Back from a short holiday, I’m starting my work with a clear mind. Having analyzed all the recent news bits and the yesterday’s drop, I see that the news background has hardly changed. BTC/USD is still moving without any regard to the news background, affected by a manipulator or a group of them. Therefore, if we still analyze the news background, currently, it makes some sense only in terms of how the manipulators will exploit a certain news bit.

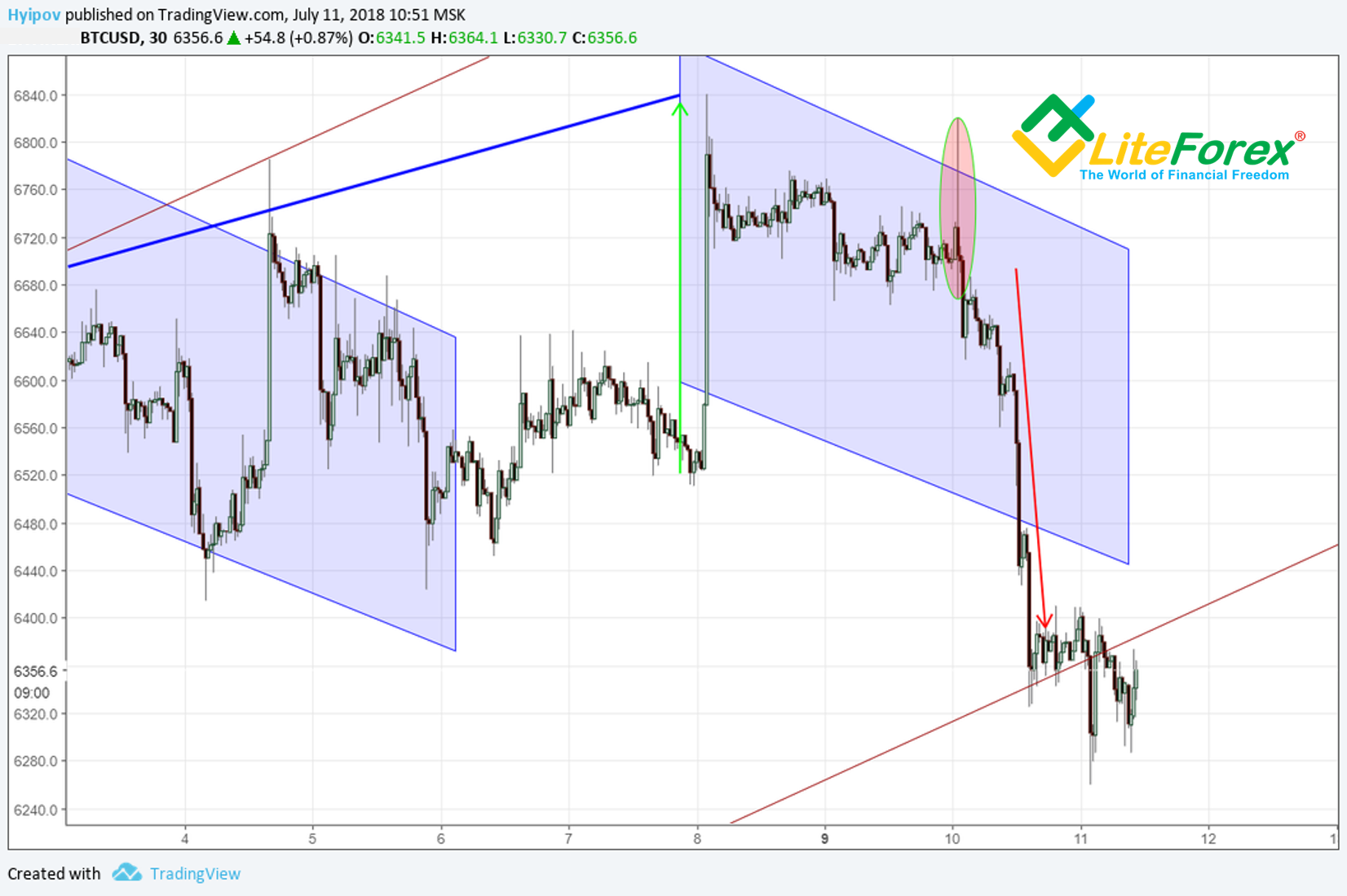

It is clear in the chart above that all the recent growth attempts were associated with one market player who tried to develop a pivot signal; however, it turned out to be hard to reverse the market, even in the context of positive news.

You see, after the manipulator’s impulse buy out (green arrows in the chart above), the market? Represented by the majority of investors, moves either in the opposite direction, or stays still (blue zone of consolidation).

I’ll remind you, the main target of these obvious manipulations is to close the price above level 6800; it would be a good pivot signal and would support the ticker’s way up to 8000 USD for a bitcoin.

However, the market didn’t believe in this momentum, and when the ticker had managed to reach the important level of 6800, the majority didn’t believe in the key level breakout and traded against the bullish correction. It created divergence with MACD indicator that is clear in the hourly charts (marked with the blue line).

The manipulator’s main goal in that situation was to keep the market from dumping below the last stair level in the range of 6600-6500, holding up the zone. Many would believe in the manipulator’s unlimited power and follow it, going long and expecting another momentum.

Most traders did so at first; they opened longs after the consolidation, expecting the new momentum (marked with the red circle). However, either the manipulators changed the plans or they just ran out of resources, but they followed sellers and started taking profits at the levels reached.

