The US dollar index was seen posting gains on Thursday. This came despite import prices falling 0.3% on the month while the weekly unemployment claims rose higher than forecast. Investors look to the monthly retail sales report due later in the day. Forecasts show a modest rebound in retail sales for the month of May. The data comes ahead of next week’s Fed meeting. Investors expect the central bank to cut rates during the year.

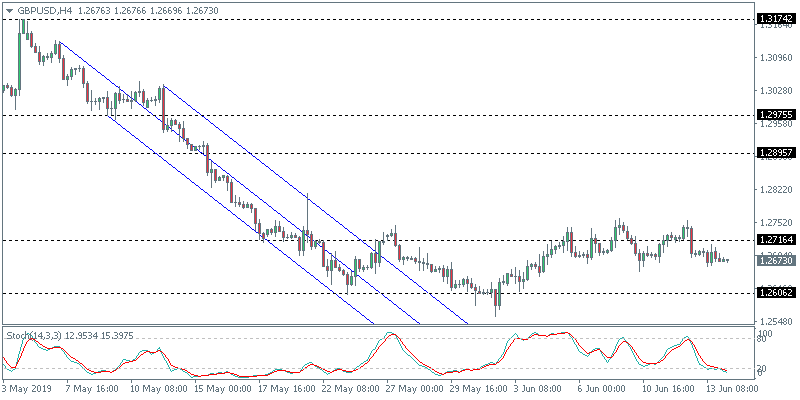

Sterling Muted as Boris Johnson Leads

The kick off to the top spot at 10 Downing street started yesterday with the favorite, Boris Johnson leading the way. The UK Conservatives voted through seven candidates with three being eliminated. The next round of voting is due to take place this coming Tuesday. The sterling was however muted to the news as it continues to trade flat.

Will GBP/USD Breakout from its Range?

The GBP/USD currency pair has managed to post some modest gains. However, price was seen testing the upper end of the range at 1.2716 before giving up the gains. Price remains flat and we could expect to see this ranging price action continue for a while. The chances of a decline lower to 1.2606 is limited for the moment. GBP/USD will need to break out above 1.2716 to confirm further upside in price.

Oil Surges Over 4% as Two Oil Tankers Attacked

Crude oil prices surged higher on Thursday erasing the gains from the day before. The reversal in oil prices came on the news about two oil tankers that were attacked in the Gulf of Oman. The news quickly stoked fears of escalating tensions between Iran and the US. Cost of shipping and insurance premiums are also expected to rise, adding to the price surge. By Thursday’s close, however, oil prices retreated off the intraday highs.

Will WTI Reverse Direction?

The rebound in oil prices coincided with the test of the support area at 51.70. The rebound was however short lived. Price is seen retreating earlier today. Thus, a retest of the support area is quite likely. As long as WTI crude oil remains above the 51.70 handle, we expect to see some upside in price. But in the event of a break down below 51.70, then oil prices could be on track to test the $50.00 psychological support.

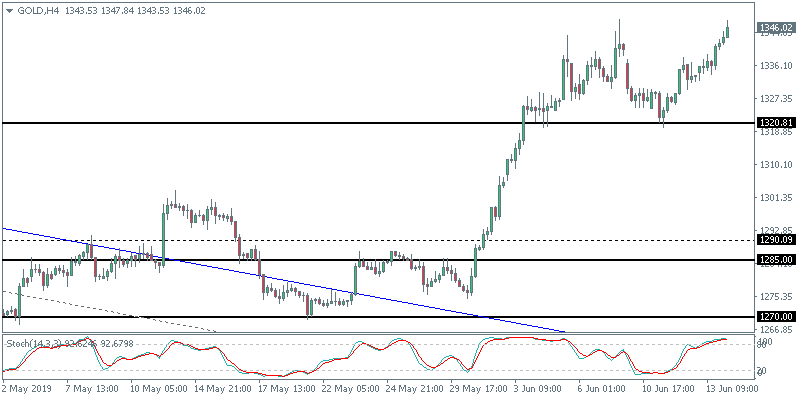

Gold Continues to Rise, Testing Early June Highs

Gold prices posted modest gains on Thursday. This came despite receding risk appetite. However, the news of the tensions near the Straits of Hormuz kept the momentum going in the precious metal. Investors await next week’s Fed meeting which could see the central bank shifting from a neutral outlook to dovish.

Will Gold be Able to Maintain the Uptrend?

The precious metal continued to maintain its strong bullish trend on Thursday. Price was seen maintaining the gains as it is currently testing the June 7th highs of 1340.44. A breakout above the 1350 level will be crucial for the precious metal to continue to maintain the gains. To the downside, the support area at 1320 remains critical to the upside.