trend border and the key resistance is Intermediary Zone [1274.2 – 1273.0]. If it is reached, we will look for sells with the target of December 5th’s low renewal. If the low is renewed before, then the key resistance should be rearranged from the new extreme.

We will buy gold when IZ is out-broken.

Today’s trading tips for gold:

Sell in Intermediary Zone [1274.2 – 1273.0]. Take Profit: Gold Zone [1262.2 – 1261.0]. Stop Loss: 1277.6.XAG/USD

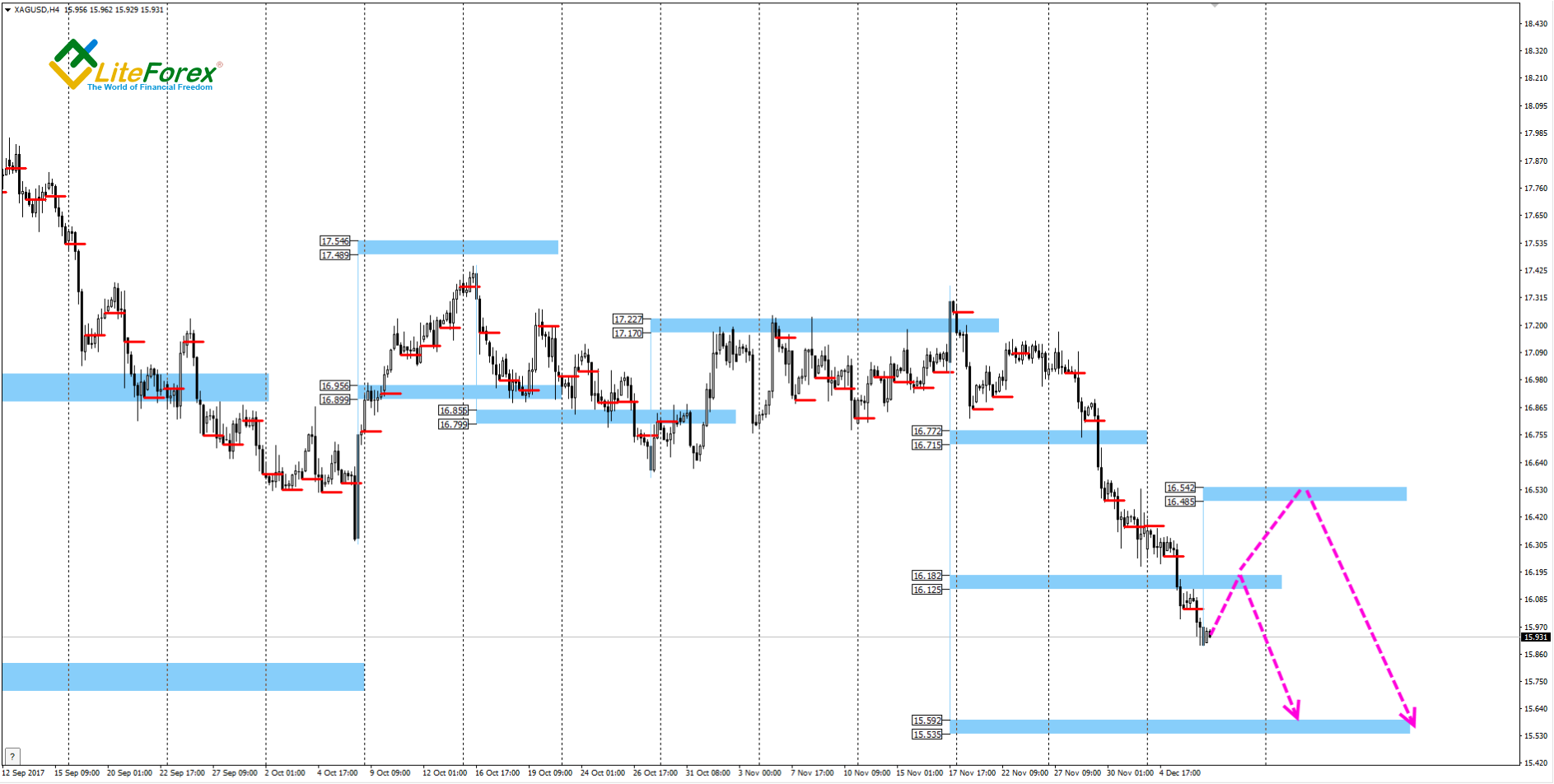

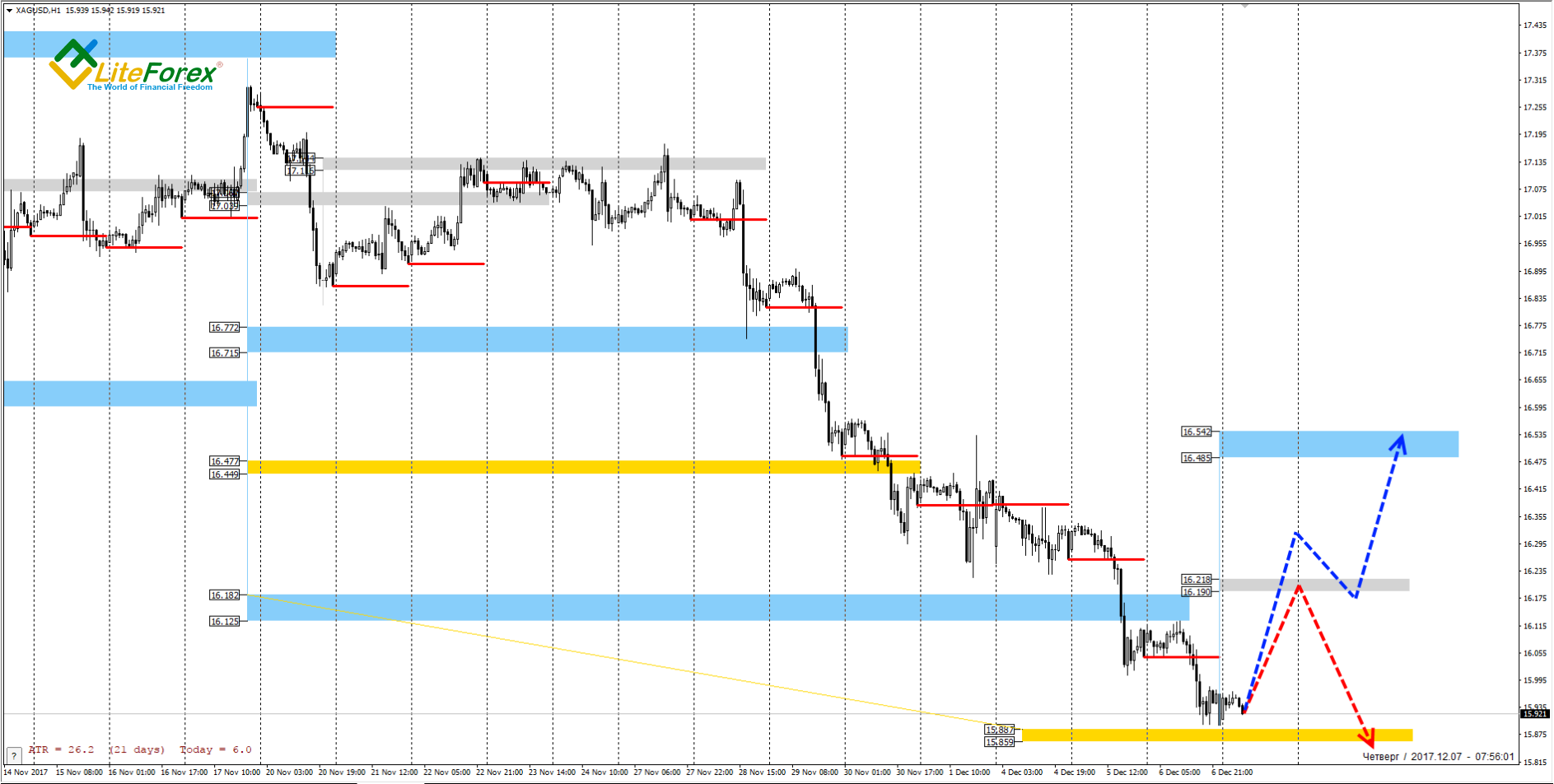

Silver price continues decreasing within the middle-term downtrend. Remember, the decreasing target is Target Zone 3 [15.59 – 15.53]. The trend border is at levels [16.54 – 16.48].

Yesterday, the next sell target within the local downtrend, Gold Zone [15.88 – 15.85], was reached. The zone is the strong support, so the correction is likely to develop, that will allow to look for sells further in the trend.

The key resistance and the local trend border is Intermediary Zone [16.21 – 16.19]. When it is reached, we first look for short trades, and in case of outbreak, buys will be available. Then, the target will be upper TZ [16.54 – 16.48].

Today’s trading tips for silver:

Sell in Intermediary Zone [16.21 – 16.19]. Take Profit: Gold Zone 2 [15.88 – 15.85]. Stop Loss: 16.31.

IZ - Intermediary Zone: responsible for changing the priority direction of the price movement.

TZ - Target Zone: a zone that, with a probability of 75%, will be reached after the breakdown of the IZ.

GZ - Gold Zone: zone in the medium-term impulse.

SZ - Stop Zone: point of Stop Loss setting, selected statistically.

All zones are calculated based on the average daily price of the instrument and margin requirements of the futures.