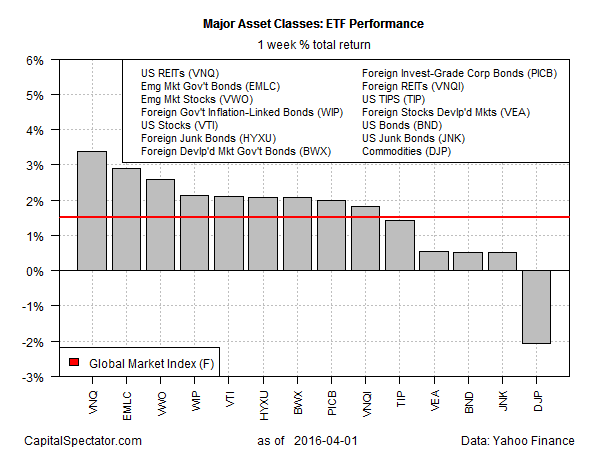

The crowd was in a buying mood last week, with most of the world’s markets posting gains, based on a set of proxy ETFs for the major asset classes. The main exception: commodities overall, which slipped back into a familiar bearish pattern. Otherwise, the trading week through Apr. 1 dispensed returns far and wide.

Last week’s big winner: US real estate investment trusts, which posted a solid 3.4% total return via Vanguard REIT (NYSE:VNQ). Meanwhile, the 2.1% loss for broadly defined commodities (NYSE:DJP) stands as the lone loser among the main asset-class buckets for the five trading days through last Friday.

The upside bias provided lift last week to the Global Market Index (GMI), a passively managed benchmark that holds all the major asset classes in market-value weights. Recovering from the previous week’s loss and then some, GMI posted a healthy 1.5% advance for the week through Apr. 1.

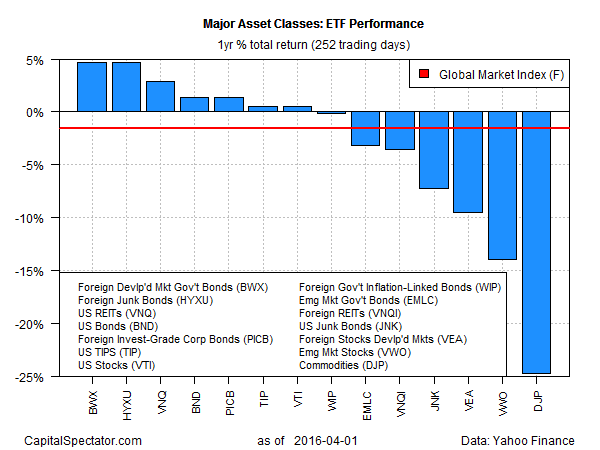

As for the trailing one-year profile (252 trading days), the field remains evenly divided between winners and losers, albeit with a hefty edge to the downside in terms of absolute prices changes. Foreign bonds continue to hold the lead among the winners for the past year (in unhedged US dollar terms) while commodities remain the biggest loser by far.

The losers over the trailing one-year window continue to weigh on GMI for this period. The benchmark was down 1.6% at last week’s close vs. the year-earlier level. Although that’s an improvement vs. the deeper one-year losses in recent history for GMI, it’s not obvious that the benchmark’s red-ink problem is set to fade in the week ahead.