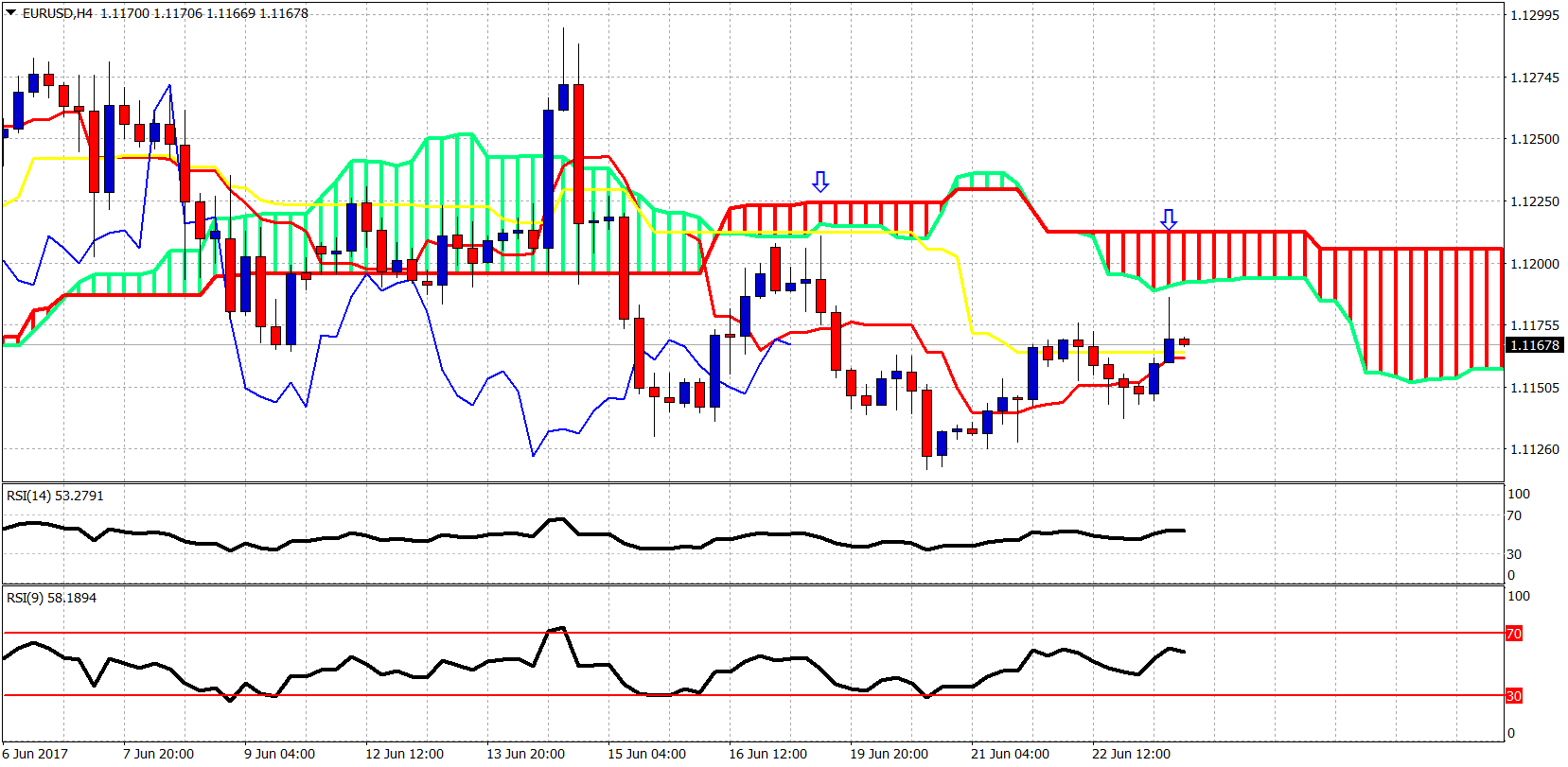

EU/RUSD got rejected for the 2nd time by the Ichimoku cloud (Kumo) in the 4 hour chart. This is a bearish sign.

Trend remains bearish as price is trading below the Kumo (cloud). The first rejection at 1.1210 lead to a nearly 100 pip decline towards 1.1117. Will we have a similar price action lower towards 1.1050?

