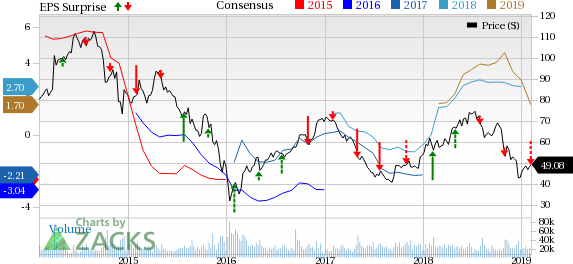

Anadarko Petroleum Corporation’s (NYSE:APC) fourth-quarter 2018 adjusted earnings of 38 cents per share missed the Zacks Consensus Estimate of 57 cents by 33.33%.

On a GAAP basis, Anadarko Petroleum’s bottom line was 21 cents per share, up from prior-year quarter’s figure of $1.80.

Total Revenues

In the reported quarter, Anadarko Petroleum’s revenues of $3,349 million missed the Zacks Consensus Estimate of $3,475 million by 3.6%. Nevertheless, the top line increased 14.3% year over year. The upside was primarily driven by higher oil and natural gas sales.

In 2018, the company reported revenues of $ 13,382 million, up 12.4% year over year.

Operational Highlights

In the quarter under review, the company’s average daily sales volume was 701,000 barrels of oil equivalent per day (BOE/d) up 10% year over year. U.S. Onshore assets delivered sales volumes of 457,000 BOE/d on a divestiture-adjusted basis, up 17.2% from the prior-year quarter’s tally.

The company’s total costs and expenses in the fourth quarter increased 19.4% year over year to $3,079 million, primarily owing to higher oil and gas operating as well as transportation, depreciation, depletion and amortization along with impairments expenses.

Interest expenses came in at $244 million, down 3.2% from $252 million in the year-earlier quarter.

Financial Condition

Anadarko Petroleum had cash and cash equivalents of $1,295 million as of Dec 31, 2018, down from $4,553 million as of Dec 31, 2017.

Long-term debt as of Dec 31, 2018 was $15,470 million, reflecting a decline from $15,547 million as of Dec 31, 2017.

The company’s net cash flow from operating activities during the quarter under consideration was $1,627 million compared with $1,390 million in the prior-year quarter.

Guidance

Anadarko Petroleum expects average daily oil sales volume in the range of 667,000-711,000 BOE/d for the first quarter of 2019.

It expects capital expenditure in the range of $1,100-$1,300 million for first-quarter 2019.

Anadarko Petroleum anticipates an average daily oil sales volume in the band of 712,000-740,000 BOE/d for 2019.

It projects 2019 capital expenditure between $4,300 million and $4,700 million.

Zacks Rank

Anadarko Petroleum currently has a Zacks Rank #5 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Oils-Energy Releases

CNX Resources Corporation (NYSE:CNX) delivered adjusted earnings of 67 cents per share in fourth-quarter 2018, beating the Zacks Consensus Estimate of 28 cents by 139.3%.

Murphy Oil Corporation (NYSE:MUR) delivered fourth-quarter 2018 adjusted earnings of 31 cents per share, beating the Zacks Consensus Estimate of 26 cents by 19.2%

Upcoming Release

Cheniere Energy, Inc (NYSE:LNG) has Earnings ESP of +59.63% and a Zacks Rank #3. The company is expected to release fourth-quarter 2018 results on Feb 26.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

CNX Resources Corporation. (CNX): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Get Free Report

Cheniere Energy, Inc. (LNG): Get Free Report

Murphy Oil Corporation (MUR): Get Free Report

Original post