Analog Devices, Inc. (NASDAQ:ADI) is collaborating with The Cornucopia Project and ripe.io to aid crop quality, yield and profitability enhancement initiatives.

The Cornucopia Project is a Peterborough, NH-based nonprofit organization that conducts agricultural and garden projects for students from elementary to high school.

San Francisco, CA-based ripe.io focuses on integrating Blockchain consisting of a framework of distributed ledgers, application program interface (API), Internet of Things (IoT) and sensors, and connected food supply chain workflow with the food system.

We observe that Analog Devices shares have rallied 9.2% year to date, underperforming the industry’s gain of 15.2%.

Deal Details

The collaboration aims to train students and farmers on how to monitor crop quality as they move from “Farm to Fork,” thus facilitating improved decision making. While financing will be done by all three, Analog Devices and ripe.io are in charge of technical training.

Most importantly, Analog Devices will make available a prototype version of its crop monitoring solution for use in the project. It is a sensor-to-cloud, IoT solution that boosts farmers with improved decision making on the basis of collected knowledge from near-real-time monitoring.

ripe.io, on the other hand, is providing its block chain technology aiming to develop a fresh produce supply chain with farmers, suppliers, distributors, retailers, food service and end consumers.

Kevin Carlin, Vice President, Automation, Energy and Sensors at Analog Devices stated that the project is an expansion of the company’s ‘Internet of Tomatoes’ program that aims at improving farmers’ decision making on farming cycle and quality of produce.

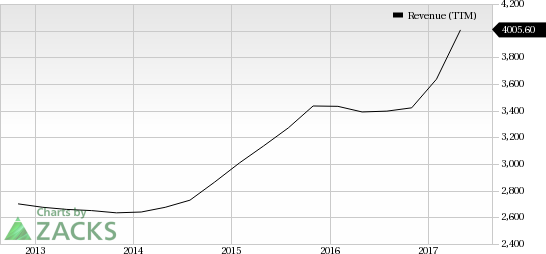

Analog Devices, Inc. Revenue (TTM)

Our Take

We believe the move is intended to increase the popularity of Analog Devices’ crop monitoring solution offering.

Funding training projects does initially act as a drain on cash balance and weighs on margins but can be fruitful in the long term if used tactfully. Given that Analog Devices has a strong market position across industrial, communications infrastructure and consumer markets, moves like this could help it attract new customers and keep the existing ones hooked on its services.

The company has been strengthening its balance sheet, expanding margins and improving cash generation capacity through continued focus on product innovation. This is required especially when it’s increasingly facing tough competition from the likes of Texas Instruments (NASDAQ:TXN) , Maxim Integrated Products (NASDAQ:MXIM) and Broadcom Limited (NASDAQ:AVGO) .

Analog Devices has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Broadcom Limited (AVGO): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Maxim Integrated Products, Inc. (MXIM): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research