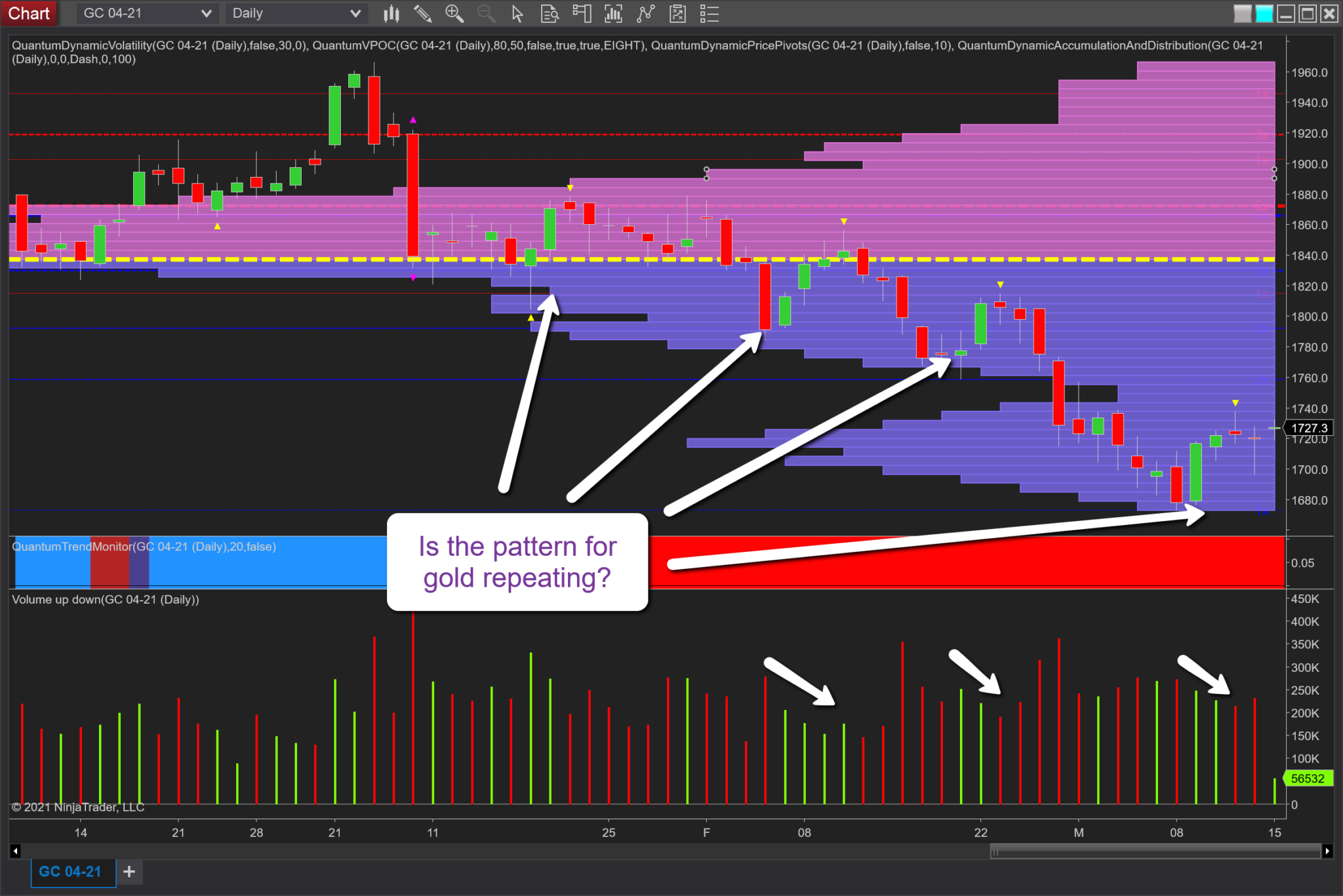

A familiar pattern for gold, which I have highlighted before in earlier posts, is emerging. Last week’s price action describes it perfectly once more. The question this time is: Will this rally will indeed be the precursor to something more sustained? Or, will it fizzle out and simply be yet another failure to stem the longer-term bearish trend?

If we take a look back over the last three months, this pattern is clear. We saw a minor recovery in January lifting from the volume point of control (VPOC) at $1,840, which was snuffed out with a subsequent return to the fulcrum of the market.

Then, in February, we witnessed a more pronounced effort. But note how this was accompanied by falling volume, so it did not go far.

At the end of the month, there was another, this time on two candles. But once more, the volume declined.

And finally, we have last week’s effort to rise. But note once again the weakness on falling volume followed by Thursday’s candle, which closed well off the highs on good volume. Friday saw some buying, but probably not enough to influence the longer-term trend. So more downside is likely. For any return to a bullish trend we will need to see some serious buying volumes over an extended period assisted by gold’s role as an inflation hedge.