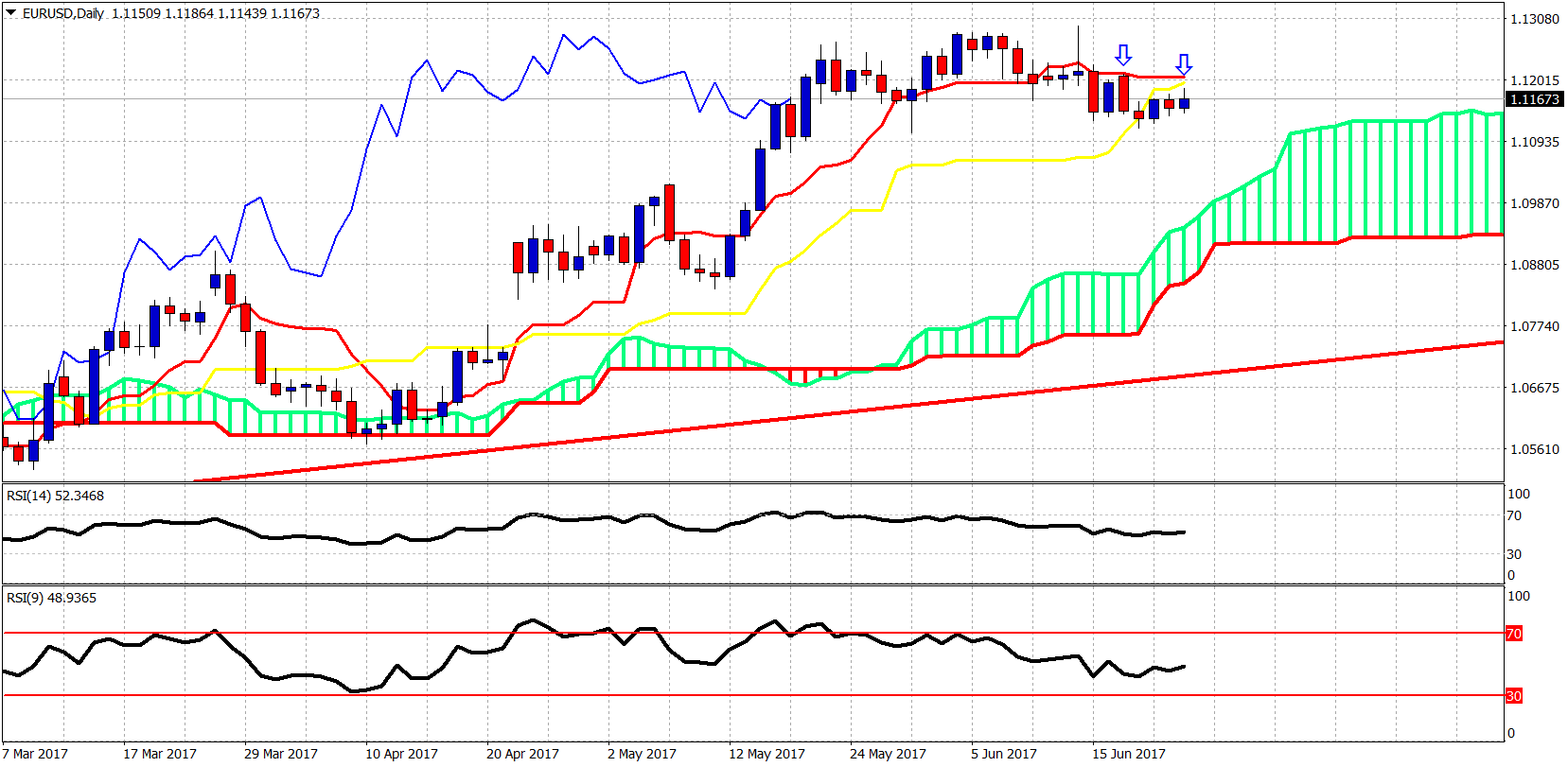

In the daily chart above we see price has broken below both the tenkan- and kijun-sen. Usually price behavior like this implies that we should expect the Dollar Index to move towards the daily Kumo (cloud) support around 1.10. Only a break above 1.1220 could change this short-term view.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.