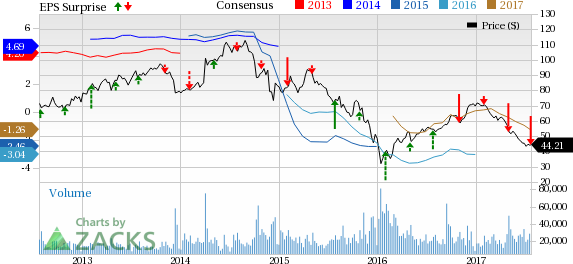

Anadarko Petroleum Corporation (NYSE:APC) reported second-quarter 2017 adjusted loss of 77 cents per share, far wider than the Zacks Consensus Estimate of a loss of 37 cents. The net loss was also wider than the year-ago loss of 60 cents.

On a GAAP basis, Anadarko Petroleum’s loss of 76 cents per share in the second quarter of 2017 was narrower than the prior-year loss of $1.36.

The difference between the GAAP and adjusted figures was due to a one-time gain of 1 cent or $8 million.

Total Revenue

In the reported quarter, Anadarko Petroleum’s revenues of $2,716 million surpassed the Zacks Consensus Estimate of $2,300 million by 18.1%. Revenues were also up 41.8% year over year.

Operational Highlights

In the reported quarter, Anadarko Petroleum's average daily sales volume improved 12.0% year over year to 631,000 barrels of oil equivalent per day (BOE/d). The average sales volume was within the expected range of 626,000–648,000 BOE/d for the second quarter.

The company’s total costs and expenses increased 26.4% year over year to $2,841 million, primarily due to higher exploration charges.

Interest expenses came in at $227 million, increasing nearly 4.6% from $220 million incurred a year ago.

Financial Condition

Anadarko Petroleum had cash and cash equivalents of $6,008 million as of Jun 30, 2017, up substantially from $ 3,184 million as of Dec 31, 2016.

Long-term debt as of Jun 30, 2017 was $15,436 million, reflecting an increase from $15,281 million as of Dec 31, 2016.

Anadarko Petroleum's net cash flow from operating activities during the quarter was $857 million compared with $1,229 million generated from operations for the quarter ended Jun 30, 2016.

Guidance

Anadarko expects average daily sales volume in the range of 630,000–652,000 BOE/d for third-quarter 2017.

The company projects its 2017 sales volume in the range of 633,000–644,000 BOE/d, down from the prior expected range of 644,000–655,000 BOE/d for 2017. The drop was to accommodate production lost due to divestiture and deferred production from its Colorado assets.

The company expects capital expenditure to be in the range of $1,100–$1,200 million in the third quarter. It expects its 2017 capital expenditure in the range of $4,200–$4,400 million, down from the prior expected range of $4,500–$4,700 million for 2017.

Upcoming Releases

Range Resource Corporation (NYSE:RRC) is expected to report its second-quarter results on Aug 1. Its Zacks Consensus Estimate of a loss of 14 cents remained unchanged over the last 30 days.

Chesapeake Energy Corporation (NYSE:CHK) is expected to report its second-quarter results on Aug 3. Its Zacks Consensus Estimate of 14 cents remained unchanged over the last 30 days.

Ultra Petroleum Corp. (NASDAQ:UPL) is expected to report its second-quarter results on Aug 9. Its Zacks Consensus Estimate of 47 cents remained unchanged over the last 30 days.

Zacks Rank

Anadarko Petroleum has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Range Resources Corporation (RRC): Free Stock Analysis Report

Chesapeake Energy Corporation (CHK): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

Ultra Petroleum Corp. (UPL): Free Stock Analysis Report

Original post

Zacks Investment Research