We’re long overdue for a correction. At least, that’s the latest cry emanating from the bears as they try to dissuade us from investing.

Total hogwash!

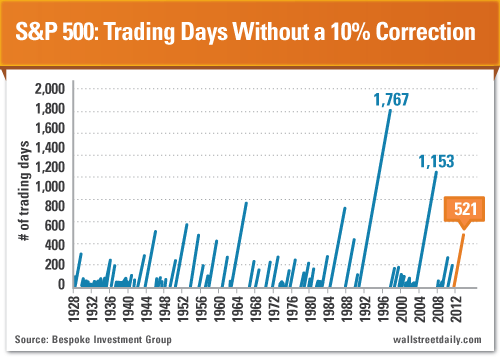

I’ll concede that it’s been a while since the S&P 500 Index suffered a 10% setback – 521 trading days, to be exact. But we’re nowhere near record territory.

Heck, we’ve witnessed two streaks without a correction in the last 25 years that were twice as long as the current one, according to Bespoke Investment Group. From March 2003 to October 2007 (1,153 trading days) and from October 1990 to October 1997 (1,767 trading days).

That means, for us to set a new record, the current bull market would need to continue uninterrupted until October 2018!

So, again, we’re certainly not long overdue for a correction.

That’s the good news. Now for the possibly troubling news – and, of course, what it means for our investing strategy…

Third-Quarter Earnings Update

The only way the market is going to keep chugging higher is if companies keep increasing earnings at a healthy clip. As I shared at the beginning of the month, analysts certainly expect that to happen, with record profits projected for 2014.

I’m sorry, but after looking at the latest earnings seasons stats, I have my doubts that conditions will be that rosy.

Sure, the headline numbers convey strength.

With nearly half the companies in the S&P 500 Index reporting results, 75% beat earnings expectations. That’s above the average for the last four quarters of 70% and the average for the last four years of 73%, according to FactSet.

Here’s the rub, though…

The rate at which companies are beating expectations is hardly impressive.

Earnings came in a mere 0.8% above expectations. That compares to an average surprise of 3.7% over the last four quarters and 6.5% over the last four years.

Either analysts suddenly got really good at predicting earnings (fat chance!) or business conditions aren’t as strong as executives originally expected.

Beyond that troubling development, there’s also an unsustainable discrepancy between earnings and sales growth rates.

So far this quarter, actual earnings are on track to increase 2.3% in the third quarter. Yet third-quarter sales are only on pace to grow 2%.

We don’t need to be math whizzes to realize that companies can’t keep growing profits faster than sales indefinitely. Or, put another way, cost cutting isn’t a permanent profit-boosting strategy.

At some point in the very near future, we need meaningful increases in demand to propel profits higher.

Run to Strength, Not Cash

Forget running for cover into cash like most of the bears want us to do. Instead, we need to keep an eye on the surprise margin for earnings and sales growth rates in the coming quarters.

We should also focus on investing in the pockets of strength in the market. And there’s no better example than the technology sector.

- The earnings and revenue “beat rates” for the tech sector are much higher than the market’s right now – at 87% and 66%, respectively.

- Unlike the broader market, tech companies continue to report better-than-expected earnings by a wide margin, too. The average earnings surprise is 11.4% above expectations.

- If we exclude the undue influence of Apple (AAPL), the sector’s earnings growth rate is the fastest in the market, at 11.2%. If we include Apple, the sector ranks second (7.2%), behind consumer discretionary (8.2%).

Most importantly, tech companies remain reasonably priced…

The S&P 500 trades at 14.7 times forward earnings, which is a 14% premium to its five-year average. Tech stocks only trade at 14.1 times forward earnings, which is only a 3.7% premium to the sector’s five-year average.

Bottom line: The smartest bet right now is to bet on tech stocks – not a correction.

Original post