For the 24 hours to 23:00 GMT, the GBP declined 0.82% against the USD and closed at 1.2629, after the Bank of England (BoE) Governor, Mark Carney, doused expectations of an interest rate hike any time soon, stating that the nation’s economic outlook is marred by the uncertainties of Brexit. Carney warned that given the dwindling consumer spending and business investment in the nation and given the still subdued domestic inflationary pressures, the central bank would wait to see how Brexit negotiations play out.

In the Asian session, at GMT0300, the pair is trading at 1.2628, with the GBP trading marginally lower against the USD from yesterday’s close.

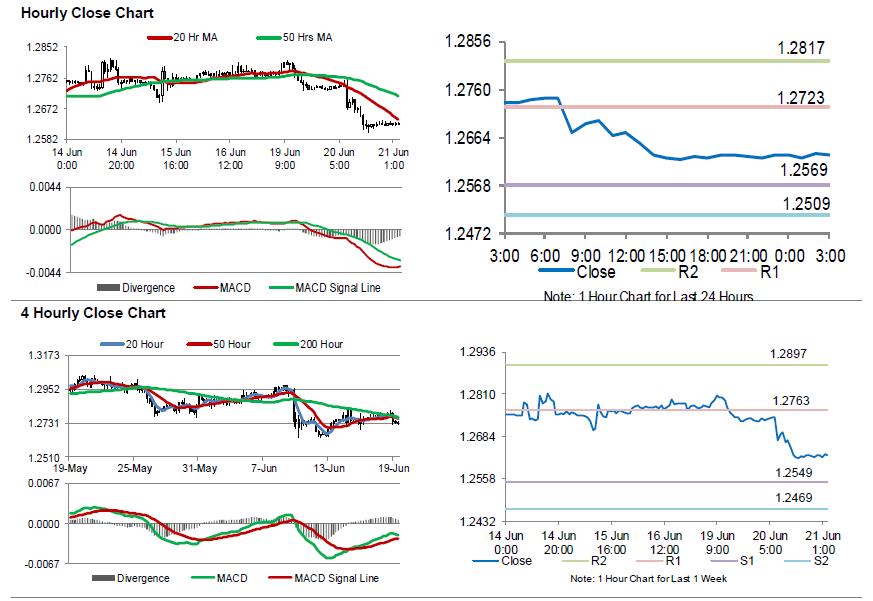

The pair is expected to find support at 1.2569, and a fall through could take it to the next support level of 1.2509. The pair is expected to find its first resistance at 1.2723, and a rise through could take it to the next resistance level of 1.2817.

Looking ahead, market participants will focus on UK’s public sector net borrowing data for May, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages

- See more at: http://forexnews.gcitrading.com/currencies/gbpusd/gbpusd-boes-carney-not-the-right-time-to-hike-interest-rates.htm#sthash.ibRcfWaj.dpuf