To understand the manipulators’ logic, you should know them personally, and you don’t have to Sherlock, to understand who the biggest player in the market is. At present, it is Bitmain company, the largest producer of miners and the cryptocurrency mining equipment. In addition to miner production, the company owns two mining pools and resources for possible cloud-based mining. The company is boosting its power very fast, and now, the Bitcoin network hashrate, produced by Bitman pools is over 42%.

Nevertheless, the corporation actively diversifies the business; now it is investing in robotics and the Internet technologies. The company total capitalization is already over USD12 bn, although it has existed for just five years. The giant’s state in the cryptocurrency market is getting almost monopolistic; which is a direct threat to the principles of decentralization and discourages investors from investing in the asset.

It is obvious that Bitmain is not interested in falling Bitcoin, as it directly affects the interest to mining, and so, reduces the demand for the cryptocurrency mining equipment. Therefore, the first to be interested in the price rise for the asset will be the monopolist, as the main Bitcoin holder and the seller of tools for its mining.

However, in addition to Bitmain, there are other forces, able to move the market, or even reverse completely:

1. Hedge funds and financial institutions

A strong force in the cryptocurrency market, able to affect the rate, is large hedge funds and financial institutions, which turned out to be the latest in this “gold fever” and didn’t take so significant positions in the cryptocurrency market.

These players don’t own large stocks of the cryptocurrency itself, but they have a strong administrative support and an unlimited source of fiat means. Therefore, they can easily affect the exchange rate through the futures market, increasing volumes of short positions and sending investors the signal to draw the basic asset down. Moreover, I expect exactly these market participants to spread different news pieces and FUD to create the panic in the market.

For these players, the Bitmain monopoly is like a bone in the throat; so, they will press Bitcoin down by all means in order to enter the market with the least losses and weaken Bitmain position.

2. Producers of graphic amplifiers

Other players, interested in the cryptocurrency growth are producers of graphic amplifiers. First of all it is such giants as Nvidia, AMD. It is not a secret that with the “gold cryptocurrency-fever” boom, the companies, producing graphic amplifiers increased their incomes by many times. The cryptocurrency market revealed a new consumer segment that yielded to Nvidia and AMD, as main graphic card producers, just incredible profits.

The best defense is offense; so, Bitmain, following this principle, targets the cryptocurrency that is traditionally thought to be the most interesting for graphic cards producers. Bitmain has already launched selling ASIC for mining Ethereum and Zcash; which bears a direct threat to miners, using graphic cards. The latter can well get in their balconies an expensive heater instead of a means of generating incomes.

As a result, the long depression in the cryptocurrency market and the spread of ASIC for altcoins by Bitmain threaten to block the capital flow into the companies, producing graphic cards. A sharp decline in the demand for the companies’ products will get these companies, on the one hand, to hold up the cryptocurrency rate, on the other hand, to upgrade their technologies of the equipment development in terms of increasing the power and productivity. They will have to take part in the technologies race and enter into direct competition with Bitmain, producing their own ASICs or the products, which can be compared by their characteristics.

3. Microelectronics producers

The last strong players that can reverse the cryptocurrency market in the near future are microelectronic producing giants such as Apple (NASDAQ:AAPL) and Samsung (KS:005930).

It is not a secret that the smartphone market has passed its peak; companies have completely exhausted its potential, launching new and new models every year, that can’t already offer anything in addition to the technically upgraded versions and restyled design.

The blue ocean strategy of creating new markets is well known to Samsung managers. Old markets die, new ones emerge and develop. It is a constant process that enables the corporation to exist and develop for many years.

Everybody knows that Samsung (LON:0593xq) produces not only phones, washing machines and fridges, it also actively builds ships and towers, and the most famous is Burj Knalifa tower in Dubai.

The cryptocurrency market can offer these giants the new opportunities to exploit their capacities and resources. For example, let’s remember the history of smartphones. If you try to remember who invented the first smartphone, a picture of Steve Jobs will immediately come up to your mind. But few know that this market emerged as early as in 1994, IBM (NYSE:IBM) started widely selling its smartphone Simon.

The same can well happen to Bitmain, which may be crowded out by such giants as Apple and Samsung.

By the way, the latter already produces microchips for independent companies manufacturing ASIC. It is the first step towards developing own miners. It is not a secret that Apple and Samsung are strong rivals, looking at each other all the time. If the mining market is entered by such giants as Samsung (capitalization of $300 bn), followed by Apple (capitalization of $900 bn), then Bitmain with its $12 bn will face a hard challenge.

If these corporations enter the market, it may boost the cryptocurrency market, creating a new mass hype among common smartphone users. Of course, in this context, the companies are interested in fueling the interest in the cryptocurrency won’t definitely let it collapse.

Summary:

Summing up all the above, from a fundamental point of view, I don’t see any reasons for panic. The cryptocurrency market is actively transforming and preparing for the entry of really big players. It is positive news for cryptocurrency investors, and negative for small miner, whose future is in the small cryptocurrencies, unnoticed by large industrial giants.

I think the current situation to be positive and treat each Bitcoin’s drop as an opportunity to enter a new trade. I haven’t changes the trading targets and the key levels since my last forecast. It is obvious that big players are not interested in the drop much lower than the current levels; and now they are trying to crowd out little guys, so that the big ones can enter a trade.

I wish you good luck and good profits!