Analog Devices Inc. (NASDAQ:ADI) is a leading supplier of analog and DSP integrated circuits. ADI is solidly positioned in growth markets like industrial, auto and communication. Also its products continue to see very strong deployment in the emerging automotive market. The company has a well-diversified business and an end-market focus that guarantee relatively steady revenues throughout the year.

Analog Devices has completed the acquisition of Linear Technology (NASDAQ:LLTC). has created an analog industry leader with an extensive range of products, customer breadth and scale.

The deal has significantly expanded Analog Devices' total addressable market allowing it to cater to phenomenal demand in some of the most attractive markets such as industrial, automotive and communications infrastructure.

Analog Devices has been benefitting from strength across all the markets - industrial, automotive, consumer and communications, and increased focus on innovation and operational execution. While its investments are aimed at strengthening the product line and countering increasing competition, the policy of returning cash through dividends and share buybacks is likely to ensure investor loyalty.

Due to this, investors are eagerly awaiting Analog Devices’ earnings report in order to set the record straight and to give some guidance on where this company is heading and are these factors effectively contributing.

Over the past month, the stock has witnessed no estimate revisions for the to-be-reported quarter.

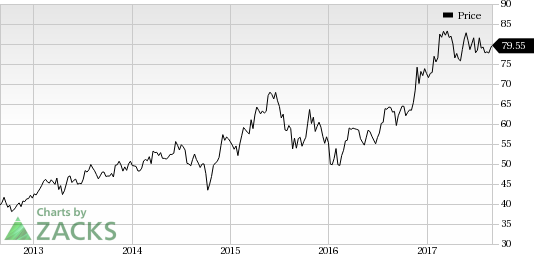

Analog Devices, Inc. Price

Currently, ADI has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings:ADI reported pro-forma earnings of $1.26 which exceeded The Zacks Consensus Estimate of $1.15.

Revenue:Analog Devices beats on revenues. It posted revenues of $1.43 billion, compared to our consensus estimate of $1.40 billion.

Key Stats:The company’s top-line performance was positively impacted by strength in industrial market and Linear Technology acquisition.

Check back later for our full write up on this ADI earnings report later!

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research