Wouldn’t it be nice to find a high-yielding investment that’s set to prosper from a powerful, long-term trend?

Such a prospect would be quite valuable in today’s challenging investing environment – especially given the dearth of real income opportunities.

While we’re at it, what if this firm was trading at a discount relative to its better-known competitors?

If you think that’s too much to ask, well, it turns out you’re wrong…

Enter (Senior Housing Properties Trust (NYSE:SNH)), a real estate investment trust (REIT) that owns independent living and assisted living communities, continuing care retirement communities, nursing homes, wellness centers, and medical office, clinic, and biotech laboratory buildings throughout the United States.

With a $4.6-billion market cap, it’s not exactly tiny – but it’s often passed over for its bigger competitors, such as Health Care REIT (Health Care REIT Inc (NYSE:HCN)), (Ventas Inc (NYSE:VTR)), and (HCP Inc (NYSE:HCP)).

However, a quick glance at the numbers shows that Senior Housing isn’t getting enough love. The chart below compares SNH to the three aforementioned companies:

One thing that sticks out immediately is SNH’s dividend – which, at just shy of 7%, is quite attractive.

In fact, this REIT stands up to other industry favorites all the way across the board.

For starters, it’s relatively cheap right now, with a 2015 estimated price-to-funds from operation (P/FFO) multiple that’s well below the competition.

Additionally, SNH’s one-year net operating income (NOI) growth is nearly four times that of the other firms, while its debt-to-total assets is right in line with the industry’s biggest players.

To top it off, SNH’s assets are widely diversified. The firm is set to close on a deal during the first quarter of 2015 that will add 23 properties in 12 states, which gives it a total of 650 tenants in 395 properties across 39 states.

America’s Aging Population

Additionally, SNH is well-positioned to benefit from America’s rapidly aging populace.

Currently, 55% of Senior Housing’s property is – go figure – senior housing, while the other 45% is mostly in medical office buildings.

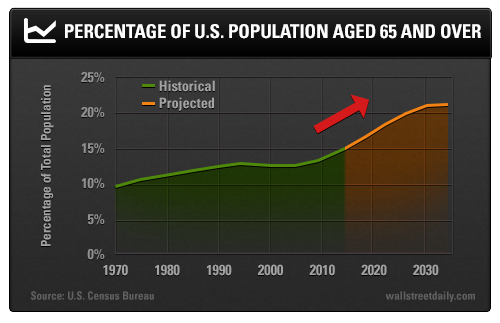

Given that the age 65+ population is growing more rapidly than the rest of the country (and will require increasing numbers of healthcare and assisted living facilities), SNH should be in good shape. The chart below illustrates the country’s aging population trend:

Soon, more than 20% of the country will be above the age of 65 – and that number has more than doubled since 1970.

Indeed, with a two-headed business that encompasses both healthcare and senior housing, SNH should be able to capitalize as more and more people enter their golden years. Plus, SNH is the industry leader in private pay assets, meaning the firm should be able to weather the uncertainties surrounding Obamacare and Medicare.

Bottom line: With a juicy yield, relatively cheap valuation, and a well-positioned business, SNH is one of the more intriguing income opportunities out there today.